[ad_1]

A week of turmoil

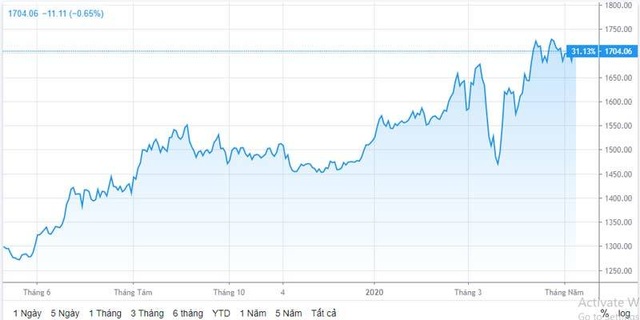

The gold market has just passed a week of relatively strong fluctuations, but there is no clear trend, sometimes it rises above $ 1,723 / ounce but sometimes it loses the important milestone of $ 1,700. At the end of the weekend, the spot price of gold closed at $ 1,702.9 / ounce.

The price of gold fluctuated in an unpredictable way after this product had a strong recovery and the Covid-19 pandemic was still complicated, leaving the United States in an unprecedented situation. The unemployment rate in the United States has reached a record 14.7% since World War II, equivalent to 20.5 million people who lost their jobs in April alone.

Normally, gold will rise sharply after negative information on the US job market. However, this time, there was no breakup. The high demand from investors seeking security in gold has not overwhelmed the absence of large buyers such as countries’ central banks.

World gold prices are still lurking.

The worldwide spread of the disease has reduced purchases in the world’s largest gold consuming markets, such as China, India and Russia. All of these are big buyers in the international gold market.

However, the fact that gold has not fallen and is around the peak of $ 1,700 an ounce thanks to the demand of a large number of investors seeking a safe haven.

Meanwhile, the US employment data is the darkest since World War II, but slightly lower than the previous forecast. According to a MarketWatch survey, the number of Americans estimated to have lost their jobs in April totaled 22.1 million, more than the actual number of 20.5 million.

Furthermore, China’s concessions after strong statements by the President of the United States, Donald Trump, also prevented the emergence of this precious metal. Leading U.S. and Chinese trade negotiators recently received a phone call, pledging to facilitate Phase 1 trade deals.

This happened after Donald Trump threatened to kill the trade agreement signed in January 2020 if China failed to honor its commitment to buy an additional $ 200 billion in US goods and services.

The Trump administration is also urging U.S. companies to withdraw China’s global supply chain soon after the Covid-19 pandemic, in the context of Washington’s consideration of punitive new tariffs on Beijing products and the card. China is considered the highest in 30 years.

Gold will be in a strong rally

Despite the fact that the pressure on gold at this stage is not small when the world is still recovering from the Covid epidemic, cash remains the number one priority and central banks that most countries have not considered buying . gold, but the prospect of this article is still quite bright.

Trade relations between China and the United States remain tense.

At Kitco, according to the CEO of the Celsius Network, the price of gold will rise sharply and could hit $ 3,000 / ounce by the end of next year, perhaps even more if the current currency war does not. be controlled

Most countries are printing money on a large scale, unprecedented in history, a quarter printing money for years combined. Large-scale money printing runs the risk of causing serious monetary disputes. This is the basis for gold to enter a period of rise.

Last week, the US Treasury Department. USA He said he planned to borrow nearly $ 3 billion in the second quarter of 2020 because rescue packages related to the Covid-19 pandemic caused a budget deficit. This number is too large, exceeding the 530 billion dollars lent in the 3/2008 quarter to face the global financial crisis. Throughout the year of 2019, the US Treasury Department. USA It only loaned $ 1.28 billion net.

For the United States, loans are generally made by selling government bonds and paying relatively low interest rates because these debts are often classified as low risk. But even before the outbreak, the country’s debt burden increased to the point that many economists warned about the risks to long-term growth.

In recent weeks, the United States Federal Reserve (Fed) has purchased more than $ 1 trillion in hard bonds, which means injecting such a huge amount of money into the United States financial market. Not only the Federal Reserve, foreign investors like Japan, Britain, France … they also gave the Trump administration the same.

Countries pump money massively, gold has the opportunity to raise prices.

CNBC Recently forecast, the US budget deficit. USA It could hit a record 80 years, at nearly $ 4 billion in fiscal year 2020 (4 times higher than the previous forecast) because the US government. USA support, helps the economy escape the stagnation caused by Covid-19.

According to the calculations of the CEO of Celsius Network, the Fed could flood the market with at least $ 10 trillion. The Central Bank of EE. USA He sold more assets in one month than he had sold in more than 100 years.

The US bond market USA You also have the risk of a growing bubble when the yield on 10-year bonds is very low, at 0.5%, while the yield on 30-year bonds is at a record low.

Not only the United States, the news of money with important economic stimulus programs in many countries have also made gold increasingly attractive. According to Reuters, Japan has just said it will increase the size of the stimulus package to almost $ 1.1 billion.

A number of central banks cut interest rates to record lows, many of which maintained negative interest rates like those in Japan and Europe.

Previously, many organizations also forecast that gold will rise sharply after a short sagging time. The VanEck representative said gold will hit $ 2,000 / ounce in 12 months. Bank of America predicts that gold will hit a record $ 3,000 in the next 18 months. Commerzbank said gold will rise to $ 1,800 / ounce by the end of 2020. And Refinitiv forecasts that gold will exceed $ 1,850 / ounce this year.

According to V. Minh

Vietnamnet

[ad_2]