[ad_1]

Friday, November 20, 2020 05:00 AM (GMT + 7)

In recent times, the asset value of the two steel industry “magnates” Hoa Phat and Hoa Sen has risen rapidly due to rapid growth in stocks.

Chairman of the Hoa Phat Group – Tran Dinh Long.

In many recent sessions, steel stocks rose sharply and turned into a big wave leading the market.

The first is HPG’s shares of Hoa Phat Group. HPG’s market price began to rise after information that the company achieved a record profit when the business’s third-quarter 2020 profit after tax reached 3.785 billion dong, more than double the same period in 2019.

This is also the highest rate of interest in Hoa Phat quarter for nearly 30 years of operating history.

In the first 9 months, Hoa Phat achieved a net profit of 8.845 billion dong and achieved 98% of this year’s plan.

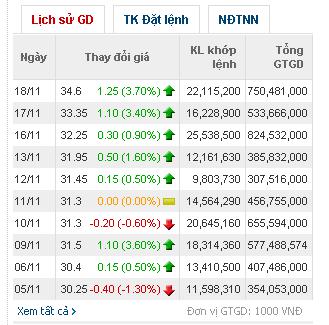

In the November 18 session, although the stock experienced unpredictable vibrations and fluctuations, HPG shares continued to grow, closing at 34,600 VND / share.

HPG shares had 5 consecutive profit sessions. Screenshots

Therefore, from November 12 until now, HPG has had 5 consecutive sessions on the rise and the current price of HPG is also at its peak. Compared to the fund at the end of March, HPG is now up 150% in value.

This is also a highly liquid stock compared to the general market level. HPG’s average trading volume in the last month reached almost 16.9 million shares per session.

Just behind HPG in trading volume was Hoa Sen Group’s HSG. At the end of November 18, HSG decreased slightly to 19,050 dong / share compared to November 17, which was 19,100 dong, the highest market price for Hoa Sen shares in the last 2 years since March 2018. .

In fiscal year 2019 – 2020 (October 1, 2019 – September 30, 2020), Hoa Sen Group’s business results are quite impressive when the after-tax earnings announcement increased 3 times during the same period, reaching 1,151 thousand of millions of dong.

HSG is still in the process of a comprehensive restructuring after extremely difficult times 2018-2019. However, it can be seen that the comprehensive restructuring of the group initially brought some achievements to HSG.

Thanks to the positive movement of the stock price, the value of the assets of the “magnates” of the Vietnamese steel industry also increased rapidly.

As of December 30, 2019, the Chairman of Hoa Phat Group owns 700 million shares of HPG.

With a market price of 34,600 VND / share, the value of the HPG shares held by Mr. Tran Dinh Long alone is up to 24,220 billion VND. Compared to the end of March, Mr. Long’s assets increased by 14.56 billion dong.

According to the Forbes update at this time, Hoa Phat’s net worth has reached $ 1.6 billion.

Le Phuoc Vu’s assets are now more modest, reaching 1.416.2 billion VND, but have improved significantly compared to the previous period. From the end of March alone until now, Mr. Vu has added 1,096.5 billion dong thanks to the shares.

Source: https: //www.doisongphapluat.com/kinh-doanh/hai-ong-trum-nganh-thep-viet-nam-giau-len-chong-mat-v …

Elon Musk, the 49-year-old billionaire, became the world’s third-richest person, overthrowing the post of Mark Zuckerberg, after asserting …