[ad_1]

SoftBank is the “whale of the Nasdaq” that has bought billions of dollars in derivatives of US stocks in a move that fueled a feverish rally in big tech stocks before a sharp pullback on Thursday, according to people familiar with the matter.

The Japanese conglomerate has been buying tech stock options for the past month in large numbers, contributing to the highest trading volumes in contracts tied to sole proprietorships in at least 10 years, these people said. One banker described it as a “dangerous” gamble.

The aggressive move in the options market marks a new chapter for the investment powerhouse, which in recent years has made big bets on privately owned tech startups through its $ 100 billion Vision Fund. After the coronavirus market tumult hit those bets hard, the company established an asset management unit for public investments using capital contributed by its founder Masayoshi Son.

Now it has also caused a sensation in the trading of derivatives linked to some of those new investments, which has shocked the veterans of the market. “These are some of the biggest deals I’ve seen in 20 years of doing this,” said a derivatives-focused US hedge fund manager. “The flow is huge.”

The rise in call option purchases, derivatives that give the user the right to buy a share at a previously agreed price, has been the talk of Wall Street in recent weeks, as the size of the trades appears to have exacerbated a “merger” in many big tech stocks over the summer. Tesla shares soared 26 percent in less than a week through Sept. 1, while Amazon and Google parent Alphabet gained about 9 percent .

A person familiar with SoftBank’s operations said it was “gobbling up” options on a scale that even made some people within the organization nervous. “People are caught with their pants down, hugely short. This can continue. The whale is still hungry. “

The options boom means the US stock market remains vulnerable to further bursts of volatility, according to Charlie McElligott, a strategist at Nomura. “The street is still in a very dangerous space, and that flow is still out there,” he said in a note on Friday, adding that this leaves the market open to major or minor changes.

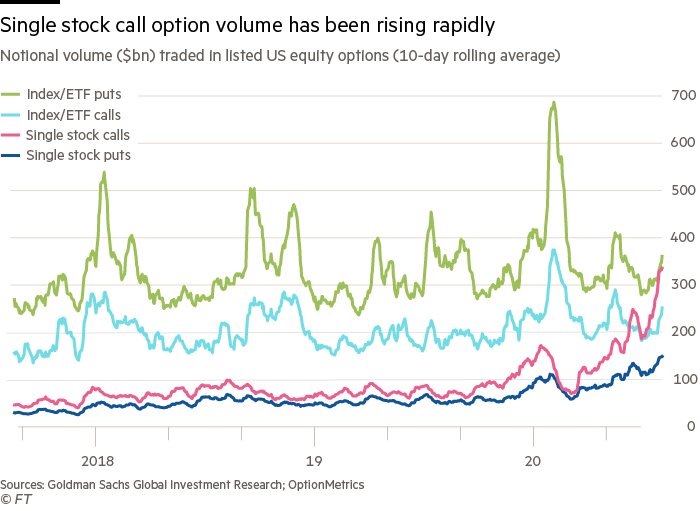

The overall face value of calls traded in individual US stocks has averaged $ 335 billion a day for the past two weeks, according to Goldman Sachs. That’s more than triple the moving average from 2017 to 2019. The retail boom has played a big part of the frenzy, but investors say the size of many recent option purchases is too large to be driven by retail.

Unusually, individual stock call trading volumes have risen beyond the average daily call volume in the broader US stock market, and are almost as high as the trading level of index call options. , which gives the buyer the right to sell at a pre-priced price and act as a popular form of insurance against falling stocks.

The size and aggressiveness of the mysterious call buyer, coupled with the summer trading hiatus, has been a major factor not only in the upbeat performance of many big tech names, but also in the broader US stock market, according to McElligott. This week he warned that the dynamics around options meant that heavy buying forced banks on the other side of trading to protect themselves by buying shares, in a “classic feedback loop.”

This also helped explain the unusual view of the US stock market rising alongside the Vix index, often referred to as Wall Street’s “gauge of fear,” and it meant stocks were fragile and vulnerable to the kind of sudden reversal that broke out. Thursday. “The stock volatility complex is acting ‘broken’ and indicating that ‘something has to give,'” McElligott warned in a note shortly before the Nasdaq fell 5 percent.

A banker familiar with the latest options trading activity said Thursday’s market pullback would have been painful for SoftBank, but he expected buying to resume. A larger and longer-lasting stock market crash would be more detrimental to this strategy and would likely imply rapid declines, he added.

The option purchase comes along with $ 10 billion in public investments that SoftBank is targeting through its new branch of asset management.

According to a filing with the Securities and Exchange Commission last month, SoftBank has purchased nearly $ 2 billion stakes in Amazon, Alphabet, Microsoft, and Tesla – investments that are partially funded with cash from its $ 41 asset sale program. billion that was caused by a collapse. in your stock price during the Covid-19 market turmoil.

Additional reporting by James Fontanella-Khan