Millions of Americans are out of work because of the business closures caused by the COVID-19 pandemic, but you would not know about the S&P 500.

The broad-market index, despite Tuesday’s strike, is about to close its first record high since February 19, a period of 121 trading days, including Tuesday’s action.

The S&P 500 stands within 1% of its February record at 3,386.15, with a move above that level showing a brilliant recovery after shares fell by almost 34% to a recent bear market low on March 23 at 2,237.40.

Since that March, the S&P 500 SPX,

has won 51%, while the Dow Jones Industrial Average DJIA,

—Within 5% of its February 12 record close – is slightly more than 51% advanced and the technology-laden Nasdaq Composite Index COMP,

has increased by about 60% and closed 32 records in the same period so far this year.

Much has been made about traversing the stock market from lows to levels that are at or near records, while the economy, although improving, remains in the wake of the worst public health disaster. in generations.

Sure, the fact that stock indices are back from the abyss of coronavirus does not necessarily change the outlook for the economy or make the profit that is hitherto more sustainable, but it is for some market experts a confirmation that the trend has been consistent higher and could continue to be so amid optimism around potential faxes, subtle improvements in parts of the business climate, better than scared business earnings and the willingness of investors to place bets on the future despite uncertainty.

“With the second wave of the virus coming under control, and jobs and spending recovering faster than expected, business earnings have come above expectations and appear on course to return to pre-pandemic levels ahead of schedule,” Brad wrote McMillan, chief investor for Commonwealth Financial Network, in comments via email.

However, if the stock market breaks a record in the coming days, it will not only represent stocks that come in the span of almost six months full circle, but the official end to the bear market for investment purists who think that a bear market, or fall of 20% of a recent peak, to be of force until a capacity can reach a fresh peak from its bear market low.

Here’s how a lot how we got from here to here.

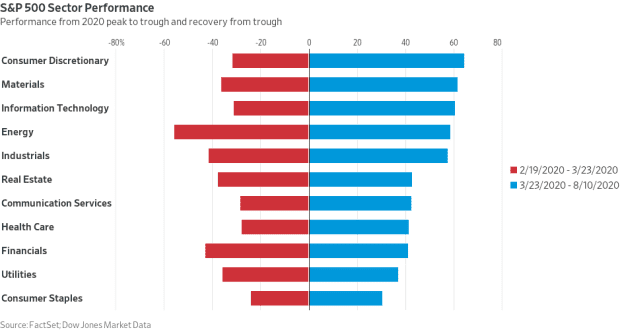

Dow Jones Market Data

About 63%

Discretionary shares for consumers, which are the likes of Amazon.com Inc. Include AMZN,

were the best performers from the low to March to date, according to Dow Jones Market Data. That segment of the S&P 500’s 11 sectors has gained more than 63% since March, as of Monday. The benchmark materials sector, led by gold mining giant Newmont Corp. NEM,

was the second-best performance, with nearly 62% increase, while information technology, in particular Nvidia Corp. NVDA,

and PayPal Holdings PYPL,

returned just below 60% of the low, the data show (see attached diagram).

The weight of the technology sector is by far the largest in the S&P 500 and has grown to 27.61% from 24.78% at the end of 2019, led by megacap companies including Apple Inc. AAPL,

Microsoft Corp. MSFT,

and Google parent Alphabet GOOGL,

Other high-flyers that are often mentioned in the same breath as tech companies include Facebook Inc. FB, and Netflix Inc. NFLX, Communications Services, and Amazon, Concessionaire, but those companies are not tech stocks by the categorization of S&P 500

The consumer discretionary sector has meanwhile climbed in weight to 11.1% from 9.89%, while industrial companies have retreated to 8.07% from 8.89%.

Investors have pointed out that a recent downturn in the powerful rise for tech companies has given more room for other sectors of the market to rise, given what investors have described as a necessary expansion of the market’s breadth.

“All it took for the S&P 500 to take the old one out was broaden the rally to raise finances and energy,” said Jamie Cox, managing partner of Harris Financial Group. “We’re there and that’s a good thing,” he said.

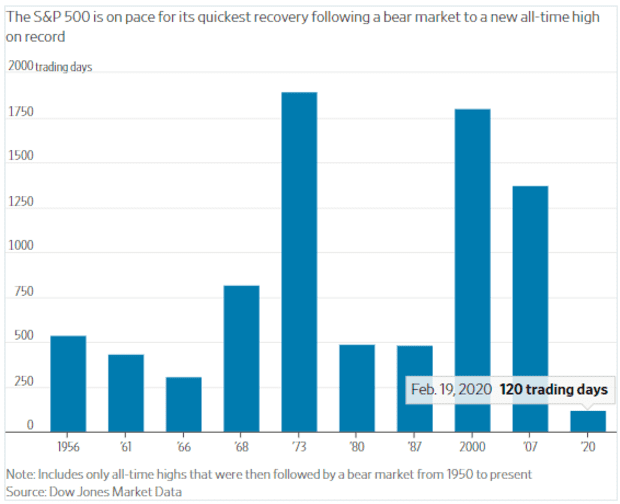

Under 310 days? Speedy recovery

The recovery of the S&P 500 is on the verge of being the fastest in history, precisely because its decline from a record to low market was also the fastest such drop on record.

The current record for the S&P 500 from a bear market to a fresh record was the 310 trading days that the index continued from its February 9, 1966, to a record on May 4, 1967, Dow Jones Market Data shows. It took the S&P 500 16 trading days only from its February 19 peak to fall by at least 20%, and met a bearer textbook definition.

The average recovery of a bear market takes 1,447 trading days.

Dow Jones Market Data

On average, a bear market for the Dow 206 trading days lasts, while the average bear period for the S&P 500 is about 146 days, according to data from Dow Jones Market Data.

.