Fox Business Flash headlines are here. See what’s clicking on FoxBusiness.com.

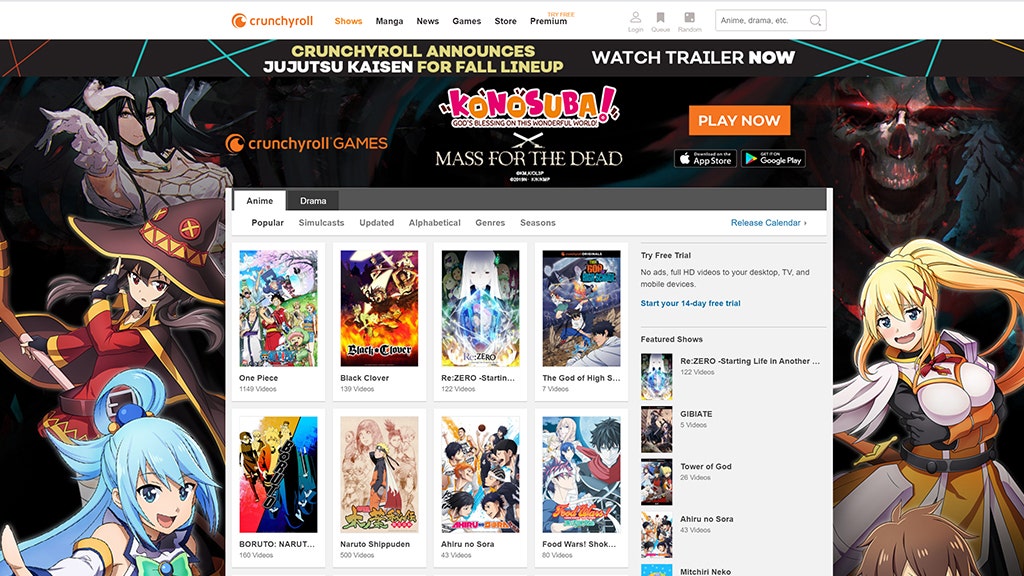

AT&T is looking to sell anime streaming service Crunchyroll to Sony Pictures for $ 1.5 billion, according to a report by The Information.

| Ticker | Security | Last | Change | Change% |

|---|---|---|---|---|

| T | AT&T INC. | 30.18 | -0.02 | -0.07% |

| SNE | SONY CORPORATION | 80.74 | +1.41 | + 1.78% |

Three sources familiar with the situation told the outlet that Sony is looking to buy Crunchyroll to complement its competing anime distribution platform Funimation.

The information added that the $ 1.5 billion price tag is “well above recent values for other niche streaming services,” but noted Sony has “balked” at the asking price.

Both AT&T and Sony declined to comment to FOX Business on possible discussions.

AMC NETWORKSFILES FCC sues AT&T, THINKS MEDIA GIANT IS TOO POWERFUL

The potential sale by AT&T would be the latest move to cut costs following massive layoffs that began this week at WarnerMedia in response to revenue from the WarnerMedia segment, which includes HBO, by 22.7% to $ 6.8 billion fall in the second quarter, with the pandemic affecting $ 1.5 billion in sales.

AT&T has also reportedly considered selling the Warner Brothers gaming unit to companies such as Take Two Interactive, Electronic Arts and Activision Blizzard for $ 4 billion. In addition, WarnerMedia Chief Financial Officer Pascal Desroches told employees back in June that the company would sell the CNN Center in Atlanta, according to Dallas News.

FOX Business also reported back in May that bankers predict that AT&T will download its DirecTV subsidiary shortly because of the impact of the coronavirus pandemic and the company’s high debt level.

GET FOX BUSINESS ON THE GO by clicking here

Launched in 2006, Crunchyroll was acquired by Otter Media in 2013. Otter, a joint venture between AT&T and Peter Chernin, became a wholly owned subsidiary of AT&T two years ago. The streaming service has three million paid users worldwide and more than 70 million general registered users.

CLICK HERE TO READ MORE ABOUT FOXBUSINESS