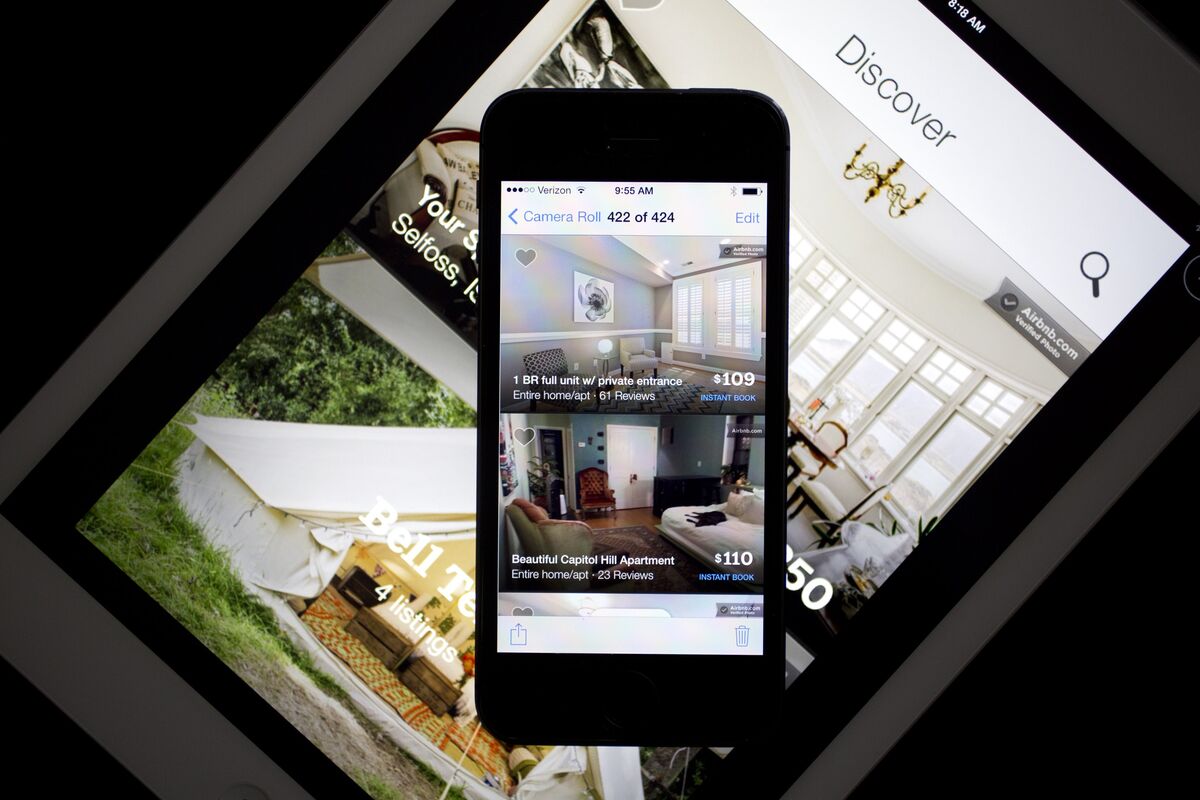

Photographer: Andrew Harrer / Bloomberg

Photographer: Andrew Harrer / Bloomberg

Airbnb Inc. reported tumbling revenues and rising losses in the second quarter, but the start-up of home shares is still seeking a stock debut before the end of the year, according to people familiar with the matter.

Revenue fell to $ 335 million in the period ending June 30, said the people, who did not want to be named to discuss private information. That’s at least 67% down from the more than $ 1 billion the company reported in the same period last year, a shift that reflects the extent of the impact of the coronavirus pandemic on global travel. It is also a steep decline of $ 842 million in sales in the first quarter, according to financial information provided by Bloomberg.

Airbnb recorded a loss before interest, taxes, depreciation and amortization of $ 400 million in the second quarter, the people said. The company began to see some signs of recovery at the tail end of the period, with bookings in June down 30% from a year earlier, compared to a 70% decline in May, year over year, people said. The company reported an adjusted loss of $ 341 million in the first quarter, compared to a loss of $ 292 million a year earlier.

| Period | First Quarter 2020 | Second Quarter 2020 |

|---|---|---|

| Income | $ 842 million | $ 335 million |

| Custom loss | $ 341 million | $ 400 million |

Airbnb was one of the most anticipated stock lists of this year. Chief Executive Officer Brian Chesky had originally intended to begin the listing process with the U.S. Securities and Exchange Commission on March 31. That was before Covid-19 closed its borders, stopped flying from the ground and left the company with more than $ 1 billion in cancellations. With the markets in turmoil, plans were put on hold.

Since then, however, travel has returned as cities reopened and people sought refuge in rural areas, where they could benefit from work from home policies. Airbnb saw more nights booked for U.S. listings between May 17 and June 3 than the same period in 2019, and a similar boost in domestic travel worldwide. The company plans to submit paperwork to go public in the coming weeks and build the path for its shares to trade as soon as the fourth quarter, people familiar with the plans have said.

The company spent $ 569 million on business operations in the three months to March 31, a large swing of $ 314 million that it introduced from operating activities the year before.

(Updates with diagram)

.