[ad_1]

The flow of foreign capital rapidly changed in a positive direction. The return of large cash flows, especially the cash flows from Korea, Thailand … is an indicator that Vietnam is always an attractive direction.

The flow of foreign capital rapidly changed in a positive direction. The return of large cash flows, especially the cash flows from Korea, Thailand … is an indicator that Vietnam is always an attractive direction.

Positive sign

After many weeks of strong net sales due to complicated movements in the Covid-19 epidemic, at the beginning of the 2/2020 quarter, selling pressure from foreign investors showed signs of decline. Foreign capital inflows tend to return to the market with a number of sectors such as real estate, construction, finance …

Some codes were purchased by foreign investors. On April 27, foreign investors bought shares of Vingroup (VIC) and Vinhomes (VHM) of billionaire Pham Nhat Vuong, even if their value was low. Some other shares were also bought net, such as Sabeco (SAB), Coteccons (CTD), Hoa Phat (HPG), Ho Chi Minh City Stock Exchange (HCM), POW, NT2, …

At Upcom, net foreign investors bought 2 shares, namely VEAM (VEA) and LienVietPostBank (LPB).

In the OTC market, inflows of foreign capital continue to flow into Vietnam despite the epidemic affecting the world. In late March 2020, a Thai owner spent VND 5 billion to buy Thinh Phat Electric Cable Company (ThiPha Cable) and Dong Viet Non-ferrous Metal and Plastic JSC (Dovina).

In February 2020, according to NikkeiThailand’s Central Retail Group has announced information about increasing its ownership in electronics chain Nguyen Kim to more than 81% after acquiring BigC and Lan Chi supermarkets.

|

| Net purchase of foreigners in recent years. |

Also according to Nikkei, while the Covid-19 epidemic was still complicated, Thai giant Siam Cement (SCG) announced that it would buy Bien Hoa Packaging JSC (SVI). SCG entered into a joint venture with Japan’s leading cardboard maker, Rengo, to purchase approximately 15% of Bien Hoa Packaging’s total assets, equivalent to almost 635 billion baht (approximately 500 billion VND). .

In Vietnam, SCG’s “big man” is no stranger to many M&A deals in the past decade, such as the acquisition of tiles from Prime Group, Tin Thanh Packaging, Binh Minh Plastics or Long Son Petrochemical Complex. .

Super Energy also recently announced the acquisition of the group of solar power plants in Binh Thuan.

The VinaCapital fund group bought a large number of PHR shares from Phuoc Hoa Rubber Joint Stock Company, raising the ownership rate to almost 5%. JPMorgan Vietnam Opportunities Fund has announced the transfer of 2 million shares of the Military Bank (MBB) to the Vietnam Growth Stock Mother Revenue Fund, worth approximately VND 34 billion.

Asian Smaller Companies Fund, Vietnam and Vietnam Growth Stock Income Mother Fund and Arisaig Asia Consumer Fund also recently transferred 1.7 MWG from Mobile World Investment JSC, …

Attractive foreign capital after the pandemic

Not only in real estate, retail, food, … in recent years, the financial banking segment also has a special attraction for foreign investors, especially Korea and Japan. In early 2020, the SBV approved OCB to increase its share capital and its shareholders by offering 11% to Japan Aozora Bank.

Several banks like SHB, MBBank (MBB), VPBank, NamABank, … also plan to sell capital to foreign countries.

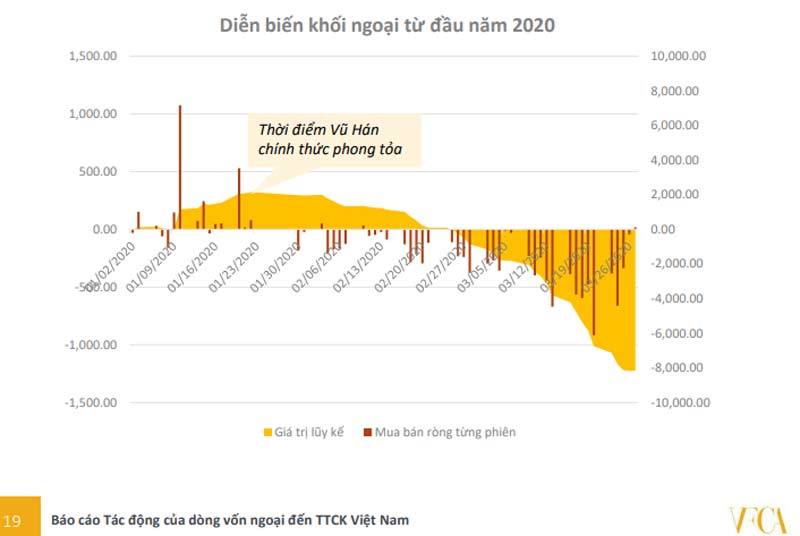

|

| Foreign capital movements in early 2020 when the Covid-19 epidemic broke out. |

In early March 2020, MBBank increased foreign space to almost 23% after disclosing it to Reuters on the plan to sell 7.5% of the capital to foreign investors.

In a recently released report, the Vietnam Financial Consulting Association (VFCA) said that in the long term, foreign capital inflows will become a major driving force that will contribute to the strong recovery of the Vietnam stock market, especially in Vietnam. when the economy returns to a growth cycle.

According to VFCA, during the development of the Vietnam stock market, foreign cash flow is considered an important indicator of the market trend. Occasionally, this cash flow creates a huge supply and demand force, which is an important determinant of growth in stock prices, particularly stock indices and market valuations. general

The Covid-19 shock has reversed the trend of strong net purchases, which has been going on for years. A continuous net sale of dozens of sessions abroad was triggered in recent weeks. However, this is a common situation in the world and it is common in times of crisis. Furthermore, cash flow shows signs of a return and is seen as a major driving force contributing to strong recoveries of the VN Index when the economy returns to the growth cycle.

In recent years, only in the listed market, foreign investors have continuously bought net shares in the stock market. In 2017, net foreign investors bought more than 29 trillion dong (almost $ 1.3 billion), which helped the VN index rise by 46.46%. In 2018, net foreign investors bought more than VND 44 trillion (around USD 1.9 billion), which helped the VN Index exceed 1,200 points.

|

| Many predict that foreign investors will continue to invest money in Vietnam. |

In the early 2020s, foreign investors were net buyers in the stock market and the VN Index also approached 1,000 points before declining dramatically when the Covid-19 pandemic broke out in the world, causing a sell-off situation in the market. The entire stock market.

According to VFCA, the pressure from foreign investors is evident. However, in the long term, when foreign investors return to the market when epidemics and the economy stabilize, this is an extremely important resource to bring the recovery of the VN index to the point level. Balance

Vietnam has always been considered the most attractive place in the emerging and marginal markets group, one of the “destinations” for post-pandemic cash flow, VFCA said.

In fact, financial investment funds are always under pressure to disburse rather than hold cash for too long. Therefore, the rebound will be strong when the economy returns to the growth cycle.

According to the Vietnam Financial Directors Club (VCFO), Vietnam is considered to have gained the SARS-CoV-2 virus because it has taken advantage of the “golden moment” to stop the pandemic. This victory gives Vietnam a great advantage in the next war to attract both FDI and FII. The wave of withdrawal from China can bring great benefits for Vietnamese companies and the economy.

VCFO recommends that Vietnam needs to create favorable mechanisms and policies to attract FDI. For FII, it is recommended to loosen the foreign investment margin from the current limit of 30% to 49%, while the 49% limit will be unlimited.

Previously, the Baker McKenzie Report said that Vietnam remains an attractive destination for investors, although the value of M&A deals will decrease in 2020, but will increase significantly in 2021 and 2022. Vietnam is attractive. on the opening index of the economy.

M. Ha