[ad_1]

Friday May 15, 2020 16:09 PM (GMT + 7)

The market continued to decline with red in most blue chips.

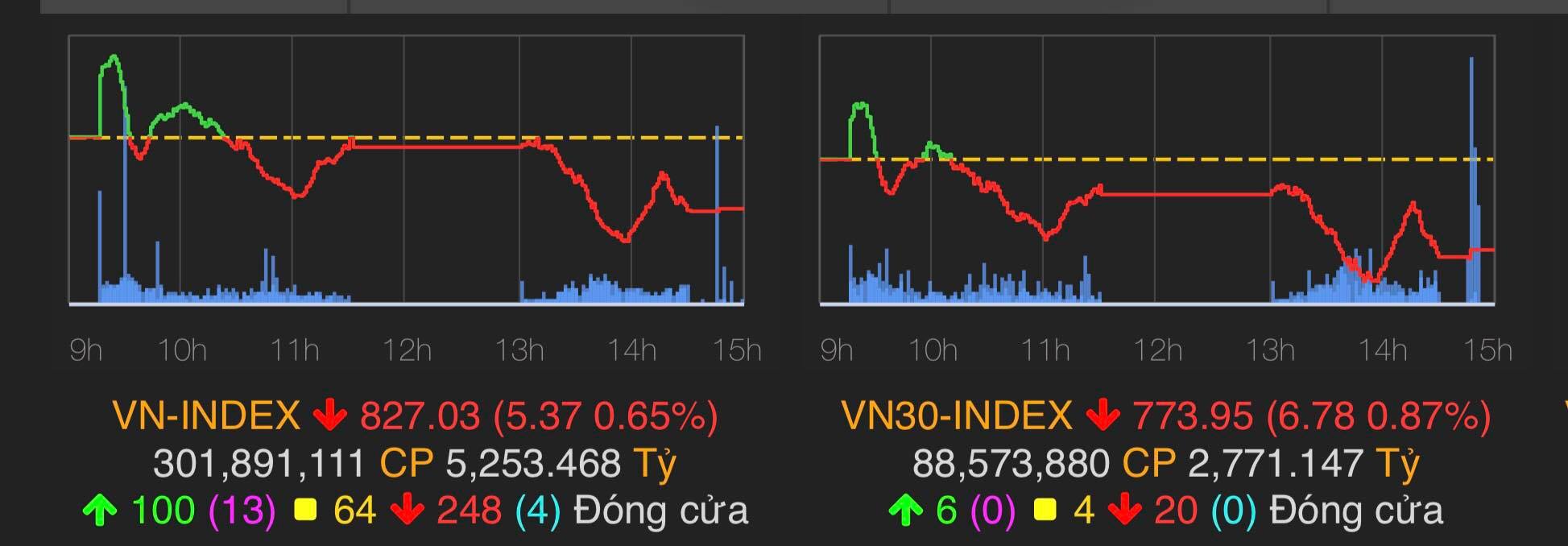

At the close of the session, the VN Index fell 5.37 points (0.65%) to 827.03 points; The HNX index decreased 2.08% to 109.02 points and the UPCom index decreased 0.62% to 53.15 points.

The VN index decreased by 5.37 points (0.65%) to 827.03 points.

Liquidity in the market decreased slightly compared to the previous session, but still remained at a fairly high level with the value of matching 3 floors reaching approximately VND 6,146 million. The number of losers in 3 floors overwhelmed with 417 codes, while the number of advances was only 276.

However, the positive point is that foreign investors still bought almost VND 120 billion in HoSE, in which purchasing power was mainly focused on FUEVFVND, VCB, VPB …

Pressure correction not only in Bluechips but also in many other sectors, such as securities, real estate, construction, industrial parks, textiles, aviation … Of which there are only a few names like VIC. , VRE, VHM, VPB and EIB could remain green, while most of the other blue chips fell.

A set of 3 stocks VIC, VHM, HNG are the stocks that have the most positive impact on the VN index when they bring respectively 0.98; 0.96 and 0.16 points. On the other hand, BID, VNM and MSN had the most negative impact when they were removed from VN-Index 1.24; 1.08 and 0.59 points.

GEX is currently recovering quite well with an increase of 6.84% after 1 week.

GEX shares also had a remarkable session after the actions of this business owner. Throughout the session, GEX struggled and continued to increase slightly. Despite closing the purchase surplus with 334,730 shares and the sale surplus of 338,630 shares, GEX still closed at the reference price of VND 16,400 / share. This price level is somewhat disappointing after the roof hit yesterday.

GEX is currently recovering quite well with an increase of 6.84% after 1 week and 4.79% after just 1 month.

Nguyen Van Tuan, an 8x entrepreneur can earn 1.2 billion VND.

The 8X giant Nguyen Van Tuan’s Vietnam Electrical Equipment Joint Stock Corporation (GEX) has reportedly announced the divestment of logistics operations through the sale of all contributed capital in Gelex Co., Ltd. Logistics. The expected implementation time is in quarter II, quarter III / 2020.

Consequently, Gelex assigned the Chief Executive Officer to negotiate, negotiate, decide related matters and sign the necessary documents to carry out divestment transactions in this logistics segment.

According to the financial statements, Gelex owns a 100% stake in Gelex Logistics, the original investment value amounted to VND 1.2 trillion. In 2019, Gelex’s transportation and storage business reported revenues of more than 1.6 trillion VND.

Logistics is one of Gelex’s key industries in addition to the electrical equipment, energy infrastructure and real estate industries. At the end of December 2019, Gelex had a 100% stake in Gelex Logistics, the original investment value amounted to $ 1.21 billion. Gelex Logistics was established with the purpose of anticipating the growth trend of the logistics segment.

Gelex Logistics currently has a controlling stake in many large logistics companies such as Sotrans (54.8%), Sotrans Logistics (100%), Sowatco (84.4%), Vietranstimex (84%). In addition, Gelex Logistics also has two logistics centers in Hanoi (30 hectares) and Long Binh – Ho Chi Minh City (50 hectares).

Mr. Nguyen Van Tuan’s Gelex pulled out of logistics is not too surprising because analysts said this move is putting effort into other areas that the private giant 8X has led.

For example, Gelex bought Viglacera (VGC) and then decided to establish Yen My Industrial Park in Hung Yen, with a scale of 280 hectares and a period of operation until 2068.

In addition, GEX must also distribute money in many other fields, wind energy, solar energy or the project of two 5-6 star hotels in diamond land in 10 Tran Nguyen Han (Hanoi), ….

Source: http: //danviet.vn/dai-gia-tre-kin-tieng-thu-ve-hon-mot-nghin-ty-dong-tien-mat-trong-chop-mat-502 …

The Group’s total assets have increased its assets by 2.2 times.