[ad_1]

If saving is an art, then those who really save money are definitely masters of money and finance. Because we all memorize theories about the need to manage spending, record income and expenses, to save in case of uncertainty … But it is one thing that still applies to them. Or it is not another, and using it to get rich is even more remote.

But don’t worry, maybe the theory is too dry and rigid, so you don’t know how to do it. If so, try the 12 spending tips below, to avoid unnecessary baggage drift and to know where your money is going.

1. Imagine in advance

Marketing experts always focus on how you see the product and want to buy it. That is why the fitting room is always in the farthest corner of the store and the most expensive items always appear before your eyes. In their strategy, they will have competitively priced products, huge door price tags, music, and fair-use lighting.

So what should we do?

– Try to test a stranger: Do you want to buy a new dress? So imagine having a person in front of you, a hand holding a skirt, a hand holding money to buy that dress. Which hand do you want to choose? If you choose money, you really don’t need to buy that dress.

– Imagine 6 months after buying the product: Her dress is only worn once and is now hanging in the corner of the closet. Think twice and make the right decision.

2. Don’t touch what you like

People often appreciate what they own, so when they sell their stuff, they often leave it at a high price. After holding something you like in your hand, you will move on to the item that already belongs to you. And now, the price of the item is no longer an issue, you also forget about saving and are willing to spend a lot of money to buy a new phone that you really don’t need.

So what should we do?

– Ask a seller for advice how to use the phone or hold the skirt, the shirt you like.

– Buy fewer things online again. Studies show that online shopping makes it even more out of control and makes it easier to spend money on things.

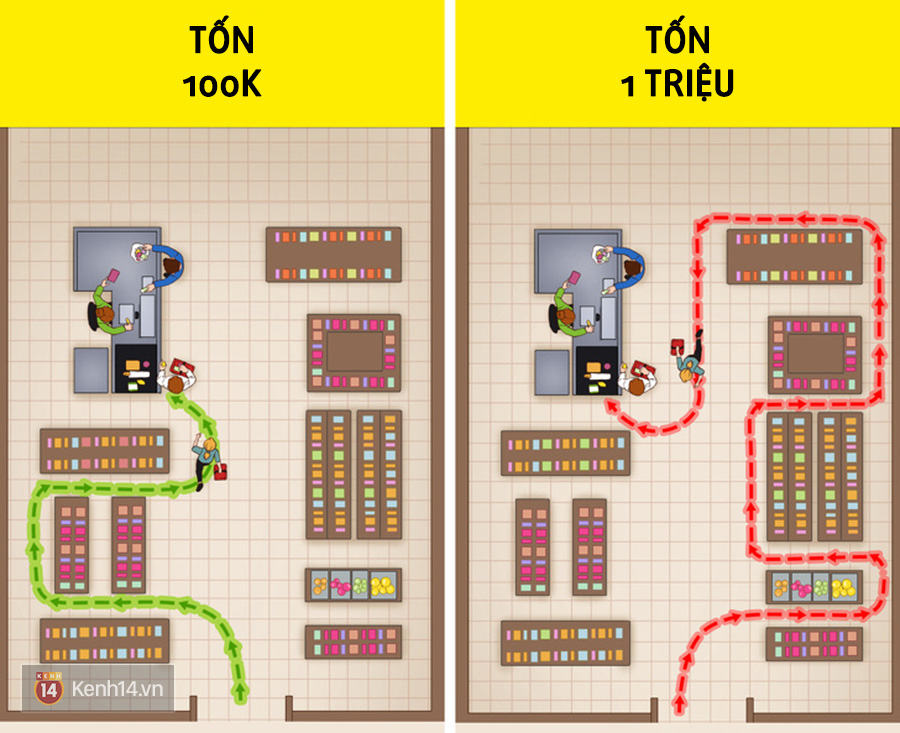

3. Go left

When entering a store, most customers tend to go well first because they are all right-handed. Marketing experts know this and often put more expensive products on this side.

So what should we do?

– Be prepared when you go shopping: Make a shopping list and tour the store to choose items from the list. In this way you can buy more organized.

– Pay attention to the products on the bottom or top of the shelf, because there are often cheaper things.

– Do not use a stroller, try to hold everything with your own hands. If you buy more than 1-2 items, please use a basket instead of a cart. As such, you will not exceed.

4. Don’t chew gum

People who chew gum circulate blood better to the brain, and their cognitive function develops more at any given time. This makes them want to see more people around them, look more at the items, and tend to buy them.

So what should we do?

– Do not chew gum. According to research, this process takes more time to choose and will buy more items than expected.

– Focus on what you need to buy and ignore the attractive offers. You must list or know what your purpose of going to the store is.

– Limit your own purchase time. Come in, collect what you need, pay and go.

5. Don’t look around

When a person sees a discounted product, they tend to want to buy now to save for next time. It all comes from the idea that if you don’t buy, you will probably have to pay a larger sum in the future.

So what should we do?

– Ignore the sale items if it is not on the list you need to buy.

– After you get what you need, go to the ATM right away. And say “No” to these 7-pack deals and get an additional bundle or buy this product for an incredibly low price.

6. Think carefully before spending

When you hear a salesperson say that there is a shocking product, that a limited product is out of stock, or that a sale is 1-0-2, you are easily convinced because you will regret it later.

So what should we do? To make the right decision, wait.

– Resist the temptation. The feeling of “I need it! I want it” generally takes 24 hours to pass. For bigger and more attractive products, you will need at least 3 days.

– Use the time to review online and compare prices.

– Count how many hours you need to work to earn enough money to buy the item you like. Sometimes the number will surprise you and give up on your intention to buy it.

– Check the items you had to see if there is something equivalent. Occasionally, look closely and you will find that you don’t need anything else.

7. Enjoy life in a different way instead of spending money

When you buy things while bored, shopping is no longer a hobby, but a difficult habit to quit. When you buy things, you’re only happy for about 20 minutes, and then you start to feel upset about the money you’ve spent.

So what should we do?

– Buy only what you need and don’t go to the supermarket, go to the mall, go to any store if you don’t need one.

– Plan when you visit a certain store. Shopping can be fun, but only if you are shopping awake. If you plan ahead, you won’t regret the money you spend. If you don’t, you will probably spend the last few coins you have.

8. Save what you have left

You know how much you spend in a week. After 7 days, look at the wallet or verify the account and you still have 500k “left over”. If you keep it in your wallet, there is a risk that you will spend it on several.

So what should we do? Invest for your own future.

– Don’t spend all the money you “accidentally” get. If someone pays you money or you save something, divide it into two parts: spend the first part and save the second.

– Gather and read the invoice you have in your wallet, will show you the discounted amount. Take that money out of your wallet and put it in another account. Give up the change you have.

– Stop buying things you really don’t need. For example, buy a new mug every week because it’s beautiful, every half a month buy a notebook because it’s nice.

– Drop the money from the piggy bank you don’t use. In case you don’t want to spend money to buy a piggy bank, save online quickly and conveniently.

9. Save money for the sole purpose

We often want many things, so we also have many different goals. And then we start to think: so many goals, which one is more important than the other? Do I have to save money for that?

And in this case, what should we do?

– Choose a priority objective. It doesn’t have to be a big goal to change the world or a destination, it’s just a goal that shows you how your efforts work.

– Don’t settle for what you have accomplished. If you have already completed saving for one goal, start moving to the next goal.

10. Focus on why you want to save money, not how you save it

The moment you try the noodles without sauce, you will understand how the tiredness of these tasteless things tires you and saving money doesn’t make sense either. So the next day, you will take a lot of meat home, buy a lot of junk food you have left before.

So what should we do?

– Think about why you decide to save more. Science shows that when everyone knows exactly why they need to save money, they will save more money than the plan they have established.

– Don’t be afraid to make decisions. Our lives are full of risks and choices, and you will often have to make decisions to balance financial planning.

11. Check the money you save regularly

People often focus on their destination because they notice how their process is going. That’s why you save money, deposit money in a secure or savings account, but rarely touch or review the money you have. As a result, the money suddenly became strange, like a bogus financial source. Reputation is your money, but not to make you happy.

So what should we do?

– Notice the amount saved. This helps you see yourself trying.

– Make it a habit: Every month, stop what you are doing and check how much you have saved in the past month.

– Don’t forget to reward yourself for trying: When you get to a number you set, congratulate him and give yourself a small but nice item.

[ad_2]