[ad_1]

Stock markets came under pressure and expectations of volatility rose after President Donald Trump announced that he and the first lady had tested positive for coronavirus just weeks before the US presidential election.

European stocks fell on Friday, with the region’s Stoxx 600 down 0.6%, London’s FTSE 100 down 0.7% and Germany’s Dax down 0.9%.

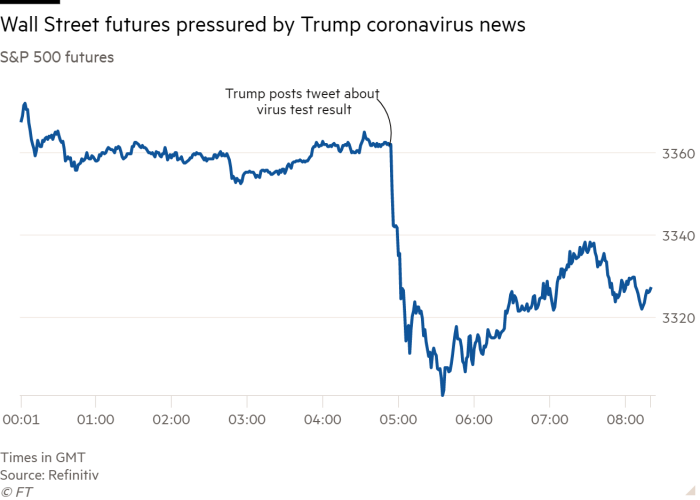

Trading in US stock index futures was choppy for several hours before the opening bell on Wall Street. S&P 500 futures, which trade relatively sparingly in Europe’s early hours, recently fell 1 percent.

Trump’s diagnosis came just over a month before Election Day as investors were already bracing for a strong election-induced market shake. Wall Street’s Vix volatility index rose 2 points to 28 on Friday morning, and futures contracts also point to higher expectations of turbulence in November and December.

“We are in a situation where there are more questions than answers,” said Robert Rennie, Westpac’s head of market strategy. Rennie said investors are likely to avoid riskier assets until there is greater clarity on the health outlook for Trump and others in the White House.

“This is happening in early October and we still have four weeks left. . . certainly the road ahead is one of extreme uncertainty until early November and potentially beyond, ”he added.

Sebastien Galy, senior macroeconomic strategist at Nordea Asset Management, said that “this shock should create a series of aftershocks,” noting that it was already “expensive” for investors to hedge against potential large market swings.

Japan’s yen, which often rises in times of increased uncertainty as domestic investors return funds to the domestic market, strengthened 0.5 percent against the dollar at 105.01 yen. Considered a safe haven asset, US Treasuries rose modestly in price, sending yields down slightly.

Oil prices, which have been hit this month by concerns about falling demand, fell further on Friday, and Brent crude, the international benchmark, fell 3.2% to $ 39.62. the barrel, near its low of the month.

Some investors suggested that it was not yet clear what the broader implications of Trump’s diagnosis were for markets. The market “still can’t really determine if this represents a big time of risk, so it’s too early to say how this will work out,” said a Tokyo trader.

Analysts have other sources of uncertainty to grapple with: US lawmakers continue to disagree on a new fiscal stimulus package. The stagnation is being closely monitored by economists who fear the withdrawal of support will be a blow to the US recovery.

Data released Thursday showed a 2.7 percent drop in personal income in August as government support measures lapsed. Analysts will be closely watching the latest monthly jobs report released later on Friday.

In Europe, England’s largest coronavirus infection survey indicated that the growth rate of infections was beginning to slow. But the government has warned that further restrictions could be imposed, as new rules were announced in Spain’s capital.

The EU called for caution on the progress of the Brexit talks, which will end on Friday. Brussels is suing the UK for its plans to violate last year’s withdrawal agreement.

In the Asia-Pacific region, Tokyo’s benchmark Topix Index fell 1% after rising nearly the same level previously, while Australia’s S & P / ASX 200 lost 1.4%.