The stocks rose sharply before facing some volatility and surpassing some gains.

This Dr. (INDU) Even after the early afternoon it was up 1.2% or some 320 points. At that high-point, the index jumped more than 500 points. Extensive S&P 500 (SPX) Was up 0.8%.

Both benchmarks have been pulling back some of their losses since last week, when they noted the worst week since March.

Meanwhile, this Nasdaq Composite (COMP) Reversed its previous gain and fell 0.1% in the early afternoon.

Although stocks generally support Republican policies, investors are eager for more monetary stimulus, which will push the economy once again heading south with a surge in coronavirus cases. Investors predict that a “blue wave” will increase the likelihood of a broad-based stimulus deal during the winter.

Investors believe that a bid win will probably mean less news and major risk in stocks in the coming period.

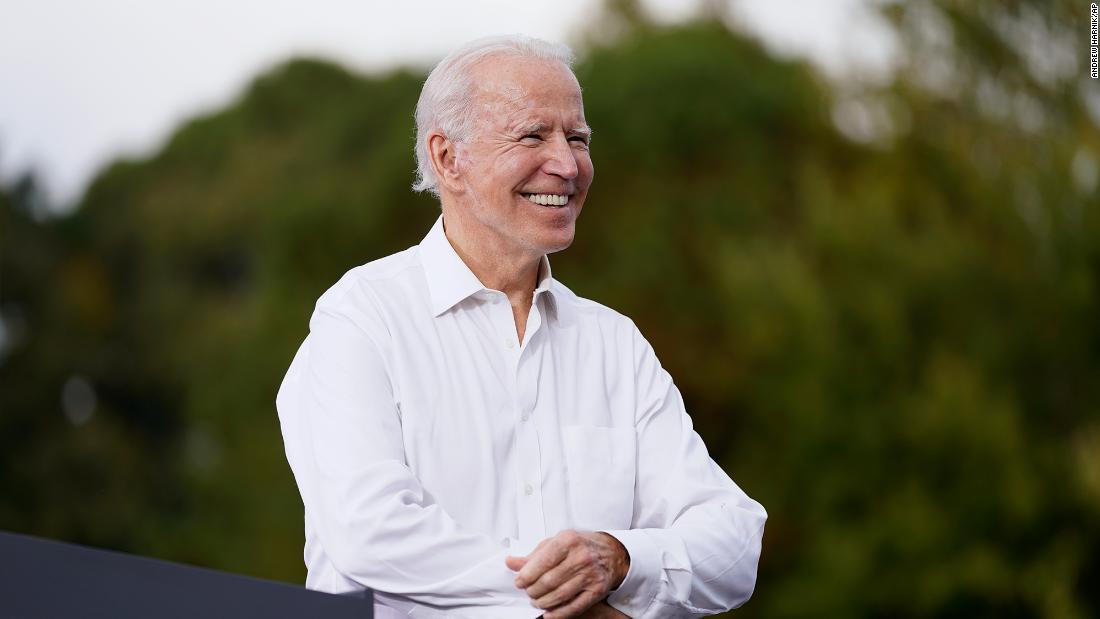

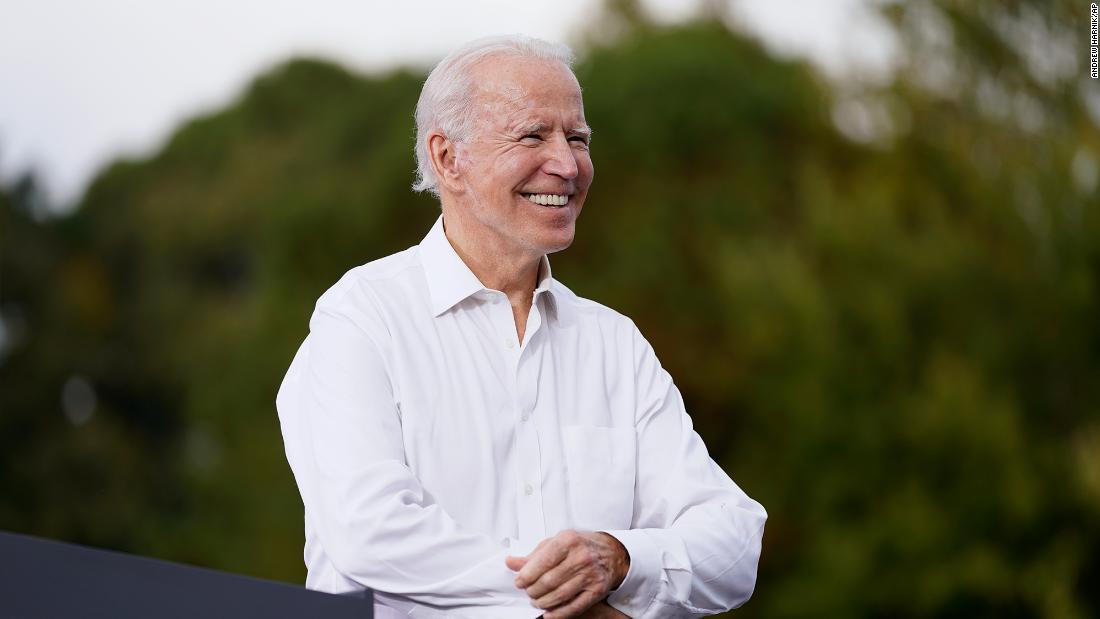

“If the turnout is almost right, then Biden is going to win the election comfortably and we’ll find out before midnight tomorrow,” Andy Leprerier and Don Snyder said on Kornstan’s Mac Crow.

Even if the vote is wrong, the evidence points to Biden’s victory, they added. The forecast puts Biden’s victory at 65% of the market forecast.

“We are emphasizing that the outcome of the Senate is crucial to the course of monetary policy,” said Ritt Andrew Hollenhorst, a City economist, in a note to consumers. For the next stimulus bill.

“Under any election scenario, we expect a 1.5 1.5 trillion financial package, probably,” Hollenhurst said. Only early after the election.

Congress has stalled negotiations on another stimulus deal since the summer. Investors are waiting for the result, bouncing on any major headlines about progress. What this really tells us is that the markets believe that the U.S. economy needs more help getting back on track as the effects of the Care Act begin.

So far the economic reforms have been uneven. For example, millions of jobs have been added since the spring lockdown, but the economy is still down to more than 10 million jobs since February.

Millions of Americans still need government benefits for ultimate satisfaction, and that’s bad news because the U.S. economy is heavily dependent on consumer spending.

Analysts Goldham Sachs (G.S.) Consumer spending is expected to worsen in the coming months due to the Covid-19 revival as people sit at home and any new stimulus package is likely to take until 2021.

And as if this election and its results were not enough for investors to think about, the week is also full of important economic reports, including the economic October employment report.

On Monday, the Institute for Supply Management reported that US factories performed better than economists had predicted in October. The sector’s purchasing managers’ index rose to 59.3 points from 55.4 points in September, the highest level since September 2018.

.

Related