[ad_1]

The positive news about US stocks came when Pfizer, BioNTech, said that its anti-Covid-19 vaccine was 90% effective.

With the Dow Jones Futures gain of more than 5%, investors appear to be optimistic as Pfizer and BioNTech lead to test data showing that their vaccines are more than 90% effective.

With this information, Wall Street believes that the American pharmaceutical industry will soon be able to find a positive way to control the epidemic, which derails the American economy in 2020 and causes the deaths of 230,000 Americans.

With Dow Jones futures soaring to more than 1,500 points, US stocks are forecast to rise to 1,400 points just after the open. S&P 500 futures also rose 3.5%.

However, this was not the case at first with Nasdaq 100 futures. Investors seem to believe that the introduction of vaccines will help traditional industries perform better. It also ends the advantages that tech companies enjoyed during the pandemic. However, at 8:35 am Hanoi time, Nasdaq futures also rose by nearly 150 points, or 1.24%.

US actions continue to prolong the optimism, which appeared even as the White House election has yet to end. The prospect of Democrats controlling the White House and the House while Republicans controlling the Senate is something investors are relieved to see.

According to experts, the 90% effectiveness rate of the Pfizer and BioNTech (Germany) vaccines appears to be better than the market expected. Anthony Fauci, America’s leading epidemic expert, previously said that a vaccine has been approved that only needs to be 50-60% effective.

“Excellent news from Pfizer with over 90% efficiency. I hope this is the beginning of the end of the war against Covid-19,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a press release. electronic letter.

With the positive news from vaccines, Boockvar believes investors should pay attention to the stocks hardest hit by Covid-19 and avoid stocks that benefit from the pandemic.

Specifically, tourism, restaurant and hotel businesses will experience a strong recovery when positive information about vaccines is announced. Shares of airlines will also rise sharply, especially as they have fallen miserably throughout the year due to the epidemic.

Leading the possible rally in US stocks are Carnival Corp. stocks with 18%, Southwest Airlines with 9% and Walt Disney Company with 6%. Investors are betting on vaccines that could make vacations and entertainment even more appealing.

“I think they are justified in being strong. I think we will start a new discussion and the discussion will be about what the United States will be like after the Covid-19 pandemic,” host Jim said. CNBC’s Cramer said. “Last week, we even felt desperate, and now suddenly there is hope.”

It seems unlikely that the turmoil surrounding the race for the White House will affect the US financial market. Instead, the good news will fuel a market boom.

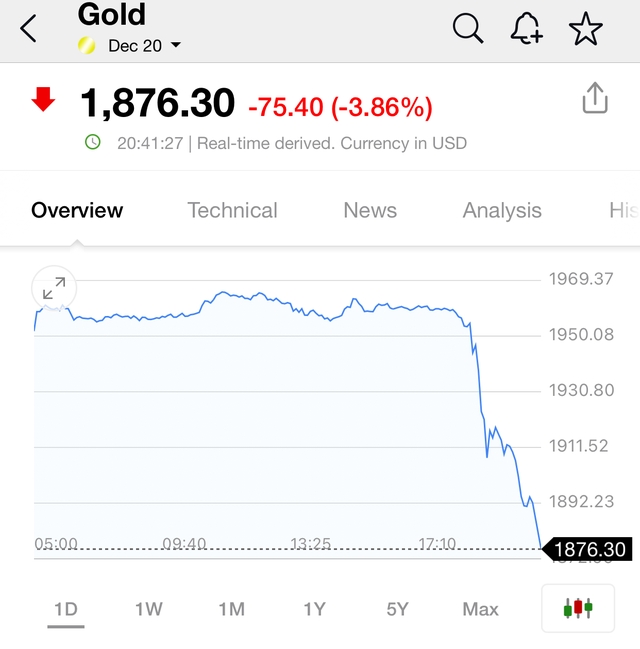

Contrary to the positive news from the US stock market, gold and silver fell. Specifically, Gold lost 76.3 USD / ounce, equivalent to more than 3.9% to 1,818.74 USD / ounce while Silver decreased more than 1,057 USD / ounce, equivalent to 4.12% to 24,605 USD / ounce . ounce.

In fact, overtime stock prices for both companies skyrocketed more than 10% just before 7:45 ET. At 9 p.m. Hanoi time, Pfizer shares were up $ 5.31, or 14.59%. This is the stock with the fifth largest pull in pre-trading to US stocks.

Vaccine gifts are not exclusive to Pfizer and BioNTech. Stocks of companies operating in the air and maritime transport sectors registered strong increases. Royal Caribbean, Carnival, Norwegian, United Airlines, American Airlines, Delta Air Lines, Southwest Airlines are the actions that have benefited the most. Many stocks even rose to more than 20% in the overtime session before 7:45 am.

In this group, American Airlines led with an increase of 2.96 USD / share, equivalent to 25.74%. Carnival Corp, the world’s largest entertainment travel company, with a fleet of more than 100 ships from 10 cruise line brands, also increased by $ 4.42, or 32.05%.

In contrast, medical and technology companies are suffering the sad news when Pfizer and BioNTech release positive data on the Covid-19 vaccine. Biogen and Hologic suffered a decrease of 29.77% and 12.06%, respectively.

Tech companies like Netflix and eBay fell 5.58% and 4.81%, respectively. These are considered the names that have benefited when the Covid-19 epidemic broke out globally, making it impossible for people to get out. The introduction of vaccines could weaken the fortunes of the seasons.