Warren Buffett reduced Berkshire Hathaway’s (NYSE: BRK.A) (NYSE: BRK.B) 13F positions in some major U.S. banks in the second quarter of 2020, including JPMorgan (JPM) and Wells Fargo (WFC). JPM was reduced by 40% to below 1% of the portfolio, and WFC was reduced by 27% to 3% of the portfolio. Towards the end of the quarter, he increased his position in Bank of America, (BAC), bringing his ownership stake to 12%.

Anyone who has seen the recent portfolio changes of Mr. Buffett wanted to study, could do less than read this helpful article by Seeking Alpha contributor John Vincent.

Warren Buffett is an excellent model, but he is not infallible

It is not for nothing that the wisdom, knowledge and movements of Warren Buffett are closely followed by Seeking Alpha readers. Not only does he have an extraordinary track record of investment success, the reasoning behind his investment decisions is generally easy to deepen and fits the ideas of most people of common sense.

Another important principle of investing is self-confidence. Let us remember that Mr. Buffett is human, and sometimes makes mistakes.

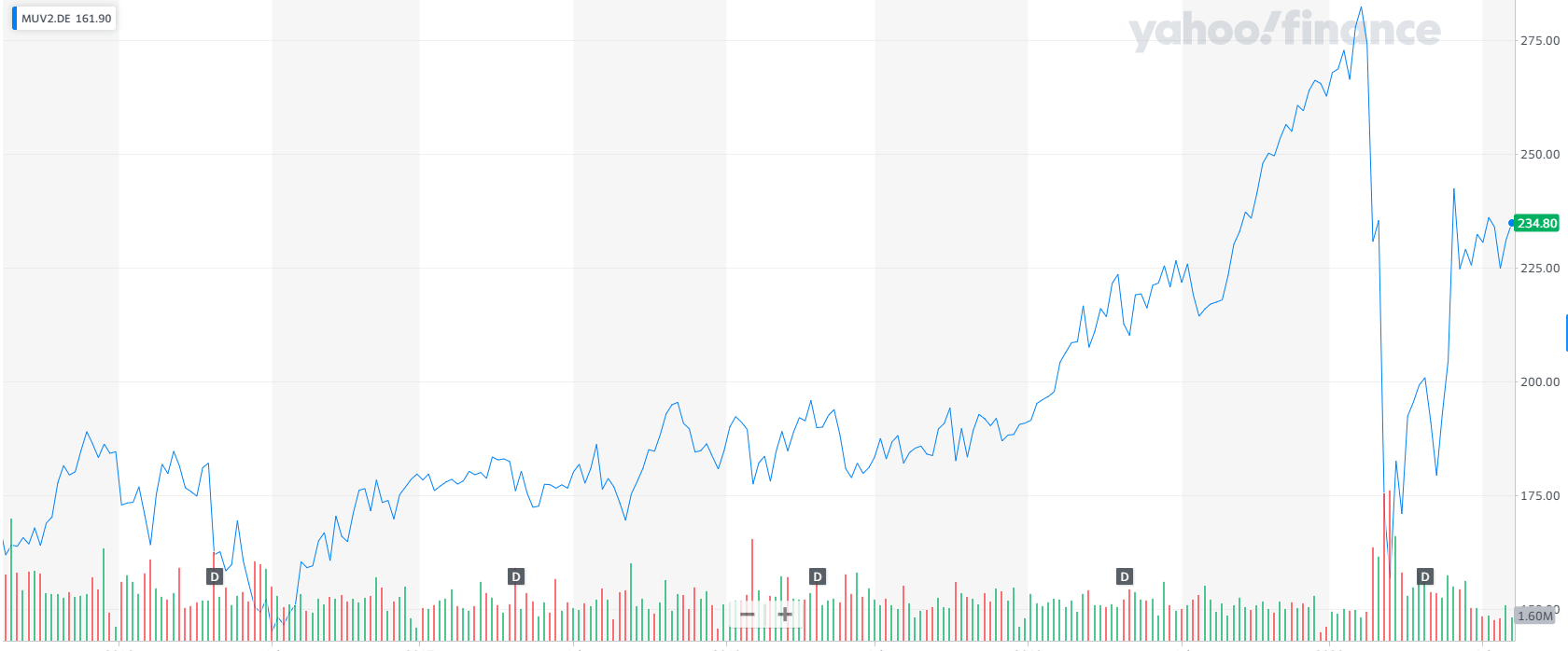

One that I can well remember, (because I ran a fund professionally that had a large position in the relevant stock!) Is the sale of Mr. Buffett of Munich Re (MUV2) in September 2015. While acknowledging that the company was doing very well and that he may be wrong in its decision, Mr Buffett explained the move by referring to the poor long-term perspective of the reinsurance sector at one time of very low interest rates.

Source: Yahoo Finance

Of the levels that Mr. Buffett sold on, MUV2 valued nearly 70% for the COVID-19 panic sell-off in March this year, and with its dividends over that period yielded a total return of 102%. Even after the March crash and a partial recovery, the total return has been 77% since the departure of Mr. Buffet, a very healthy yield over a period of five years. Selling MUV2 was not the most successful decision.

As for the reduction of large US bank exposure in 2Q, it is not difficult to see the wind for the sector.

Interest rates have plummeted, and this is putting pressure on bank income because net interest income is typically more than half of the business income of U.S. banks. At the same time, the extreme restriction of COVID-19 to exposed corporate sectors will cause a large wave of non-performing loans to hit the banks in the second half of the year. This will eat into the hefty supply buffers built in the first half, and further high loads to recharge these buffers are possible.

Where would Buffett possibly go wrong?

Mr. Buffett made two moves that are worth considering. The overall decline in bank stocks and in particular JPM and WFC, then, after the second quarter, the increase in exposure to BAC.

Banks are down 27% from pre-COVID-19 levels. This is a big hit. But it does not assume disaster on the scale of 2008-9. In contrast to that crisis, when banks were more banished and faced an “unknown” element of the crisis in the way that mezzanine bonds and credit default swaps would transfer risks into the financial system, the COVID 19 crisis so far better understood and is provided for the manifestation of credit damage (made possible by government support for income in the economy). Banks have built extra-large facilities while remaining in the black if only to place moderate losses that have not materially affected the capital write-off. They can continue to do this if they have to.

Although dramatically increased supply costs will last for a period, and then decrease as the economy recovers, the low interest rates postponed by the crisis will last at least a while outside the crisis.

Investors need to have a sense of what is already in the price.

The next model takes the bank that Warren Buffett still likes, BAC, and runs stable costs and facilities, but depressed income (which is worse than the 2Q’20 situation when non-interest income remained robust) to simulate what revenue looks like can normalize supply costs with revenue remaining weak.

Source: Companies quarterly results, analyst model

BAC would of course be able to take some measures on costs and, when the economy recovers, there should be at least some improvement in non-interest income, so I would consider this a conservative return to “normalized” post-COVID-19 income. The stock is 25% down from its pre-COVID-19 peak, which makes sense given the level of soil change in this model.

Now, if you run a similar exercise on JPMorgan and Wells Fargo, both of which reduce Buffett, you’ll get similar tie-ins with stock price performance.

- JPM sees a 24% hit to earnings, and the stock is down 24%.

- WFC sees a greater than 50% hit on earnings, and the stock is more than 50% down.

That JPM looks very similar to BAC. Why such a serious hit for WFC? There are four reasons:

- A larger share of the net interest income in the income mix corresponds to a larger hit of the low interest rates on the total turnover and the finish line.

- The Fed asset cap prevents asset volume expansion to offset margin pressure.

- A bigger hit for non-interest income due to a smaller trading company.

- Upward pressure on costs, due to re-engineering expenses and costs associated with the aftermath of its 2016 accounts scandal.

The market is looking to BAC and JPM to bring EPS levels back from 2019, or almost recovered, by 2022. WFC is expected to still be below the 2019 level, with 9%. The main drag factors in the outlook are the asset cap (the date of removal is guesswork in modeling future earnings) and the tilt to net interest income in the income mix with rates remaining low for longer.

Source: Nasdaq Poor

JPM and BAC are similar in terms of rating (P / E Ratio). WFC looks very cheap. It offers strong upside as it can meet the P / E ratios of its peers until 2022, and remember, the whole sector may have improved its rating at that point if risks have receded.

Source: Nasdaq Poor

The first potential mistake of Mr. Buffett here is reducing WFC at such a low rating.

Berkshire Hathaway has been trading WFC for days against a premium rating and I think a sale at this point comes close to a potential turning point in the stock, and risks selling at the bottom. As I showed in recent articles on WFC, the franchise’s solid and extreme factors such as asset capital and disposal costs are temporary obstacles, which will allow the enlightenment to move forward. Read the articles to get the full story. The most important point is that once these well-understood issues are addressed, there is no reason for WFC to act against a rating discount to the likes of JPM or BAC.

The second potential flaw is the advantage of BAC over JPM

Reducing JPM is also an interesting move, given that it is at a similar rating as BAC and at least is an equivalent banking company.

For example, in today’s environment, JPM maintains the advantage of generating a higher percentage of its business revenue through non-interest-bearing resources, which will be further improved in the first half of 2020.

Source: Quarterly results data

While BAC’s corporate income has declined 3.3% in the last five quarters, with a boost in trading income only offsetting the pressure on net interest income, JPM saw a revenue gain of almost 15% YoY.

Source: Quarterly results data

The rating of JPM has obviously not gained relative to BAC, because trading income, although welcome in a period like this, is unpredictable and therefore does not attract high P / E from the market. That said, it’s hard to see JPM stock as less more attractive than BAC, saw the agreement in appreciation.

It is no surprise to see that JPM is running a better efficiency ratio (operating expenses / business income) in 2Q this year because of this boost in trading income. In recent quarters, however, it has also had a slight advantage over BAC.

Source: Quarterly results data

In general, the JPM sale does not make much sense in terms of turnover composition and performance, nor in terms of management margin and efficiency, again, the investors saw a similar P / E ratio pay for the two shares.

Capital Satisfaction: JPM is the winner

In times of tension in the economy, investors tend to pay a little more attention to capital adequacy in banks. Like regulated G-SIBS, the banks we are looking at in this article all have strong capital ratios. JPM runs a higher capital buffer than the other two banks given the business composition. If anything, JPM keeps the edge over BAC and WFC here.

Source: Data quarterly results of the company

Conclusion

JPM and BAC trade on similar ratings, and JPM is more likely to be robust in today’s environment, while being slightly better suited than BAC for a very low rate environment ahead because of its revenue mix.

WFC undoubtedly has more operating challenges than its two peers saw here, but the forecast reflects this in a much lower P / E ratio (2022). This means that WFC offers a lot more upside than JPM as BAC management would have to prove that they can address the bank’s problems. It is difficult to tolerate market failure in this regard.

Take your next lunch with Warren Buffett, take this article with you and ask him why he favors BAC when JPM might be better suited to the current environment and cost the same in terms of P / E, and WFC offers a bigger head up than management the necessary remedial actions.

If you found this article useful, please consider me with the button at the top.

Announcement: I / we do not have positions in named shares, but may initiate a long position in WFC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.