[ad_1]

Intellectual people

Given the wave of hotel sales across the country, experts say this is a good opportunity for new investors to enter the market.

A series of hotels for sale nationwide

Since the beginning of the second quarter of 2020, many towns across the country have had to receive the “wave” of investors fleeing the hotel segment.

Survey of Reporter Dan Tri It shows that right now, on the real estate sales pages, in Hanoi’s Old Quarter there are dozens of small hotels that need cheap bars.

Specifically, on Hang Bac Street, the investor offered a 2-star standard “mini” hotel for a price of VND 20 billion. This is considered a cheap price, down 10-15% compared to the end of 2019.

Without tourists, many hotels in Hanoi’s Old Quarter post information to sell or transfer. Artwork: Vu Duc Anh

The representative of this hotel said that due to the Covid-19 epidemic, in the last 8 months, the number of reserved guests was almost zero. Unable to support himself, the hotel owner decides to liquidate it to recover capital. However, during 3 months of hanging, this hotel has yet to find a new owner.

In Ho Chi Minh City, along the Ly Tu Trong, Thu Khoa Huan, Le Thanh Ton road, there are many hotels that are for sale for hundreds of billions of VND.

For example, the AS hotel on Ly Tu Trong street with 110 rooms for sale costs 230 billion dong. Less than 1 km away, the investor also offers the 4-star MT hotel for a price of 380 billion VND.

This situation not only occurs in large cities, but also in areas of heavy tourism, there is a wave of liquidation of new hotels.

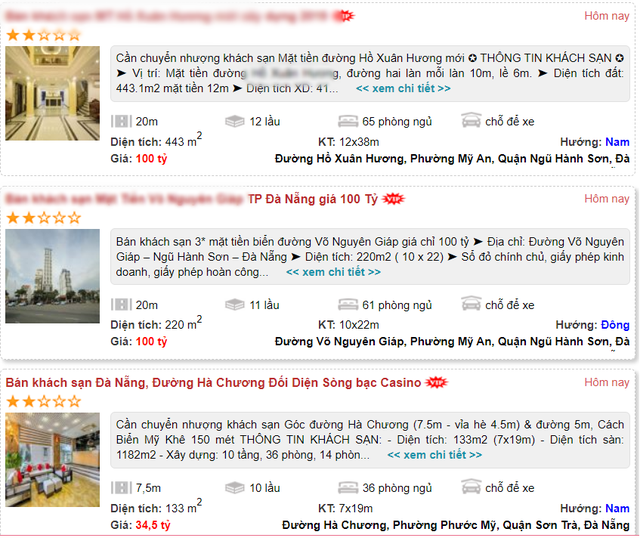

On the real estate trading pages, many hotels in tourist cities also posted information for sale with transfer prices ranging from a few tens to hundreds of billions of dong. Screenshots.

Specifically, in Nha Trang, a 4-star hotel on Tran Phu Street, with 17 floors and 145 rooms, is offered for sale for 250 billion VND.

Similarly, in the coastal area of My Khe (Da Nang), a number of hotels are simultaneously cutting prices to find new owners, such as the MP hotels on Ha Bong Street (VND 65 billion); SNT Hotel on Bach Dang Street (price VND 100 billion); hotel PD Phan Ton street (price 110 billion); ….

A recent report from Savills Vietnam said that there is currently a lot of information about the massive reduction of hotel property losses, but is it just 2 to 3 star hotel properties, small family hotels? ; while the 4 to 5 star luxury hotels are mostly owned by developers, large investors with financial potential from other companies, so they can still resist.

Mr. Mauro Gasparotti, Director of Savills Hotels Asia Pacific, said that for quality hotel projects (4 – 5 stars) there is no loss of sales phenomenon, but these projects are influenced by translation. can offer a more suitable price.

If they did not want to sell in the past, with the current epidemic, investors and investors will be willing to sit down and discuss more openly to negotiate, not sell low or liquidate. .

Many experts believe that if investors with capital do not have to use financial leverage, they should “fish for the bottom” in the hotels liquidated at this time. Artwork: Vu Duc Anh

Should the hotel investment be liquidated?

Mr. Phan Cong Chanh, a real estate expert, said that the 3-star hotels featured on real estate sales pages are becoming “golden eggs” for investors planning to “catch the bottom” of the market. market. school.

According to Mr. Chanh, Vietnam’s tourism industry has always grown more than double digits every year, of which the number of international visitors has increased by 15% on average in the last 3 years.

At the same time, with the world’s most dynamic economy, Vietnam is becoming an ideal destination for foreign investors, experts and scientists. Therefore, the hotel segment still has great development potential in the future.

However, Chanh acknowledged that, before deciding to invest capital in liquidated hotels, investors must have a strong financial capacity to pay the transfer costs, along with the maintenance costs in around 3-6 months, the time it takes the disease disappear.

“In those 3-6 months, the international tourism industry will continue to freeze, this factor will cause most hotels to fall into a negative income situation.

However, hotel owners still have to spend a relatively large amount of costs for hotel upkeep and maintenance. So if investors have capital to pay these costs, the settlement hotels are potential “gold mines,” Chanh said.

Otherwise, if you do not have enough financial resources, it is absolutely not advisable to use financial leverage to invest in liquidated hotels. Because, when there is no income, investors will still have to pay monthly bank interest, which causes companies to face bankruptcy.

“No matter how much the loan amount is, the interest rate on loans will continue to decline, absolutely avoid using financial leverage when investing in hotels,” Chanh added.

To safely invest in a liquidated hotel, Chanh cautioned, before deciding to invest, investors must fully verify the hotel’s legality.

“In the current difficult context, many owners and investors lack capital, they have to mortgage hotels to banks; in some other cases, there are problems related to the divestment of shareholders; … Therefore, investors should consider carefully before charging, ”said this expert.

Viet Vu