[ad_1]

Many experts predict that the price of gold next week (5-10.10) will rise against the background of a number of supporting factors.

Gold price this week closing the domestic session in which DOJI Group quoted the gold buy-sell price at 56.10 – 56.45 million dong / tael, 50,000 dong / tael more on the buy and sell side compared to the close of session on 3.10. The difference between buying and selling gold is 350,000 dong / tael.

Meanwhile, Saigon VBDQ Company quoted the gold purchase price of 55.95 million VND / tael; The sale price was 56.45 million dong / tael, unchanged on both the buying and selling sides compared to the closing time of 3.10. The difference between the sale price of gold is greater than the purchase price of 500,000 dong / tael.

The world price of gold closed the trading week at around 1,898.8 USD / oz, 7.6 USD less than in the previous session. The weakening of momentum at the end of the week caused the world gold price to fall below $ 1,900, but still nearly $ 38 above the end of last week.

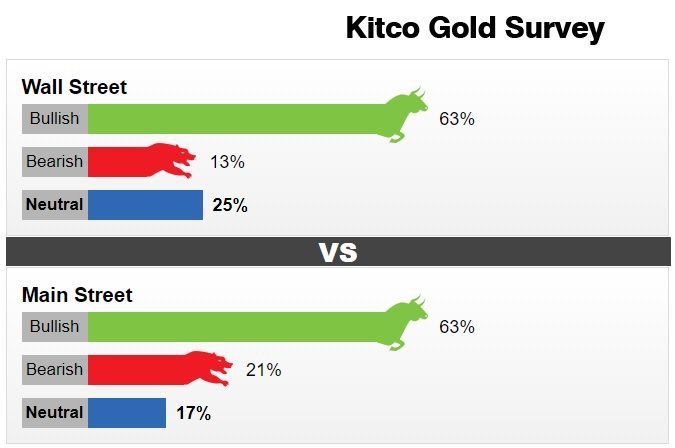

Gold price next week Based on the results of the Kitco News weekly gold survey, retail investors and market analysts are forecasting a rise.

Specifically, 16 Wall Street analysts participated in the survey. 10 analysts (or 63%) believe that the price of gold will increase next week; 2 analysts (equivalent to 13%) found that gold will decline next week and the remaining 4 analysts (equivalent to 25%) predicted that the price will go sideways.

A total of 1,194 votes were cast in the Main Street online polls. Among them, 749 votes (or 63%) say they are optimistic about gold next week. Another 245 votes (21%) predicted that gold would drop in price, while 198 votes (17%) gave a neutral opinion.

Experts believe that precious metals are understandable when many factors have been and continue to affect the gold market. The weak dollar and the influence of the US presidential election on January 3, as well as the uncertainty about some policies, make more people want to own gold.

There is also information, the United States Congress is closer to the time of launching the second rescue package. Therefore, a new amount of money will continue to enter the economy and will cause inflation to rise and also a “new spark” for gold prices.

The global epidemic has gone wrong, especially epidemics are large economies and have far-reaching influences, such as the United States, India, Europe … they also help gold to promote its role as a safe haven for cash flow.

Kelvin Tay, chief investment officer of UBS Group AG (UBS – Swiss multinational investment bank and financial services company) said: “Investors should invest their money in gold right now Because gold will be protected from risks and uncertain events in the next time, especially in the November 2020 presidential election in the US This year, gold is likely to hit $ 2,000 / ounce. “

Although both investors expect the price of gold to rise further next week, there are some cautious opinions in the market. Consider especially when investing in gold for surfing.

[ad_2]