[ad_1]

Good morning and welcome to our ongoing coverage of the global economy, financial markets, the eurozone and business.

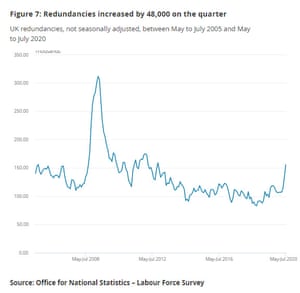

We start with bad news from the UK job market. The number of people laid off has risen at the fastest rate since the financial crisis, as Covid-19 continues to seriously damage the UK economy.

Newly released figures show 156,000 people were laid off in the May-July quarter, an increase of 58,000 compared to the same period in 2019.

It is also a 48,000 increase compared to February-April, when the Covid-19 crisis began.

This, says the Office for National Statistics, is the biggest jump in more than a decade:

Layoffs increased 58,000 for the year and 48,000 in the quarter, to 156,000.

These are the largest annual and quarterly increases seen since 2009. While layoffs are at their highest from September to November 2012, the level remains well below that seen during the 2008 recession.

Many of those jobs will have been lost in the retail, hotel, lodging and leisure sectors, where companies were forced to close this spring and have suffered slow sales since.

Worrying, it comes before the government finalizes its job retention plan, forcing employers to decide whether to keep unlicensed workers on their books or not.

Today’s employment report also shows that the number of UK employees on payroll dropped by around 695,000 in August, compared to March 2020.. That is another good indicator of the damage caused by the coronavirus crisis.

This has raised the UK unemployment rate to 4.1%, another worrying sign. That’s still pretty low by historical standards, and it shows that the leave scheme helped prevent an immediate spike in unemployment.

The employment rate has also increased slightly, to 76.5%, as more people returned to work as the lockdowns eased.

But today’s employment report also shows that younger workers are especially suffering from the recession.

During the quarter, there has been a large decrease in the number of employed youth, while youth unemployment has increased.

More details and reaction to follow …

Also comes today

We get a fresh check on the oil market, where demand had been hit by the pandemic, in addition to the latest economic confidence survey in Germany. US industrial production figures will show if its factories are still recovering.

Overnight, China has reported a rebound in industrial production and retail sales (more on this later).

There is not much drama in the markets, and European stocks are expected to open unchanged.

IGSquawk

(@IGSquawk)European opening calls:#FTSE 6036 + 0.16%#DAX 13197 + 0.02%#CAC 5051 -0.02%#AEX 552 -0.06%#MY B 19806 + 0.06%#MOUNTAIN GOAT 6957 + 0.08%#OMX 1804 + 0.07%#STOXX 3313 -0.10%#IGOpeningCall

The agenda

- 7am BST: UK Labor Market Report

- 9 a. M. BST: IEA Oil Market Report

- 10 am BST: ZEW institute survey of German economic confidence

- 1.30pm BST: Empire State Manufacturing Index for September

- 2.15pm BST: US Industrial Production Report for August

[ad_2]