[ad_1]

Thursday, May 14, 2020 4:30 PM (GMT + 7)

Cash flow continues to flow into the stock market with liquidity reaching the highest level in many months.

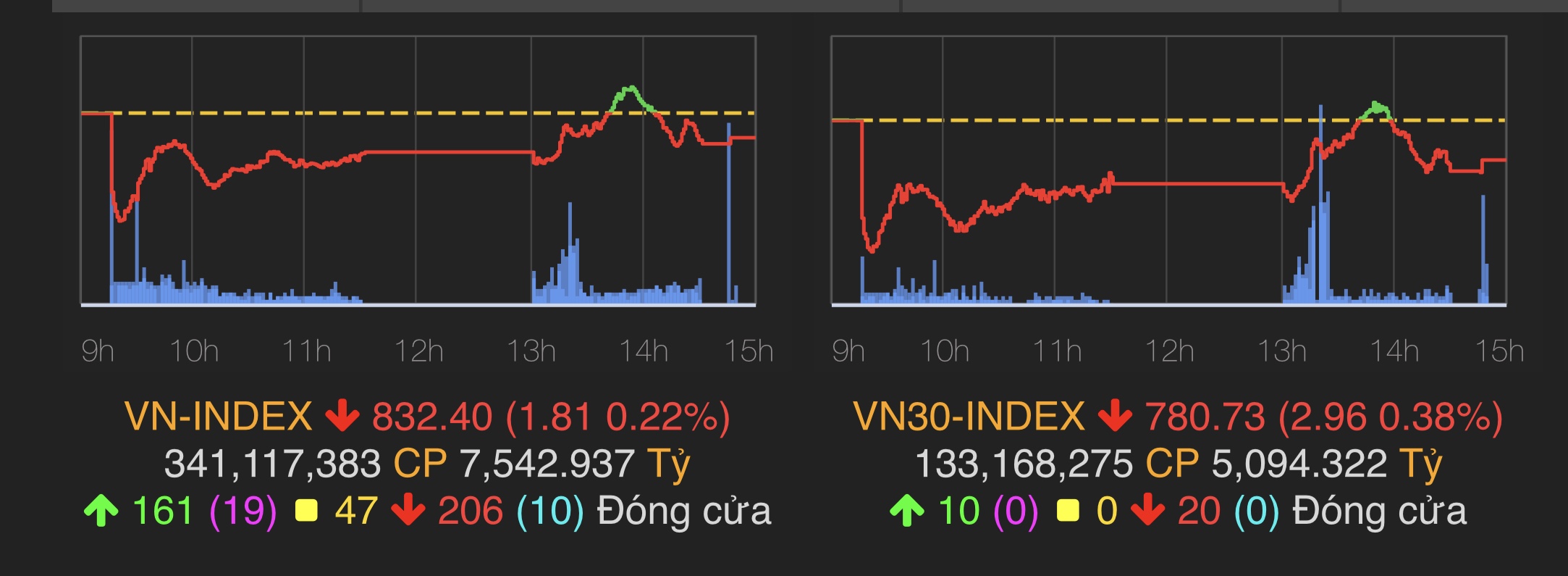

At the close of the session, the VN index decreased by 1.81 points (0.22%) to 832.4 points; while the HNX index decreased 0.46% to 111.34 points and the UPCom index decreased 0.46% to 53.48 points.

The VN index decreased by 1.81 points (0.22%) to 832.4 points.

Market liquidity reached the highest level in recent months with an equivalent value of 3 floors that reached more than 8.3 trillion VND, equivalent to 425.9 million shares.

The market has 271 advances and 59 ceilings. While on the other side, there were 335 decreased shares and 38 shares fell to the floor.

MSN is the focus of the market when foreign investors bought up to about 2.5 billion dong, the shares rose sharply but during the session did not reach the maximum price.

Bank stocks continued to attract cash flow when STB, MBB, CTG, VPB and TCB reached the trading volume of more than 3 million shares. In particular, STB reached over 12 million shares and MBB reached almost 7.4 million shares traded today.

The aviation stock group had a crash session when many of the group’s stock declined. Codes like VJC, HVN, ACV, MAS, SCS … all fell. NCT was luckier to close on the reference.

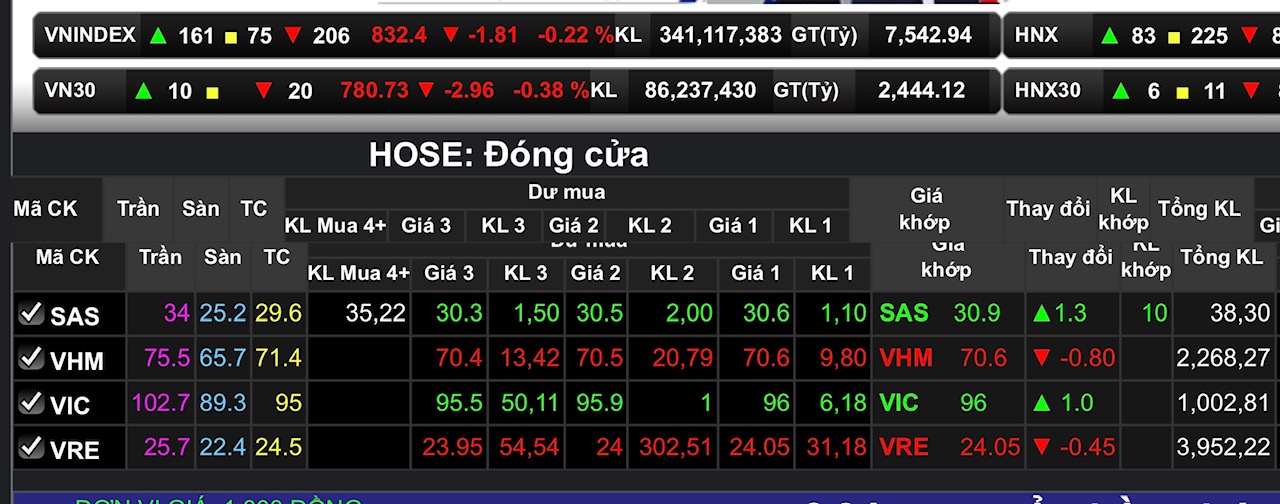

After more than 1 month, SAS recovered quite impressively when it recovered 16.17% of the value.

Only SAS continued to have a good upward session. At the close in SAS, Tan Son Nhat JSC (Sasco) airport services increased 4.39% to VND 30,900 / share. This is the third consecutive strong gain of this stock.

After more than 1 month, this stock rebounded quite impressive when it recovered 16.17% of the value. As a result, until now, the impact of Covid-19 on SAS is not much when it is calculated that more than a quarter of this code increased again to 15.30% in value.

It is known that the Board of Directors of the Tan Son Nhat Airport Services Limited Company recently approved the second 2019 dividend payment in cash at a rate of 15% (VND 1,500 / share). Expected payment time in June.

With 133.4 million shares outstanding, the amount of money Sasco paid to pay dividends to future shareholders is estimated at VND 200 billion.

The Hanh Nguyen family is estimated to receive more than VND 90 billion from the dividend advance.

The ownership structure in Sasco is highly concentrated with two main groups of shareholders. Vietnam Airport Corporation (ACV) is the largest shareholder with 49% equity. The group of shareholders, including 3 family companies, Chairman of the Board of Directors, Hanh Nguyen, represents 45% of the shares.

Therefore, in the dividend distribution next month, the amount ACV receives is expected to be approximately 98 billion, while the Hanh Nguyen family is estimated to receive more than 90 billion.

Previously, Sasco advanced the first shares in late 2019 in cash at a rate of 8% (VND 800 / share). Therefore, in total, Sasco’s dividends in 2019 at a rate of 23% (2,300 VND / share). This is one of the publicly listed companies with a stable dividend payout ratio for many years.

In 2019, the total net income of the company led by Mr. Hanh Nguyen is VND 3.1 billion. The company’s after-tax profit reached VND 370 billion.

However, in the first quarter, Sasco only reported a net profit of 16 billion dong. This is Sasco’s record low quarterly profit since the company was listed on the stock exchange in 2015.

Source: http: //danviet.vn/hang-chuc-ty-do-ve-tui-dai-gia-thue-chuyen-co-dua-con-ve-nuoc-chua-covid-19-50 …

Currently, all of the company’s assets are sealed by banks to squeeze debts with debts of up to more than a trillion dong.