[ad_1]

Good morning and welcome to our continued coverage of the global economy, financial markets, the eurozone and business.

World markets are in shock today as a surge in government bond yields triggered a red sea on Wall Street.

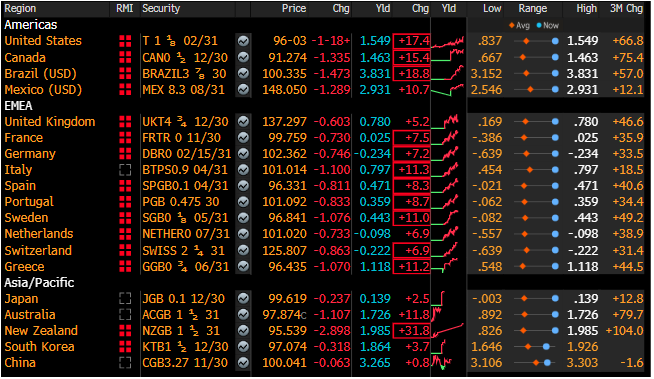

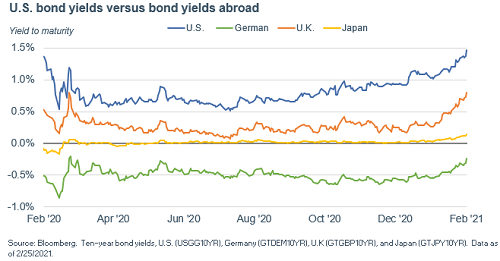

Sovereign bond prices fell across the board yesterday, driving up the yield (or interest rate) on bonds. There were surprising moves in the United States, where the 10-year Treasury yield jumped to 1.5% for the first time in a year.

Xero

(@TradingandMore)Defeat of the global bond market pic.twitter.com/5A3tn7cRvC

Kathy jones

(@KathyJones)Bond yields on the rise worldwide with the US and UK leading the way pic.twitter.com/UUnR9eCZeV

The bond sell-off suggests investors anticipate that this year’s economic recovery will drive inflation, especially with the Biden White House planning a new $ 1.9 trillion stimulus campaign.

That could force central banks to tighten monetary policy, ending money-printing stimulus packages that have helped markets rebound from last March’s crisis.

Last night, the tech-centric one Nasdaq plummeted 3.5% – it’s the worst day since October – with the Dow slipping 1.75% from Wednesday’s all-time high.

CNBC

(@CNBC)US stocks fell sharply on Thursday as a huge spike in bond yields spooked investors, who scrambled to ditch risky assets, especially high-flying tech names.

The Dow Jones fell 1.8%.

The S&P 500 fell 2.5%.

The Nasdaq fell 3.5%. https://t.co/l6Ut7bjPJL pic.twitter.com/7w51yeFWwT

Asia Pacific markets have tumbled overnight and we expect losses in Europe this morning. the FTSE 100 The London First Class Stock Index is on track for a more than 1% decline.

IGSquawk

(@IGSquawk)European opening calls:#FTSE 6584 -1.03%#DAX 13724 -1.12%#CAC 5712 -1.24%#AEX 653 -1.69%#MY B 22776 -1.25%#MOUNTAIN GOAT 8229 -1.07%#OMX 2011 -1.35%#STOXX 3636 -1.33%#IGOpeningCall

One alarming thing about the liquidation is that Federal Reserve Chairman Jerome Powell spent two days testifying before Congress this week, insisting that the Fed was unwilling to end its stimulus.

The markets, however, are certainly on edge, abandoning riskier assets and returning to havens like the US dollar.

The selloff came after some encouraging economic data from the US: Jobless claims fell last week, while durable goods orders were up 3.5% in January. However, that appears to have heightened concerns about possible interest rate hikes.

Ipek Ozkardeskaya, senior analyst at Swissquote, Explain:

Investors dropped their sovereign bond holdings like a hot potato as all the new data pointed to an improvement in economic conditions and called for a rise in inflation.

Stocks sank along with sovereign bonds. Nasdaq led the losses with a sizable 3.52% drop as tech stocks fell big as a result of a massive migration from growth stocks to value stocks. Nike, Caterpillar, Johnson & Johnson and Goldman Sachs were among the few stocks that ended the session higher. Apple, Microsoft and Disney all fell as Tesla lost 8%.

Then it could be a lively day …

Reuters UK

(@ReutersUK)European equities futures tumble more than 1% as rising bond yields stir stock markets https://t.co/lhMXgmeP9n pic.twitter.com/WOVh4y6lA6

The agenda

- 12.30pm GMT: Bank of England Deputy Governor Dave Ramsden: Speech at the Institute of Chartered Accountants of England and Wales

- 1.30pm GMT: US personal consumption spending data for January

- 3:00 pm GMT: The University of Michigan Survey of US Consumer Confidence.

[ad_2]