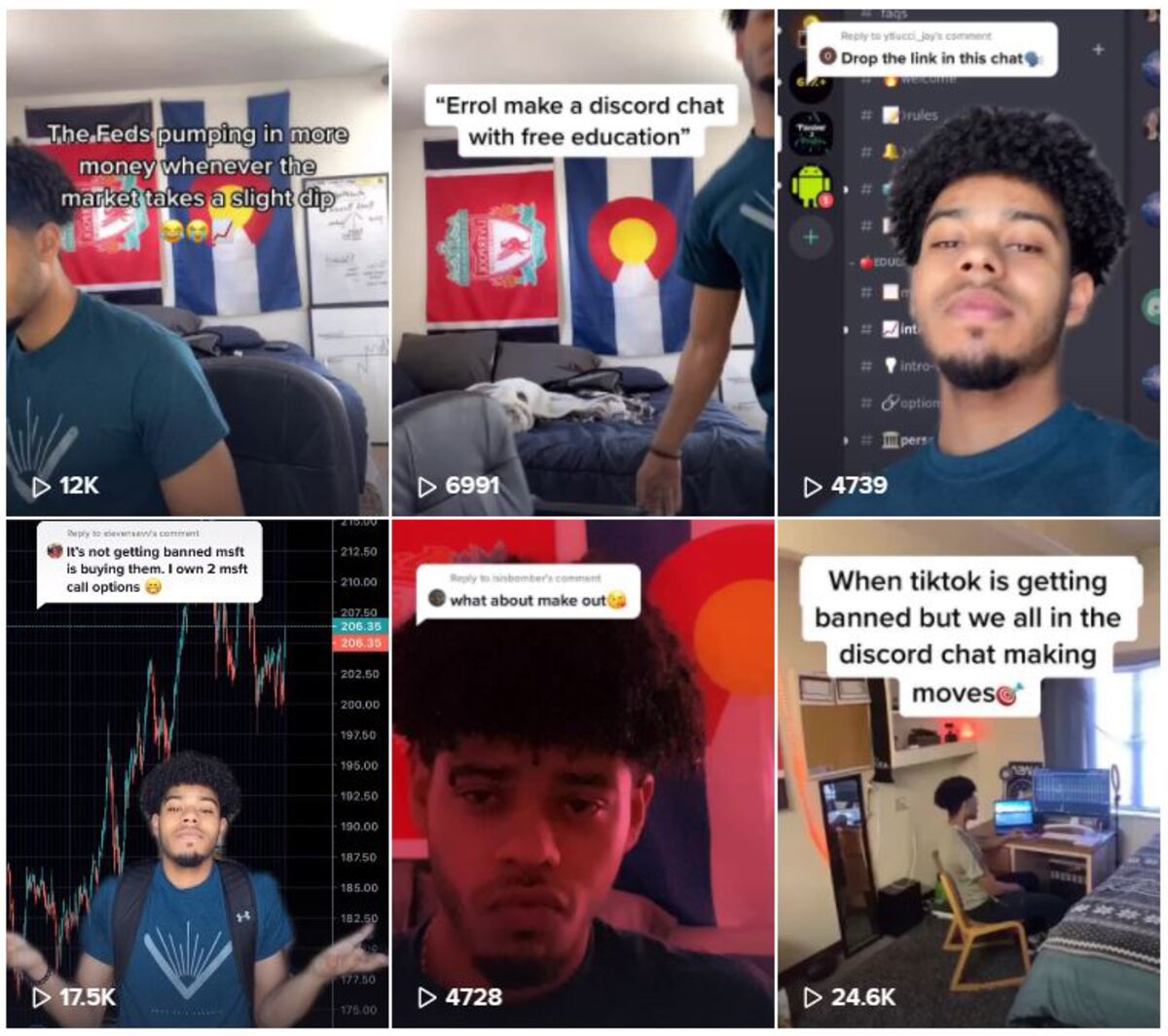

Source: tiktok / errol_coleman

Source: tiktok / errol_coleman

New minted day traders have questions. What is an exchange fund? What is a value proposition? What’s in resistance level?

Errol Coleman is done with a video explorer. Pointing to a line drawn at the top of a stock price spike, he says, “We already know this is a resistance, because it tried to push and was rejected. “

Coleman, with nearly 158,000 TikTok followers and more than 5,000 YouTube subscribers, is one of the growing number of influencers on social media looking for rookie day traders.

He’s not an investment professor – in fact, he’s still in college. Financial bona fides are rare among these influencers. That does not mean that their information is useless, but it is nothing but advice from professionals who market data with robots mining. And the dangers of investing are disappearing not only because stocks have staged one of the biggest rallies.

However, the question of trading how-tos is off the charts. TikTok videos under #robinhoodstocks have more than 3.1 million views, and Coleman is close to the top of the site’s #daytrading. The seniors at Adams State University in Colorado studying business marketing offer explanations on everything from spotting a short squeeze to penny stock trading.

While Robinhood investors some of the biggest winners during the last rally, study after study has shown that hitting the market with an actively managed portfolio is over time almost impossible.

This did not make many people like diving into the trading pool for the first time. Therefore, established financial institutions offer their own primers. Charles Schwab Corp. explains what an ETF is to help beginners among the 1.7 million people who opened brokerage accounts with the company in the second quarter of 2020 – an increase of 328% from the same period a year ago.

Wrinkle-free advisors

Many young traders are already spending a lot of time on social media, so these sites are easy starting paths for searches. And the Robinhood audience seems to like getting answers from peers.

Ben Pryor, a 22-year-old influencer, said seeing a young man over front “makes other people to feel like, ‘hey, I can do this thing too.’ ”

Pryor, who studied economics and communications at the University of Connecticut, placed his first TikTok salesman in the run-up to the induction sell-off. He woke up the next morning to find that he had 4,000 new followers. Their ranks have swelled to more than 109,000, in addition to more than 5,000 members in its Discord chat room and 1,000 subscribers on YouTube.

One of Pryor’s fans, Sam Masten, a first-year student at North Carolina State University, said learning about the stock market has helped him become “way more involved with the news and what’s happening in the US than I was before. “

Both Pryor and Coleman are working to keep up with their followers. TikTok has long been favored for the greater chance of going viral compared to content-saturated YouTube, but Uncertainty about the future of the app has prompted both men to hone their identity on social media elsewhere.

Unlike other social influencers, Pryor rarely shares its current stock picks. When asked what the next big deal will be, he said: “I tell them, I can not predict the future – you have the right to make your own decisions.”

Just about everyone is equally limited. That is a reason for concern for other influencers and traditional financial advisors.

Look for Snakes

Brad Klontz, a psychologist and certified financial planner with a presence on YouTube and TikTok, has been dealing with all the misleading advice he encounters online.

“What I saw was a lot of people telling people what supplies to buy,” he said in an interview, and this was aimed at “young, impressive, middle-class people who were just like me – desperate to try to improve their situation. “

One particular danger for uneducated investors is victim of pump-and-dump schedules, where the price of a share is falsely increased on the basis of misleading information.

John Stoltzfus, chief investment strategist at Oppenheimer & Co., said he was concerned about the “do-it-yourself” mindset, “especially for people who are beginners and do not understand the consequences.” He said one-minute lessons may not approach what investors can get from a financial mentor.

“It’s like a rattlesnake in the garden,” Stoltzfus said. “If there’s a rattlesnake in the garden, you better not go barefoot in it.”

Jerry Braakman, chief investor at First American Trust, thinks social media can be useful in exposing young people to the world of investing. But he warned that traders still need to think for themselves.

One of the problems with all those success stories on Twitter and TikTok, he said, is that “everyone presents the best part of their lives and not all the things that went wrong.”

Yet there is money to be made as influencers. YouTube ads provide revenue for popular users. TikTok is not monetized, but brands and apps often pay influencers based on how many new users they bring. Pryor also sells a $ 10 training course.

Coleman said money is not his primary motivation, although he would eventually like to buy better video production equipment. Instead, he remembers his days as an 18-year-old who could not get his friends to talk about the stock, he is happy with teaching because “the more I give, the more I get.”

– With the help of David Ritter

.