[ad_1]

Credit Suisse and Nomura warned of huge losses following a liquidation sale of around $ 20 billion in Chinese and US stocks, as their client Archegos Capital Management was forced to make a huge asset reversal.

Nomura could face a total loss of earnings during the second half of the financial year, while Credit Suisse warned that the sell-off could have a “very significant and material” impact on its first quarter results.

Shares of Japan’s largest investment bank fell as much as 16 percent Monday morning in Tokyo, its worst drop in a day, erasing more than $ 3.2 billion from its market capitalization, as Nomura warned of recent transactions. with an unidentified customer and the risk of a “significant loss” in its US subsidiary.

Japanese and Swiss banks provided top-tier brokerage services to Archegos, which was founded by former hedge manager Bill Hwang, according to several people close to the matter. Top-of-the-line brokers lend cash and securities to hedge funds and process their trades.

Credit Suisse said in a statement Monday: “A major US-based hedge fund defaulted on margin calls made last week by Credit Suisse and some other banks. Following the fund’s default on these margin commitments, Credit Suisse and several other banks are in the process of exiting these positions. “

“While it is premature at this point to quantify the exact size of the loss resulting from this exit, it could be very important and material to our first quarter results.”

Two people close to the bank said the expected loss was estimated to be between $ 3 billion and $ 4 billion. Credit Suisse declined to comment.

Nomura said in a statement that it was assessing the extent of the potential losses, noting that its estimated claim against the client was around $ 2 billion. The bank said the figure was based on market prices at the close of business in the United States on Friday and could rise if asset prices continue to fall.

Deutsche Bank was also exposed to the Archegos sell-off, but its losses are expected to be a fraction of those suffered by other brokers, according to a person familiar with the bank.

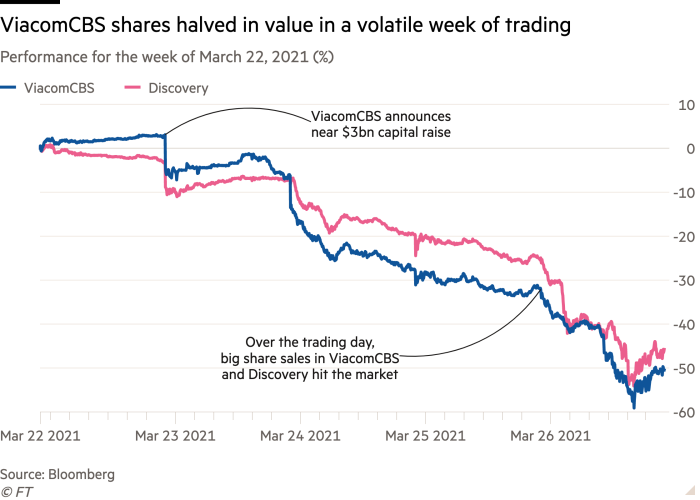

Archegos, a private investment firm, was behind billions of dollars in stock sales that captivated Wall Street on Friday. The fund, which had large exposures to ViacomCBS and several Chinese tech stocks, was hit hard after shares in the US media group began to slide on Tuesday and Wednesday. The drops triggered a margin call from one of Archegos’ top brokers, prompting similar demands for cash from other banks.

Hedge funds in Hong Kong and Tokyo said on Monday that traders were prepared for new block sales in shares associated with Archegos and other funds that could also be forced to undo heavily leveraged positions, such as Teng Yue Partners, when trading opens. in the market. United States on Monday. Teng Yue was not immediately available for comment.

Hideyasu Ban, an analyst at Jefferies, said a $ 2 billion loss estimate posted in the March quarter would wipe out most of Nomura’s pre-tax earnings for the second half of the financial year ending this week.

Other top brokers that had provided Archegos with leverage said the problems at Nomura and Credit Suisse were related to slowness in unloading blocks of shares on the market compared to their peers, notably Goldman Sachs and Morgan Stanley.

An executive at a Wall Street bank in Hong Kong said: “It is not clear why Nomura sat on his hands and racked up these huge losses.”

Another Tokyo-based banker said the extremely high level of leverage Nomura appeared to have extended to Archegos was “disconcerting.”

Archegos is a family office that manages the wealth of Bill Hwang, a “tiger cub” alumnus of Julian Robertson’s legendary Tiger Management hedge fund. It had about $ 10 billion in assets last week, according to major brokers. New York-based Hwang previously ran hedge fund Tiger Asia, but gave cash back to investors in 2012 when he admitted to wire fraud involving Chinese bank stocks.

An executive at a global hedge fund in Hong Kong said: “It is surprising that a China-oriented fund is using Nomura and that a Japanese bank is giving it so much leverage. It appears to have been at least four times larger than what a long / short equity fund would normally get. “

Teng Yue Partners, run by the Tiger Tao Li club, has also been linked to the sell-off that hit the shares of US media groups and Chinese technology company GSX Techedu last week, according to top brokers and traders in Hong Kong.

Tokyo bankers familiar with the circumstances surrounding the strong liquidation of Archegos assets described the event as a possible “Lehman moment” that would force multiple lenders to acknowledge that the leverage extended to the fund had created excessive risk.

Nomura and Credit Suisse were among at least five banks providing top brokerage services to Archegos alongside Goldman Sachs, Morgan Stanley and UBS, according to people familiar with the matter.

Some banks banned all global trade with Hwang after he settled with US regulators on illegal trade charges in 2012 and was banned from trading in Hong Kong in 2014.

Additional information from Olaf Storbeck in Frankfurt