[ad_1]

Bank of England Governor Andrew Bailey urged the EU not to fight over access to financial services after Brexit and accused it of demanding higher standards from the UK than other countries.

Brussels has been slow to grant the status of “equivalence” that allows British companies to access the bloc in the way that has already been granted to Canada, the United States, Australia, Hong Kong and Brazil.

That was despite the UK starting from a position of following the same rules as the EU, unlike those countries, Bailey noted.

He said the EU position was that it wanted “to better understand how the UK intends to amend or alter the rules in the future.”

But Mr Bailey said: “This is a standard that the EU does not have in any other country and I suspect I would not agree to surrender.”

The governor said it seemed to mean that Brussels was taking the “unrealistic, dangerous and inconsistent” view that the rules should not be changed in the future or that, if they do, the UK should not do so independently of the EU.

That would be “taking the rules outright” and “not acceptable,” Bailey said in a speech to finance executives.

He said that did not mean the UK was going to create “low regulation, high risk, anything goes for a financial center and system.”

However, he argued that “as the world progresses, the rules must adapt.”

Britain is already looking to relax “high-yield” international banking rules for small banks, similar to what the United States and Switzerland are doing, Bailey said.

But it is also trying to exclude itself from EU plans to dilute how lenders can measure the level of capital they have in the event of stress.

The rules for the insurance sector are also being revised.

Mr Bailey said the UK has “a very bright future competing in global financial markets supported by strong and effective common global and regulatory standards”.

He said that the world had “the opportunity to move forward and rebuild our economies, post COVID, with the support of our financial systems,” adding: “Now is not the time to have a regional discussion.”

London, Europe’s preeminent financial center, dominates trading in multi-trillion dollar currency markets, but its companies no longer enjoy “passport” access to the EU.

That has pushed several companies to move assets out of the city and establish or expand their operations in other hubs such as Dublin, Frankfurt and Paris.

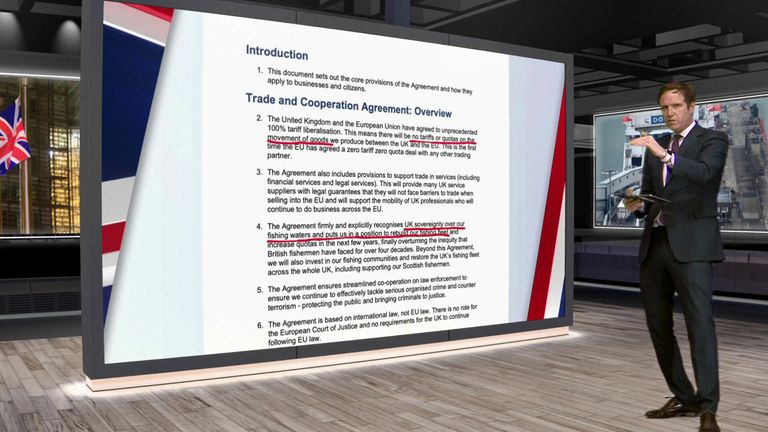

Britain’s new trade agreement with the bloc, which entered into force on January 1, does not cover financial services, and it appears that the City will only receive “equivalency” access for the future.

PwC has estimated that UK tax revenue from the financial services sector, which currently accounts for more than 10% of the total, will start to fall this year as a result of Brexit and the impact of the pandemic.