[ad_1]

Intellectual people

However, claiming to have “gone underground into the mountains” and had little involvement in the work of the Hoa Sen Group, the giant Le Phuoc Vu and his own company continued to buy and sell shares recently when the price of HSG rose sharply. blinking.

HSG shares are above the maximum price

After successfully selling 30 million shares of HSG, Hoa Sen Investment Group Company Limited recently announced that it wants to sell more than 43.1 million shares.

Specifically, the private company of Mr. Le Phuoc Vu – Chairman of the Board of Directors of Hoa Sen Group has registered to sell more than 43.1 million shares of HSG and all of these are shares owned by this unit. maintained in the largest galvanized steel company in the country.

The transactions are expected to run from December 4, 2020 to January 2, 2021. If the deal is successful, Hoa Sen Investment will cease to be a shareholder of Hoa Sen Group.

HSG share movement

This is the fourth sale of HSG shares of Hoa Sen Investment in 2020. In the three previous divestitures, in total, Hoa Sen Investment has sold 65 million HSG shares. Meanwhile, Mr. Le Phuoc Vu bought 20 million shares of HSG and increased his stake in the Hoa Sen Group to 16.73%.

Therefore, the HSG share buying and selling activities of Mr. Le Phuoc Vu and his own company made many people difficult to understand.

HSG shares peaked at 19,100 dong on November 17, up 341% from the low at the end of March. To this day, HSG shares were a profit-taking and were down 2.18%. HSG’s market price is 17,950 dong and even higher than the lower 314%.

Mr. Le Phuoc Vu, Chairman of Hoa Sen Group, has stated that in the last 3 years (after the Ca Na case), he rarely went to the company, but mainly stayed in the mountains, sometimes visiting his wife and children in Australia. Two months, Mr. Vu only came to the company 1 day and only within 1 hour, so most of the issues were handled by the board of directors. “Hoa Sen is no longer dependent on Le Phuoc Vu,” emphasized the sheet steel industry giant.

This is clearly demonstrated through Hoa Sen Group’s business results in recent times, although the president is absent, it continues to rise strongly.

In the fourth quarter of fiscal year 2019-2020 (June 30 to September 30), Hoa Sen’s revenue reached 8 345 billion VND, profit after tax reached 450 billion VND, a 31 % and 436% more, respectively, during the same period. period.

Accumulated in fiscal year 2019-2020 (October 1, 2019 to September 30, 2020), Hoa Sen’s revenue reached VND 27.534 billion, roughly the same period last year, while the after-tax profit was up to 1,150 billion dong, up 219%.

Reduced outstanding loans, lower interest expenses

In fiscal year 2020-2021, Hoa Sen aims to increase sales volume, revenue, and net profit by 10% over the same period. The company will promote sales in both the domestic and export markets.

Hoa Sen expects the sales volume in the domestic market to increase by around 10% in the 2020-2021 fiscal year.

According to analysts at VDSC Research, the demand for industrial construction activities may increase considerably in the coming years as multinational companies relocate part of their production facilities to Vietnam. However, FDI inflows also face short-term obstacles due to immigration control to prevent epidemics.

Hoa Sen’s export volume is expected to grow at a similar rate to domestic consumption. VDSC Research quoted a representative for Hoa Sen as saying that some countries have increased investment and infrastructure construction after the pandemic. Consequently, the import demand for galvanized steel sheet will be higher.

Hoa Sen’s export orders in the first quarter of fiscal year 2020-2021 are relatively high and have reached the maximum allocation for exports. Therefore, the export volume is expected to be maintained or increased compared to the fourth quarter of fiscal year 2019-2020.

Currently, the gross profit margin for exports is 10% to 12%, higher than in previous years due to the increase in the proportion of exports to difficult markets. The risk in Hoa Sen’s export orders is relatively low because the company often sets sales prices before delivery for about 1.5 to 2 months, and can purchase materials later for production.

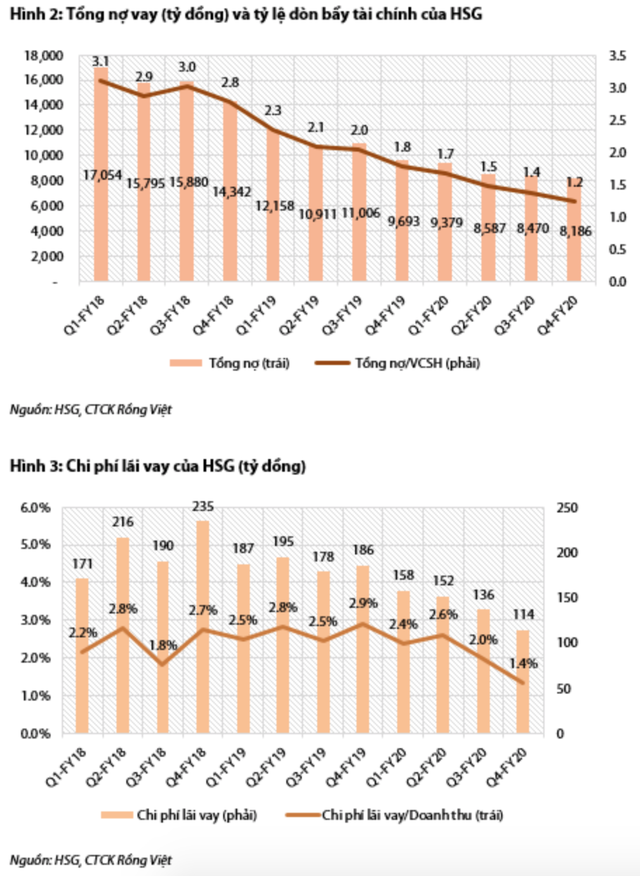

Hoa Sen’s financial structure is becoming more sustainable and lower interest expenses are supporting net profit margins. HSG’s total debt decreased 15.5% year-on-year in the fourth quarter of fiscal 2019-2020, so the total debt-to-equity ratio also decreased 1.8 times in the fourth quarter of the fiscal year. 2018-2019 to 1.2 times in the fourth quarter of the 2019-2020 period.

The HSG plans to reduce this rate below 1.0 times in the year 2020-2121. The company expects the ample operating cash flow to be sufficient to fund working capital without using debt.

Hoa Sen’s depreciation expense for the 2019-2020 year is VND 1.136 billion, higher than its investment in working capital, just VND 891 billion.

According to forecasts by VDSC Research, the corporation of the giant Le Phuoc Vu will not strongly increase inventories and accounts receivable in the period 2020-2021, so internal capital can be used to finance stored capital. Moving.

Due to the decrease in outstanding loans, HSG’s interest expenses decreased 40% QoQ in the fourth quarter, interest / sales expenses also decreased from 2.9% in the fourth quarter of the previous year to 1.4% in the fourth quarter from 2019-2020, so the net profit margins have also been supported.

Mai Chi