[ad_1]

Companies in Britain that ship packages to customers in Northern Ireland will not have to complete new customs processes for three months, the government said.

The announcement came after large retailers, including the John Lewis department store chain, halted deliveries to the region, while others canceled orders due to uncertainty over the introduction of mandatory controls at the Irish Sea border after the Brexit.

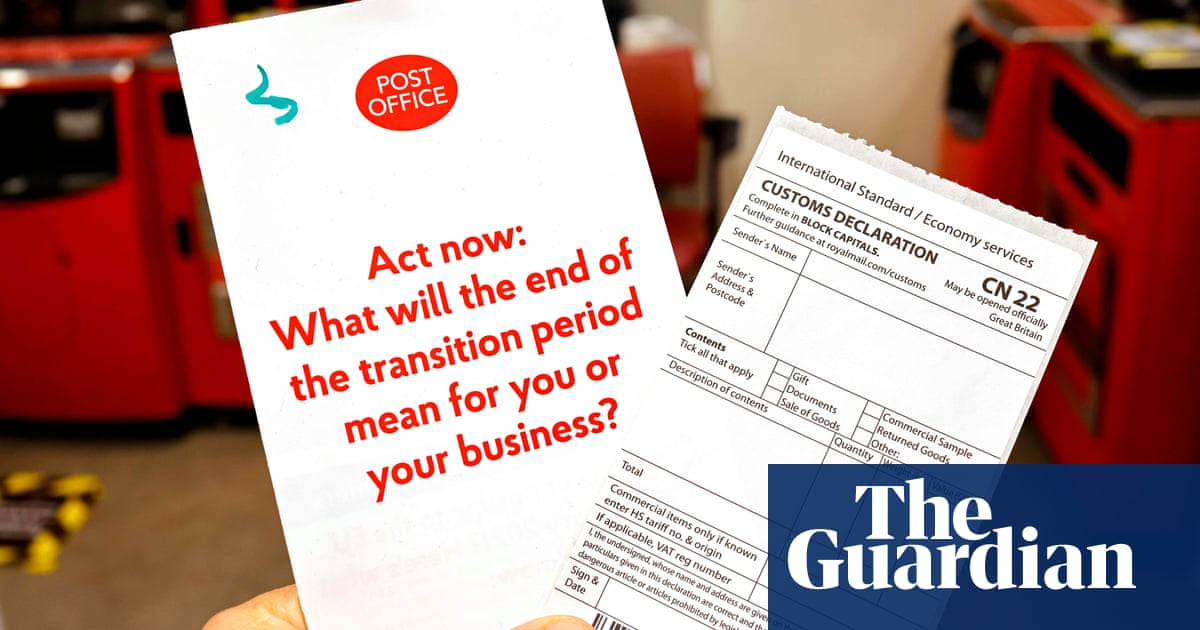

Starting at 11pm on New Years Eve, Northern Ireland will apply EU customs rules in its ports, which means that goods crossing the Irish Sea from other parts of the UK will be subject to customs controls .

Customs declarations will also be required, despite the fact that the Brexit deal allows for duty-free trade in goods.

Just hours before the trade deals were introduced, the government announced that customs declarations would not be required for most packages received by Northern Ireland residents or businesses for a three-month grace period, until 1 April.

An exception is packages sent by companies to companies that contain goods worth more than £ 135. However, companies will have three months to submit the customs declaration.

The government guide does not state what will happen after April 1.

Retailers and other companies had suspended delivery services to Northern Ireland and had warned of a possible disruption in early December due to uncertainty about the new requirements.

John Lewis said he was reviewing the government guidance and hoped to resume delivery services to Northern Ireland as soon as possible.

In contrast to the three-month grace period for retailers, the food industry only anticipates that it will have a week to familiarize itself with the new rules.

Northern Ireland’s Veterinary Director Dr Robert Huey has said that food and animal products shipped from Britain could be returned or destroyed after Brexit if they fail to comply with the new controls.

Britain’s traders have been given six months to get used to Brexit checks at Dover and other ports, but under the special arrangements for Northern Ireland, some will apply immediately.

Huey said there will be no penalties for a grace period of one week. “During the first week there will be no drama,” he said.

There will be another week for suppliers to ensure they label stocks for sale in Northern Ireland. “After that, there will be 100% compliance,” Huey said, adding that property that did not have the proper health certification would be destroyed or returned.

“It sounds harsh, but that is legally what I am obligated to do,” he said. “And just to emphasize that we do it right now. So, for example, there is a requirement that farm machinery entering Northern Ireland at this time be clean due to the eel worm, which is a plant health problem. If they are not clean, they come back. That happens half a dozen times a year. “

Trusted supermarkets and large food suppliers were given a six-month grace period for all checks in a deal reached between the UK and the EU in early December. But other companies, which may include small suppliers of fresh fish, cheese or cereals, will need to have their products certified for entry from day one.

Huey said he did not expect a high level of non-compliance because goods entering Northern Ireland from Britain had the same post-Brexit standard as before the end of the transition period.

However, software vendors have predicted chaos in the coming weeks as companies trading in Ireland find they have to submit customs documents for the first time.

They will also be asked to use new HM Revenue & Customs software, known as the Customs Declaration System (CDS), which was only delivered in early December.

“Expect a software company to not only test all those changes, but to roll them out to thousands of customers, or [even] hundreds of customers is just not feasible, “said Stephen Bartlett, president of the Freight Software Providers Association.

Typically, it would take “at least 12 to 24 months to implement this for our customers,” Bartlett said, adding that CDS was so complicated that it could take customers two weeks to install it on their internal systems. “HMRC has made it very difficult to move people even if we wanted to. To name one of them is like wading through molasses, ”he said.

A government spokesperson said: “Our IT systems will be fully operational on January 1. Over the past year, we have continued to work with key delivery partners to support CDS preparations.

“In addition, the government has established the Trader Support Service, which is a free to use service that will submit declarations to CDS on behalf of traders moving goods under Northern Ireland protocol.”