Investors familiar with the rapid acceleration of the US dollar could look to Washington for an answer.

“The state of political anger clearly knows the dollar as the failure of more fiscal stimulus [and] the clear partisan skirmishing over post-in voting, which threatens to undermine the credibility of the election, is all taking its toll on the dollar, ‘said Boris Schlossberg, managing director at BK Asset Management, in a Tuesday note.

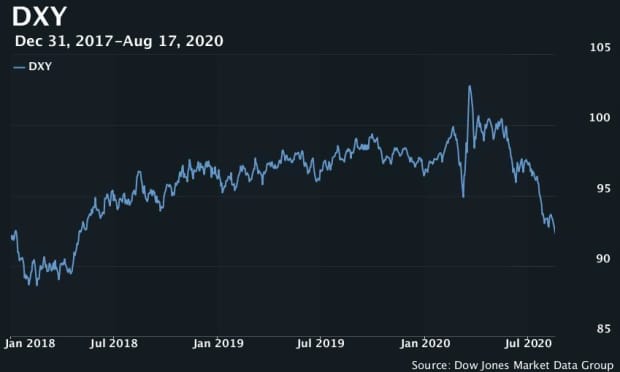

The currency tumbled 4% in July, as measured by the ICE US Dollar Index DXY,

which provides its value against a course of six major rivals, for its largest monthly fall in nearly a decade. After some consolidation earlier this month, the dollar is back under pressure, with the index sliding 0.6% on Tuesday to its lowest since May 2018.

Ascent of stagnation

Washington remains at a standstill over the expansion of a fiscal aid package that disappeared at the end of July and raised $ 600 a week in additional unemployment benefits. President Donald Trump earlier this month signed executive orders aimed at delivering up to $ 400 a week in additional benefits, but the order faces logistical and political challenges.

First Republicans were planning to introduce a scaled incentive plan this week that would include $ 300 a week in additional benefits, according to news reports.

Post Office battle

On Tuesday, Postmaster General Louis DeJoy pleaded that the e-mail service is ready today to handle all mail-in moods it receives in November following last Friday’s warning that it may not be able to do so in time. The agency said earlier it had stopped removing mailboxes and mail sorting machines in response to a scare from lawmakers.

House Democrats have summoned top U.S. Postal Service officials to testify before a panel on Aug. 24 over concerns about postal delays and austerity measures in place due to lack of budget by DeJoy. Trump told Fox Business Network last Thursday that he had refused to approve $ 25 billion in emergency funds for the agency because Democrats sought to expand mail-in for the November 3 presidential election.

Elections or everything about the Fed?

Fool fears of a disrupted election result in November alongside signs of an increasingly polarized voter were cited by some analysts as a possible driver for the July swan of the currency. Some dollar watchers have expressed fear that the greenback could hardly fall in case of election-related unrest.

To read: Dollar could be a ‘crash risk’ if US loses ‘credibility’, says analyst

Others have argued that dollar weakness is in large part a function of a backward US response to the pandemic amid signs that much of the rest of the developed world had made more progress in containing the virus. and reopened towards direction, although an increase in cases in Europe more has recently resulted in new rounds of restrictions.

An aggressive response from the Federal Reserve, and expected to move to provide additional monetary stimulus when the economic rebound stagnates, especially if politicians remain stagnant, were also seen by some analysts as the primary driver of the downturn. dollars.

“The Fed seems confident that it is loosening its interpretation of its inflation mandate, and is working hand-in-glove with the government to ensure funds are available for fiscal spending, yet 5-year / 5-year swaps inflation [a measure of future inflation expectations] stand at 2%, just 0.1% above the average CPI rate of the last decades, ”said Kit Juckes, global macro strategist at Société Générale, in a note.

‘When I look at it this way, the least I would expect is for the Fed to be able to significantly cheapen the dollar. In real terms, it is about 7% lower than the peak, but it is still 25% above the level of 2011, ”he said.

The euro EURUSD,

in the meantime, was 0.5% up against the dollar, trading near $ 1,952, the highest since May 2018. The strength of the euro is seen as potentially driving the European Central Bank to its own program for to encourage the purchase of bonds.

Weaker dollar, stronger stocks?

The S&P 500 scored a small profit on Tuesday, to break a new record, complete a round trip that saw the U.S. benchmark with large cap with 34% of a record Feb. 19. Near its March 23 low as the COVID-19 pandemic forced the near-shutdown of the US and the world economy. The Dow Jones Industrial Average DJIA,

fell 66.85 points, or 0.2%.

A weaker dollar, in general, is seen as a positive for equities, although investors and analysts have noted that the negative correlation between the currency and non-US equities is stronger than the negative correlation between the greenback and US equities.

To look: Here’s what the fall of the US dollar means for the stock market

‘Favorable safe haven’

And other analysts have argued that the dollar is likely to prove a haven in the storm should stocks and other assets perceived as risky get a hit in the coming months.

In fact, analysts at Morgan Stanley claimed on Tuesday that the dollar could still be a favorite in such events as traditional ports such as the Swiss franc USDCHF

and Japanese yen USDJPY,

While these currencies will continue to benefit from all flights to safety, the US dollar will “probably become the favorite safe haven if the fall in

US rates this year make it an attractive financing currency for borrowing and trading, “she wrote. Carry trades are a popular strategy in which a trader typically borrows in a low-yield currency and converts it into a higher-yield currency or uses it. to buy assets denominated in the second currency.

Gold tells the story?

Schlossberg, however, claimed that a renewed rise by golden GOLD,

which shot above $ 2,000 per ounce is the best expression of weak dollar sentiment.

While the rally of gold to full heights this summer has largely been a function of a fall in real, as inflation-adjusted Treasury yields by eliminating the opportunity cost of holding a nonyielding asset such as a precious metal, it came handball despite a bounce last week in rates, he noted.

That means gold “now acts as a store of value because the market loses confidence in the leadership of the United States of America,” Schlossberg wrote. “The longer the stalemate in DC stays in place, the greater the danger that the dollar could be sold into a rut.”

.