Due to Allison McNeely and Christine Buurma op 8/19/2020

NEW YORK (Bloomberg) – Valaris Plc became the latest victim of the global drop in oil prices, which filed for bankruptcy on Wednesday as the world’s largest owner of offshore rig by fleet size attempting to restructure a roughly $ 7 billion burden.

The filing of Chapter 11 in the U.S. Bankruptcy Court for the Southern District of Texas comes after the company said it may be forced to seek credit protection after skipping bond payments.

Valaris has signed a binding restructuring support agreement with about half of its shareholders and received $ 500 million in debtor financing, the company said in a statement. The company reported total assets of about $ 13 billion and total debts of about $ 7.85 billion in its bankruptcy petition. Under the proposed restructuring proposal, Valaris will cancel shares and exchange its revolving credit facility and unsecured notes for equity.

“The substantial decline in the energy sector, exacerbated by the Covid-19 pandemic, requires us to take this step to create a stronger company that can adapt to the longer-term contract in the sector,” said Valaris Chief Executive Officer Tom Burke in the statement. The company plans to go ahead with customers without interruption due to the entire bankruptcy, he said.

The restructuring agreement, which will cut more than $ 6.5 billion in debt, will convert Valaris’ existing credit facility and unsecured notes into equity, according to the statement. Existing noteholders have agreed to backstop $ 500 million in new notes.

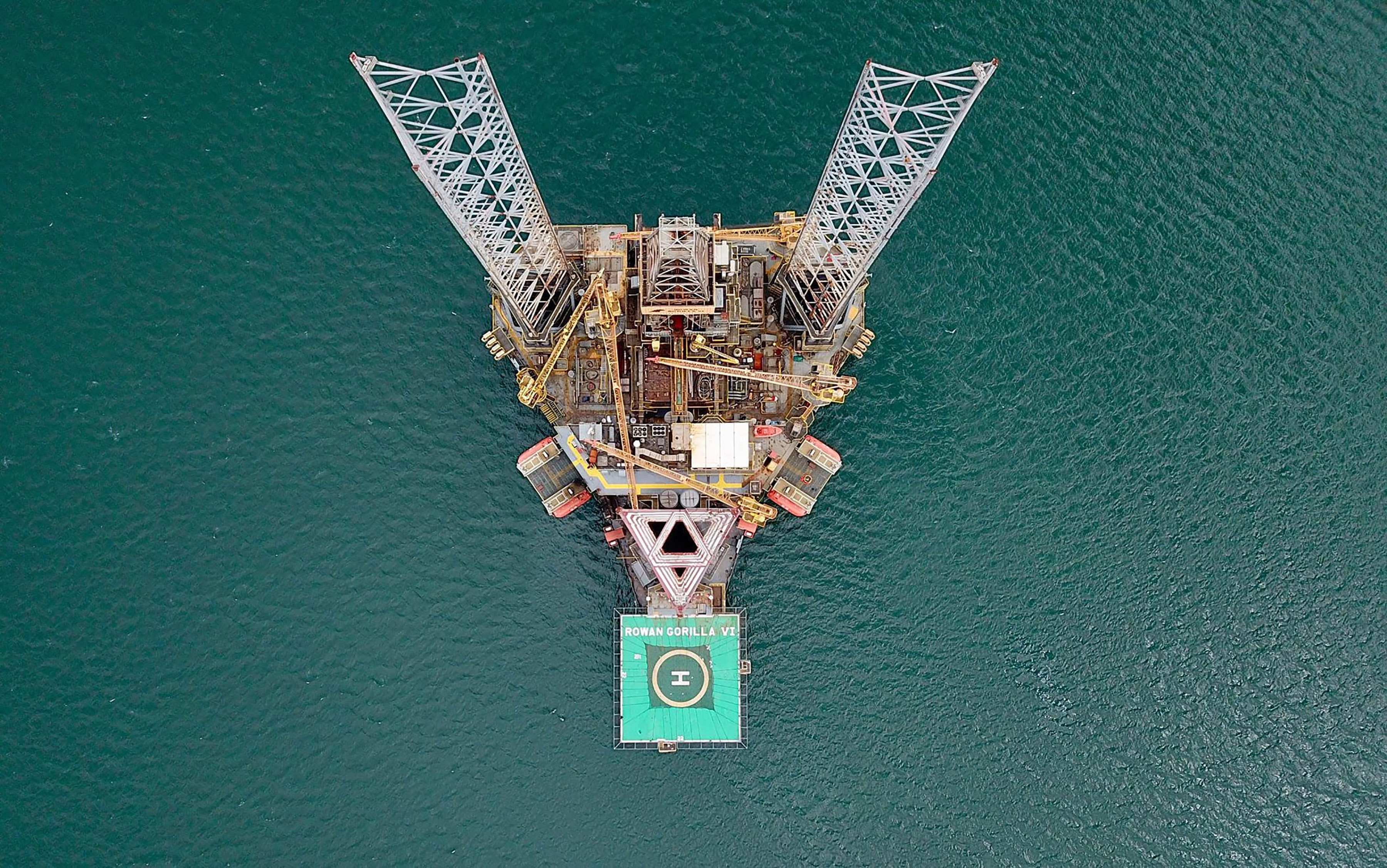

London-based Valaris, which was created in 2019 from the combination of Ensco Plc and Rowan Companies Plc., Joins competitors Noble Corp. and Diamond Offshore Drilling Inc. in bankruptcy. Pacific Drilling SA said earlier this month that it may return to bankruptcy court for the second time in less than three years, and Transocean Ltd., the world’s largest owner of deep water oils, said it was exploring strategic alternatives.

The offshore industry has struggled since oil prices dropped to less than $ 30 per barrel in 2016 after reaching more than $ 100 in mid-2014. While newer deepwater projects are less expensive, they take even longer to develop than land-based agricultural land and are typically more expensive, which is a disadvantage because raw fell further this year in the middle of the Covid River. 19-pandemic.