[ad_1]

The Vietnam stock market just closed 2020 full of volatility due to the influence of the Covid-19 epidemic. Thanks to good disease control and the positive growth momentum of the economy, the VN-Index had a strong break in the second half of the year and even exceeded 1,100 points.

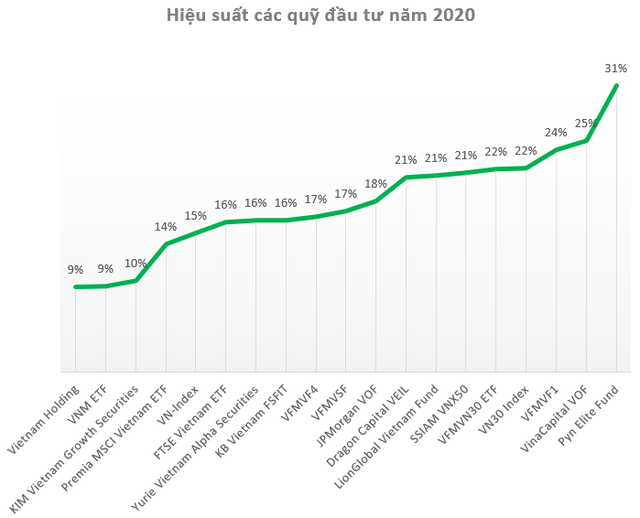

At the close of the session on December 31, the VN-Index stopped at 1,103.87 points, which is equivalent to an increase of 14.87% compared to the beginning of the year. Meanwhile, the VN30 made an even more spectacular breakthrough with an increase of almost 22% in 2020.

Positive market movements have helped the portfolio of many mutual funds to grow strongly in 2020. Statistics show that most of the large mutual funds in the Vietnam stock market have a growth rate of more than 15% in 2020, outperforming through the general market rally.

Pyn Elite Fund is the best performing investment fund in the Vietnam stock market on our list with a 31% NAV / share growth over the past year. Having a large number of bank stocks (CTG, HDB, TPB, MBB), as well as investment in VFMVN Diamond ETF fund certificates, helped the fund’s portfolio to grow strongly over the past year.

Pyn Elite Fund Portfolio

Second in terms of investment efficiency last year was the VOF fund managed by VinaCapital with NAV / Share growth of almost 25%. Last year, large investments in the portfolio of funds like HPG, ACB saw a breakthrough. In addition, the divestiture of International Dairy JSC (IDP) also helps the fund make a lot of profit. This was an opposite achievement compared to 2019 when VOF VinaCapital was one of the “worst” performing funds at the time.

VFMVF1 managed by VFM also performs quite well with a growth rate of 23.8%. VFMVF1’s portfolio has a large proportion of good stocks in the last year, such as HPG, NTC, ACB, …

Over the past year, the VN30 index has had quite positive fluctuations with a growth rate of 21.8% and this helps the VFMVN30 ETF portfolio perform similarly.

The largest foreign fund in the Vietnam stock market, VEIL Dragon Capital, also performed quite positively with a growth rate close to 21%. This is also the achievement of the Singapore LionGlobal Vietnam Fund.

The SSIAM VNX50 fund continued to maintain its growth rate of 21.4% in 2020. Previously, in 2017, 2018, 2019, SSIAM VNX50 was also among the best growth funds on the market.

Foreign ETFs posted modest performance in 2020. As a result, the FTSE Vietnam ETF achieved 16% NAV / equity growth, slightly above the VN index. As for the VNM ETF, this fund only achieved a growth rate of 9.2%, the lowest among exchange-traded funds and much lower than the VN-Index. Similarly, Premia MSCI Vietnam ETF also posted growth of nearly 14% in the last year, equivalent to Index.

Meanwhile, the worst performing fund last year was Vietnam Holdings with only 9.1% growth in NAV / Shares.

Overall, 2020 is an unexpectedly successful year for the Vietnam stock market, as well as mutual funds. In early 2019, the achievement of mutual funds on the Vietnam stock exchange was not too high when most of them underperformed savings interest.