[ad_1]

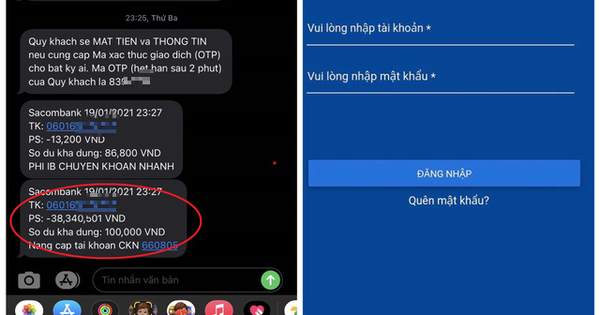

Ms Q.’s money scam message also comes from the same information system she normally receives and from the fake website – Screenshot

Recently, 2 girls from Ho Chi Minh City have become victims of fraud by following the instructions of the bank messaging system they are using.

Follow the bank’s message, take tens of millions

At 22:00 on January 19, Ms. LNTQ (26 years old, living in District 7) received a message from Sacombank’s messaging system (SMS Banking) with the content: “Show your login account other than the illegal Enter http: //i-sacombank.com to confirm the information and change your password. “

According to Ms. Q., because this message was sent from Sacombank’s messaging system (not another number), she trusted and accessed the web link to access her account and password.

After entering your account and password, the web interface displays the box where you should enter the OTP (transaction confirmation code). After that, it was also Sacombank’s SMS banking system that sent SMS to issue the OTP code.

Ms. Q. entered the OTP code on the website and received a phone message from Sacombank with the content of the notice that the account has been deducted more than VND 38 million and another message notifying that the fast transfer fee is 13,200 VND.

“In a panic, I quickly contacted the Sacombank customer service center and was instructed the next day (January 20) to contact the bank branch that signed up to open an account to access the recipient’s account, coordinate . “- said Mrs. Q.

Ms. PTTD (29 years old, living in Binh Thanh district) also fell into a similar situation.

Ms. D. also received the SMS Banking from Sacombank, which she often uses with the content: “New year, I need to confirm your information, completing the information is 50k …”.

Ms. D. said that because every day every transaction through the bank is sent by the bank using this message, Ms. D. thinks that the bank wants to confirm the information, so there is no doubt that clicks on the link, imported posted.

“When I logged into internet banking, I saw that the money from the account had been fully deducted. In that account, there was more than 1 million VND in that account, if there were more, it would have been cleaned up,” said Ms. D. bothersome.

“The fake messages did not come from Sacombank”

Reply withOnline youthA representative from Sacombank said that after reviewing Sacombank’s system and the network of partners that provide telecommunications services to Sacombank, it is possible to confirm that these false messages did not come from Sacombank.

“We have quickly asked the banks to block the accounts of the beneficiaries of fraudulent transactions, and we are coordinating with the authorities and telecommunications service providers to find out the cause of the problem, as well as the solutions to overcome” – Information from the representative of Sacombank .

According to lawyer Tran Minh Hai (Hanoi Bar Association), this is an incident with criminal signs and the behavior of the objects using the above deceptive tricks is the fraudulent act of appropriation of property specified by the criminal law of the Ministry.

“Credit institutions law requires banks to keep account information, transaction information, and customer information confidential. The fact that customers are misled in this case needs to verify more information.

However, you also need to wonder why scammers have customer information with Sacombank accounts and customer phone numbers as well. Is the message being used by the Sacombank SMS user correct? These issues need to be clarified, if it is true to the customer’s reflection, it cannot be said that the bank is not responsible in this case, “said Hai.

Frustrated by the loss of money, Ms. Q. submitted a request to the Department of Cyber Security and High-Tech Crime Prevention, Ho Chi Minh City Police to report the incident.

Phishing warning

Given the above situation, Sacombank recommends that customers do not click on any link other than the official Sacombank e-banking website isacombank.com.vn and do not provide confidential information such as passwords, OTP., Card PIN .. anyone, including bank staff.

Customers should type the official address in the web browser instead of clicking on the pre-made link sent by SMS, email or suggested by search engines because the links can be spoofed almost like the real address.

Customers immediately contact the hotline 1900555588 for assistance and verification upon receipt of information on suspected fraud.