[ad_1]

In the recently released financial report, Berkshire said the company posted a net loss of $ 49.75 billion in the first quarter, equivalent to $ 30,653 per class A share, making the loss of major investments. Investment: mainly ordinary shares, for a total of US $ 54.42 billion. Meanwhile, last year, Berkshire’s net profit was $ 21.66 billion, equivalent to $ 13.209 per share.

Quarterly earnings, a factor Warren Buffett considers a more efficient measure of performance, rose 6% to $ 5.87 billion from $ 5.56 billion last year, or $ 3,388 per share.

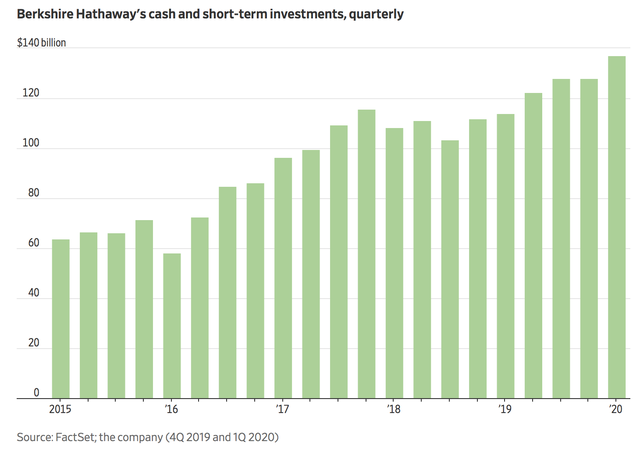

An accountant requires Berkshire to report unrealized gains and losses and gains. This has made a big change to Berkshire’s net results, which Buffett considers to be pointless. However, the billionaire group has bought more shares in part because Buffett was unable to find large companies to make acquisitions. Consequently, for more than 4 years, Berkshire has kept around $ 137.3 billion in cash.

The S&P 500 saw a 20% decline in the first quarter, but Berkshire’s large holdings even plummeted, including American Express, Bank of America, Wells Fargo and four U.S. airlines. , Delta, Southwest and United.

Like many other businesses in the United States, the Berskhire business was heavily influenced by Covid-19. Berkshire business companies were negatively affected by the pandemic, on a “relatively small to severe” scale, and turnover of some companies considered essential was significantly reduced. in April

The most affected companies are railways, energy, public services and insurance valuation. The epidemic caused the BNSF railway company (acquired by Berkshire in 2010) and the retail companies to cease operations.

Sharing with the Wall Street Journal, Vice President Charlie Munger said last month that some of Berkshire’s small businesses may be closed entirely.