[ad_1]

Whiskey, cheese and chocolate producers have suffered the biggest post-Brexit export losses in the food and beverage sector, new figures from HMRC show.

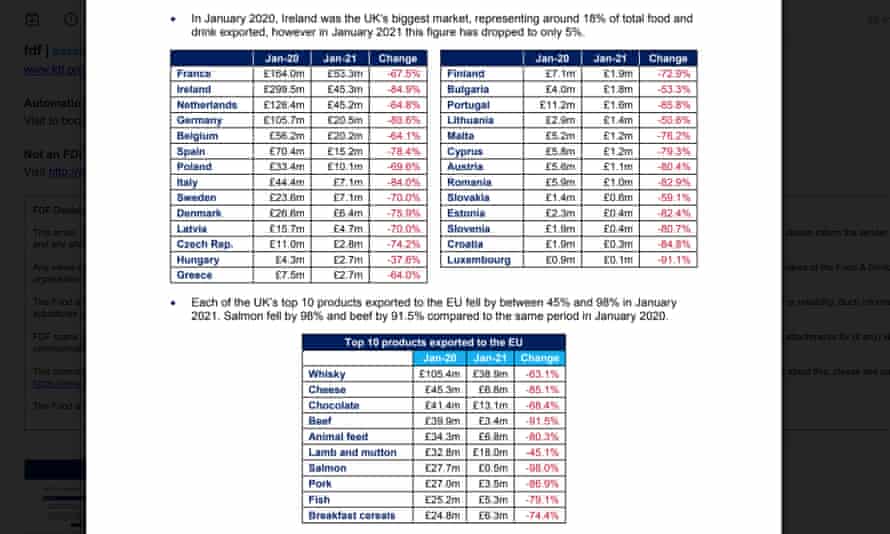

Analysis of the Food and Drink Federation (FDF) figures shows that cheese exports in January plummeted from £ 45m to £ 7m year-on-year, while whiskey exports fell from 105m. of pounds to 40 million pounds sterling. Chocolate exports went from £ 41.4 million to just £ 13 million, a decrease of 68%.

They exposed the collapse of trade to a combination of Brexit and weaker demand in Europe, where restaurants, hotels and other hotel establishments remain closed.

Exports of some other goods such as salmon and beef almost came to a complete halt, with falls of 98% and 92% respectively, but in value they were the seventh and fourth biggest losers of the top 10 exports to the EU.

Overall, the fish trade, thanks in part to the total ban on exports of certain live shellfish, declined by 79%.

The figures come on the heels of data from the Office for National Statistics (ONS) showing UK-EU trade was hit hard in January, with total exports falling 40.7% in January. compared to December.

It comes as the House of Lords EU subcommittee on the environment expressed deep concern over the disruption to trade caused by Brexit. “We are dismayed that our agri-food sector is facing such high trade frictions,” said Lord Teverson, chair of the subcommittee, in a new report to be released on Tuesday.

“The increases in paperwork and preparation required for exports of food and agricultural products to the EU are presenting very difficult challenges, especially for small businesses,” he added.

The FDF said the most affected trade route was Ireland losing its place as Britain’s largest export market, accounting for 5% of overall trade compared to 18% in January 2020. This was in line with the figures released by Ireland’s Central Statistical Office on Friday.

Exports to Germany and Italy followed closely: 85% and 81%, respectively.

While pre-Brexit warehousing and weak hospitality demand during the pandemic will have been a factor, the FDF said “much” of the drop is likely due to new non-tariff barriers that have hit smaller producers with special hardness.

“Businesses face significant challenges when trading with the EU and small businesses in particular have closed because groupage distribution is not working,” said FDF head of international trade Dominic Goudie, referring to a logistics system that previously it allowed carriers to transport small shipments from a variety of vendors.

ONS figures released 10 days ago showed UK goods exports to the EU plummeting 40.7% in January, the biggest monthly drop in British trade in more than 20 years.

The latest HMRC figures show that the agri-food sector has been one of the hardest hit with new controls and requirements for health certificates, a major barrier to trade.

Headline figures now show that food and beverage exports collapsed in January, falling overall 75.5% year-on-year. Up to £ 256 million from £ 1 billion.

The government says trade between the UK and the EU has been affected by the pandemic and problems with companies adapting to the new customs rules, which it hopes to improve over time.

Defra said overall cargo volumes “returned to normal levels since early February,” adding that the ONS had said caution should be exercised with year-on-year data as business environments were very different.

“A unique combination of factors, including storage last year, Covid closures in Europe and companies adjusting to our new business relationship, made it inevitable that exports to the EU were lower this January than last,” a department spokesman said.