[ad_1]

Intellectual people

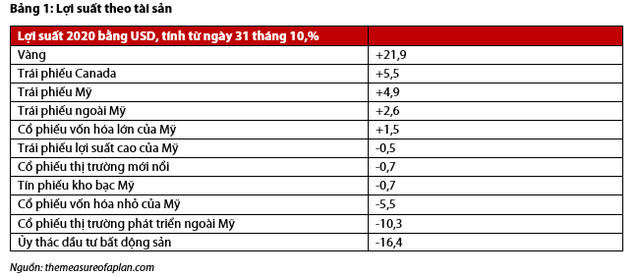

The best performing asset class this year is gold, with yields four times higher than Canadian bonds (second place).

Gold has the best rate of return among assets.

In a recently released report, expert Bernard Lapointe, chief analyst at Rong Viet Securities Company (VDSC), said that for 2020, the asset with the best rate of return is gold. , with yields four times that of Canadian bonds, ranked second.

Real estate investment trusts, on the other hand, are the investment with the lowest yield. The reason is that this year, the economic activity halted due to the Covid-19 epidemic had a serious impact on the commercial real estate industry globally.

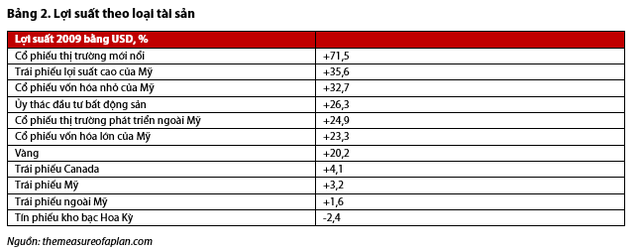

Over time, asset class returns have fluctuated quite randomly. For example, the performance of emerging market equities slumped to last place amid the 2008 global financial crisis, then rose to the top in 2009 due to investor risk preference. Returns.

Historical asset returns that do not indicate a specific investment will always have a better rate of return with rankings that change over time based on macroeconomic and geopolitical indicators.

However, one thing is for sure, bonds have a low correlation with stocks and can offset losses during market recessions.

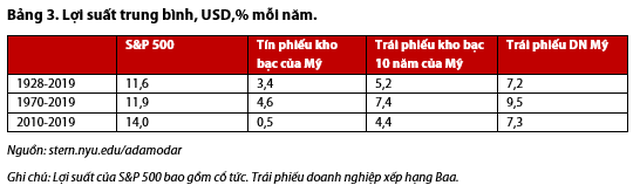

However, the expert also noted that government bonds and short-term money market instruments have had lower rates of return than stocks since inflation in the United States peaked in the late 1970s and in throughout the last century.

“We can’t just look at historical market returns to build a portfolio,” noted Bernard Lapointe. The consequence of the expected return forecast is the risk forecast by asset type.

Typically this is done by measuring volatility or direct correlation between asset classes using time series, or indirectly using a pricing factor model.

The asset allocation approach directly predicts the volatility and correlation of asset pairs and results in an increase in the covariance matrix as the number of asset classes in the portfolio increases.

This approach helps to visualize the common characteristics of an asset rather than looking at each individual asset. Asset type risk is measured by classifying assets into a set of risk categories.

In summary, the VDSC Director of Analysis comes to a conclusion, some types of assets have quite strong fluctuations from year to year. This is especially true for stocks in emerging and developed markets.

Lower risk asset classes tend to be less volatile and the change in their classification depends on the strong volatility of risk assets.

Despite relative risks and volatility, large US stocks remain fairly stable relative to other asset classes.

Mai Chi