[ad_1]

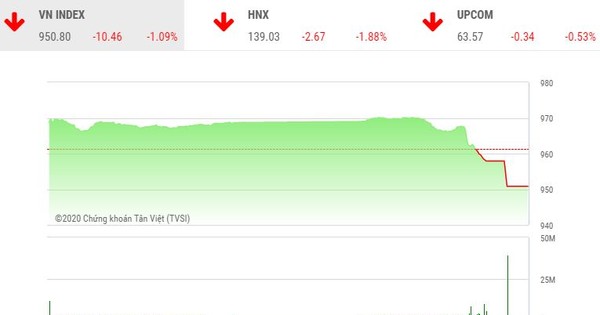

(ĐTCK) Some rumors and rumors spread, and this is a very good excuse to explain the sharp drop this afternoon when the market plunged almost 20 points in just over an hour of trading late in the afternoon session.

In the morning session, although market movements were quite differentiated and foreign investors continued their strong net selling trend, large stocks still acted as wings to help the VN-Index continue to soar during the session. the morning of October 26.

The uptrend was still holding up well entering the afternoon session, which helped the VN-Index to successfully challenge the 970 resistance level after just over 30 minutes of trading.

However, with the support focused solely on the big stocks, investors are quite cautious about the situation of pulling the pillars to unload goods. Not because of the concern above, the uptrend lasted for more than an hour and the market suddenly turned due to strong selling pressure.

The sell force took place quite decisively and increasingly widespread, especially the large stocks that played the supporting role in the morning session also reversed, or simply kept the green light as in VIC and VNM, which makes VN The index fell vertically to the lowest level of the day, to the price range of 950 points.

The difference between the highest score and the closest VN-Index score is almost 20 points.

In particular, this sudden reversal has in fact been warned, for example, in the news published last night (link below), KB shares mentioned the possibility of a reversal. However, the fact that the market today, many investors has been explained by another rumor. Rumors are inherently unproven!

Comment on the stock market on October 26: Pay attention to HPG, VIC and VNM

In the end, HOSE had 137 winners and 286 losers, the VN-Index fell 10.46 points (-1.09%), to 950.8 points. Total trading volume reached 428.25 million units, worth VND 8,550.87 billion, decreased by 5.36% in volume and 9.61% in value compared to the last session of the previous week to October 23. Put-through transactions contributed 23.48 million units, worth VND 597.13 billion.

There were only 6 winners in the VN30 pool, including VIC, VNM, KDH, MSN, PLX, and PNJ with an increase of just over 1%, except for MSN with the best gain of 2.2% at VND87,900 / share.

The remaining 23 stocks fell, with a considerable burden coming from the bank line when in turn looking for the lowest price of the day.

Specifically, VCB decreased 1.7% to VND 86,000 / share, BID decreased 4.2% to VND 41,000 / share, CTG decreased 4.1% to VND 30,500 / share, HDB decreased 1.77% to VND 25,000 / share. CP, MBB decreased 2.39% to 18,400 VND / share, TCB also fell back to decrease 2.71% to 23,350 VND / share, STB fell 3.09% to 14,100 VND / share, VPB fell 4.44% to 24,300 VND / share.

Also, other big codes that support the market in the morning session like VHM, SAB also lost points.

Not only the first and large caps stocks, the small and mid caps also fell back below the benchmark level, such as FLC, ITA, HQC, HAI, HAG, LDG …, they even fell to the ground like AMD.

On the HNX, the selling pressure was also quite strong and, on a large scale, the HNX Index lost almost 2%.

At the close, in the HNX, there were 48 winners and 96 losers, the HNX index fell 2.67 points (-1.88%), to 139.03 points. Total combined volume reached 55.67 million units, worth VND 776.33 billion. The transfer transaction added 5.88 million units, worth 100.55 billion VND.

Not unlike on HOSE, the big codes on the HNX also raced deeply as ACB -3.1% to 24,800 VND / share, PVS -2.9% to 13,500 VND / share, VCG -4.1% down. VND 41,800 / share, SVC -2.6% to VND 75,900 / share, SHB -1.2% to VND 15,900 / share, NVB -2.17% to VND 9,000 / share …

In which, ACB and PVS were the two most liquid tickers with an equivalent volume, respectively, 11.66 million units and almost 6.8 million units.

Also, in small and medium stocks, hot stocks such as KLF, HUT and ART stopped at the lowest price with a trading volume of several million units.

At UPCoM, the market also extended the decline at the end of the session.

At the close, UpCoM-Index lost 0.34 points (-0.53%) to 63.57 points with 81 advances and 106 decreases. Total combined volume reached 17.76 million units, worth 235.88 billion VND. The transfer transaction added 3.95 million units, worth VND58.3 billion.

BSR continued to decline further when it lost 2.82% to VND 6,900 / share and remained the most active ticker on UPCoM, reaching 3.13 million units.

BVB came in second with a trading volume of 2.33 million shares and ultimately fell 6.06% to 12,400 VND / share.

Not only BVB fell deeply, other bank codes in UPCoM also corrected like VIB, NAB and SGB.

In addition, the adjustment of large stocks such as MSR, VGT, VGI, VEA … also increased the pressure on the market.

In the derivatives market, 3 futures fell and only 1 contract maintained a slight increase. In which, VNF2011 decreased 0.86% to 927 points, the combined volume exceeded 127,360 units, the open volume was 33,780 units.

In the guarantee market, the CVRE2007 code with the largest transaction reached 186,724 shares and rose 6.12% to 520 VND / CQ.

[ad_2]