[ad_1]

Thursday, November 19, 2020 05:00 AM (GMT + 7)

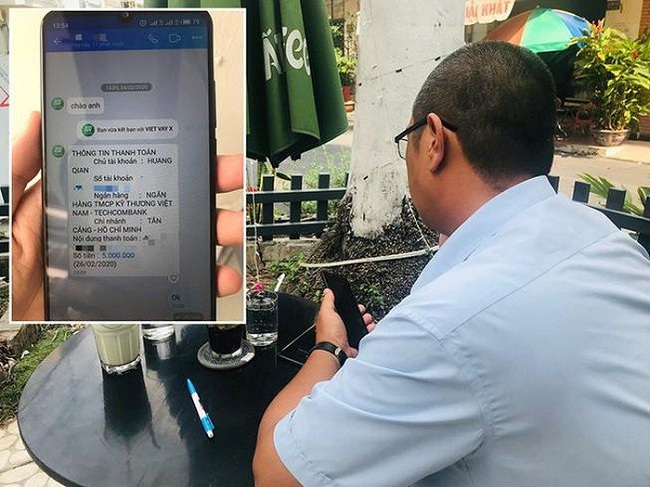

Recently, the state of online loans, loans through applications installed on the phone (online applications) with very devastating tricks. Many victims, unable to withstand the pressure, have died.

Borrowers “drowned” in debt

Mr. Nguyen Van T. – office worker (Cau Giay, Hanoi) said that he is one of the victims of borrowing money through the phone app, currently sinking into black credit and thinking about death .

Mr T said at first he only used 1 Cashwagon app, sometimes when he was in trouble he would sign up for a loan, the loan amount was not much, just 1.5-3 million VND with interest of about 400,000 to 800,000 VND within 14 days, but after each payment, you have to borrow money from friends, colleagues or borrow from the app to have money to use because the salary is used to pay off the debt.

Many people are in danger because they borrow money through the phone application

“The loan limit gradually increased and the amount I borrowed gradually increased according to the allowed limit, when I reached the limit of 10 million / loan, I could not pay the full amount, so I had to choose to pay 3 million dong for an extension within 30 days. Right now I have looked for other online loan apps to manage, in about 4 months after borrowing from one app, I have borrowed up to 16 different apps (Cashwagon, Tubevay, Vinvay, Minivay, Wetien, NowC, Vayday, YoYo, Cashdone, Vndong, Andvay, Openvay, ATM online, SaigonCredit, DoctoDong, Ufun) the loan period is 6 to 15 days just to pay money from this application, or to renew for another application, the loan amount of the application is increasing ”- said Mr. T.

It is known that, because he did not have the timely payment, every day, Mr. T. also received calls and messages reminding him of debts, if he requested an extension he would have to hear insults and threats. Even family members, friends, colleagues, labor relations, diplomacy received calls and messages with content that announced the fraud of Mr. T., the appropriation of the property quickly. quick payment.

Too embarrassed, Mr. T. wrote a resignation in the office, did not dare to go home, thinking about suicide in his mind.

“One afternoon, I found the riverbank to end it all. But when I get in the middle of the line thinking that after that, the credit company will believe, forgive my friends and relatives or not, it will just die, leaving family and relatives to suffer. in fact, two children are too young to have a father, I could not have. I just hope people with the same mistakes as me get out quickly when it’s not too late, “said Mr. T.

Similarly, Ms. Nguyen Ngoc Trinh, TP. Nha Trang and Khanh Hoa have borrowed money from a usury group with principal and interest of up to VND 570 million. Being obliged to pay for 20 days, every day 28.5 million. Ms. Trinh cannot pay the debt. The moneylenders found her, cursed and threatened her, and then took her motorcycle. They asked Trinh to bring money to pay before she could receive the car.

Since he had no money to pay the debt, he was too scared, so Trinh committed suicide. Fortunately, people quickly saved the victim and took her to the Provincial General Hospital for emergency treatment. Not seeing Ms. Trinh come to pay the debt, the loan group came to the house to threaten and force the husband to pay the debt on behalf of his wife. When they found out that Trinh was being treated at the hospital, they continued to come here to threaten and force her to pay the debt. Unable to bear it, his family went to the police to intervene.

Unable to find a way out due to debt, many victims have come to their deaths to rescue

More sadly, also borrowing money through the app has turned into a tragedy with the family of Ms Truong Thi Ngoc Bich in the city. Bien Hoa (Dong Nai) in March 2020. Due to pressure to borrow money through the phone app, his only daughter, 23, thought and died. In her suicide note, the girl mentioned getting black credit through an internet application. She was heavily in debt, including more than 10 loan applications. Unable to pay the debt, she is constantly threatened, so she must seek death to be released.

The cruel thing is that after her daughter’s death, Ms. Bich was constantly haunted by app calls, demanding reimbursement. Every day, there are about a hundred phone calls, curses, intimidations, insults, …

Not for dishonest tricks

In fact, there are tens of thousands of people who got caught in this type of loan trap with hundreds of millions of dong in debt.

There was a victim who was trusted, initially he only borrowed 8 million dong from 2 apps and when there was no payment due, the app staff submitted them to borrow on another app to pay off the debt. Until now, after 3 months, from only 8 million dong so far, you have to borrow more than 200 million dong to pay off the debt. From the place of borrowing only 2 apps, so far I have to borrow 64 apps with the amount of interest and penalties increasing exponentially every day.

From just a few million initial loans, in a short time the victim became a giant “debtor” of hundreds of millions.

Discussing this issue at the last meeting of the National Assembly, delegate Nguyen Thi Thuy (Bac Kan) said that it is a new type of black credit, which turns small debtors into large ones by accumulating debts. unbearable debt.

Regarding the above situation, some delegates also said that the way to collect debt from app employees is even more devastating than black credit in real life. Initially, the applications allowed employees to use vulgar and cruel language, constantly calling the borrower and his family, not only that, but also calling everyone in the phone book to slander the borrowers to pressure repayment. There are victims who said that because of the loan, their phone was haunted 24 hours a day, even up to 200 different phone numbers.

When cell phone terrorism is ineffective, subjects will make full use of social networks. They cut the image of the entire borrower family, put it online with photos of prostitutes, other criminals to humiliate them. There are cases in which the father asked to borrow money but altars were set up for the children, they were put on very cruel social networks and there were people who, because they could not bear these pressures, turned to death to free themselves, such as schools. Consolidated in Kien Giang, Tien Giang …

Recently, the local police have scanned many usury groups through the application, including fines and interest of up to more than 1000% per year, but the local police are reflecting that they are having problems. many difficulties in the application of the laws to drive.

Deputies Nguyen Thi Thuy made 3 recommendations: First, to propose to the Ministry of Public Security that it report in a comprehensive manner the methods and tricks of this crime so that people can actively prevent them. Second, the central procedural units are recommended to urgently summarize the problems in the application of the legal provisions to handle this behavior; and to propose to the National Assembly to correct the pertinent laws. Third, propose to the State Bank to study to have small loans with fast and favorable loan approval procedures to help people in need to access these credits.

Source: http: //danviet.vn/bi-kich-vay-tien-qua-app-dien-thoai-vay-8-trieu-sau-3-thang-no-thanh-200-trieu …

In order to have multiple checking accounts at the bank that are beautiful and easy to remember, clients may have to spend a few …