[ad_1]

Gérard Brudi, who rents two apartments for winter workers in the popular French ski resort of Val Thorens, hasn’t had a single reservation this year.

Even though it’s snowing and sunny, the lifts are closed. Travel reps who would normally receive guests have little more to do than search empty villas for frozen pipes.

Val Thorens can host around 50,000 visitors a week at the peak, but there are currently only a few thousand weekend guests scattered around.

“We are absolutely, as we French say, in uncertainty”Said Mr. Brudi. “People don’t rent apartments or hotels at a high price just to smell the good fresh air. If I can’t ski, I’m not interested ”.

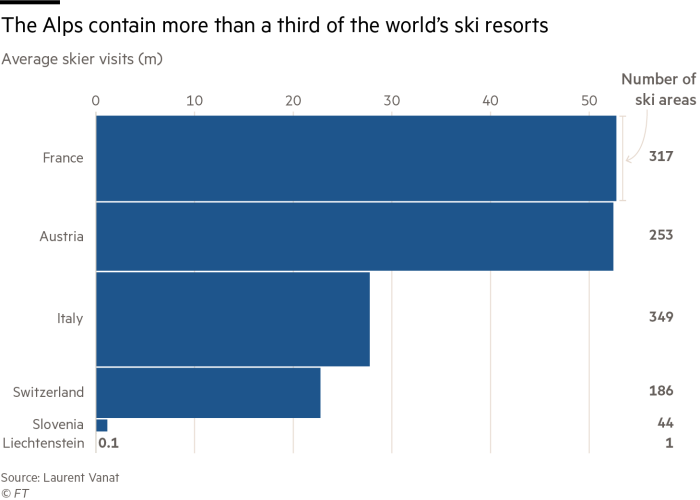

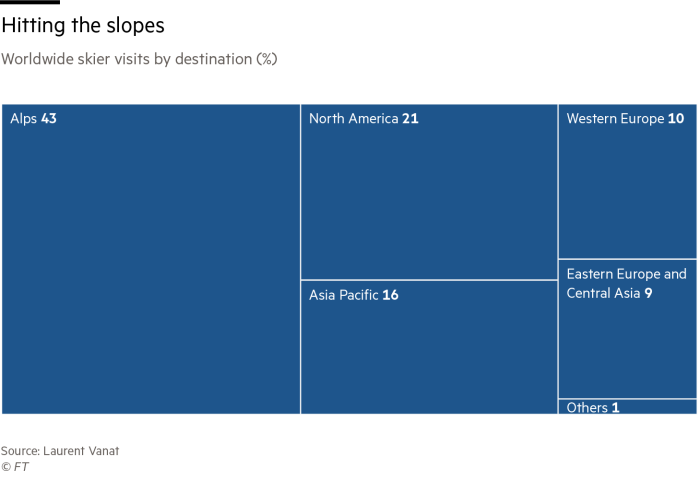

The European Alps account for more than a third of the world’s 2,084 ski resorts, according to data from industry analyst Laurent Vanat. Its ski season typically generates 28 billion euros in revenue, also about a third of the world total and almost 7% of the total value of the EU tourism market.

But this season it will not generate anything like it. After Covid-19 disrupted the busy Easter period during its initial spread across Europe in March, leaving operators and airlines scrambling to repatriate tourists, it appears that a third wave will wipe out bookings over Christmas and New Years.

Many resorts in Austria and Italy are closed, while France has said that all ski lifts will remain closed until January 7. Switzerland has cautiously opened, but its European neighbors are pushing to close again and with quarantine restrictions in place, international travel is almost prohibited.

With the median price of a ski holiday from the UK to the Alps costing around £ 1,200, consumers are hesitant to compromise as infection rates across the continent rise and authorities change restrictions.

Seasoning ‘on the edge of a knife’

Crystal Ski Holidays, the largest company in the industry, said bookings were “well over” 50 percent below last year’s levels. The operator typically sends around 170,000 tourists to the Alps each season, but has halved its capacity since January and cut the number of resorts it feeds by more than a fifth.

Its closest rival, Hotelplan, which is less than half the size of Crystal Ski, canceled all reservations for December and January, as well as its annual Santa to Lapland program.

“The rest of the season is on a razor’s edge,” said Joe Ponte, who became Hotelplan’s CEO in October. “As an operator, we just have to understand the myriad of different circumstances and communicate it to customers.”

Owen Chapman, head of member services for the Ski Club of Great Britain (SCGB), a tour operator and the UK’s oldest snow sports association, said bookings were 70% lower than last year. Because hotels were hired and costs committed in advance, the company had to cancel vacations six to ten weeks in advance or face heavy losses.

A sign telling people to cover their faces at the Kleine Scheidegg ski resort in Grindelwald, Switzerland © Stefan Wermuth / Bloomberg

If international skiers decide to thwart government advice and travel, costs are high and connections are few © Fabrice Cofferini / AFP / Getty

The closures and cancellations have left the ski holiday industry with significant losses.

Crystal Ski is owned by the Tui travel group, which this month posted a record annual loss of € 3.2 billion.

Crystal Ski and Hotelplan said they had negotiated costs and capacity reductions with hoteliers to minimize financial damage.

But having lost a quarter of last season’s revenue in the wake of the coronavirus, several smaller operators have already gone bankrupt. 23-year-old UK-based chalet expert Alpine Elements was the latest to collapse in administration this month.

Chris Hamblin, managing director of The Boutique Chalet Company, said that with 14 properties to rent and almost no reservations, he wasn’t sure if his company would survive. “It is very difficult to advance the forecast at this time.”

Few flights and no parties

If international skiers decide to thwart travel and government advice, costs are high and connections are few. EasyJet, the largest airline to Geneva, the gateway airport to the Alps, has cut more than three-quarters of its flights there in January. The few insurance companies that are willing to cover holidays according to the official guide do not insure against the capture of Covid-19, although some will cover cancellation or reduction as a result of the pandemic.

“It’s very difficult to find that coverage, so either you take the risk and go without it or you pay a lot but you don’t get full coverage,” said SCGB’s Mr. Chapman.

The European Alps account for more than a third of the world’s 2,084 ski resorts © Jean-Christophe Bott / EPA / Shutterstock

Operators are clinging to hopes of a great 2021-22 season and have opened reservations early © Marco Bertorello / AFP / Getty

Skiers should also be aware that the experience will not be the same as in previous years.

“We need to be very honest with customers who cannot expect an Austrian après or the Folie Douce. [a well-known bar] in Val d’Isère to be what it used to be, ”said Chris Logan, CEO of Crystal Ski.

The Austrian town of Ischgl, known as the “Ibiza of the Alps,” became one of the 10 highest-risk areas for coronavirus in the spring, raising fears of a similar scenario this season.

“Ischgl was an après party town, which will not be sold this year,” added Mr. Logan.

The European snow sports industry is also facing the challenges of Brexit. In addition to British tourists losing access to the European health card system, UK companies send some 25,000 seasonal workers to the Alps on UK contracts each year. Starting in January, staff must be employed by companies with local contracts with the implicit requirement that employees and companies must pay social security contributions and respect stricter working conditions, which will increase the cost of the hand of work.

Most operators said they would hire workers locally rather than fly, while others have scaled down their chalet operations with staff from UK hosts, which British skiers have traditionally favored.

Hopes rise for 2021

There are some green shoots for ski resorts. The demand for the summer season increased as city dwellers rushed to the mountains to escape the tedium of confinement. Hotelplan said that walking trips had increased from 25 to 55 percent of total booking volume under its Adventure Explore brand in 2021.

Bookings for all-season accommodations, allowing remote workers to get their work done from the resorts if they can and ski alongside, have also skyrocketed, as has interest in alternatives to skiing. Ski equipment sales are at record lows, but retailers have noted increased demand for cross-country ski boots and bindings, while hotels in the French Alps, where the lifts are closed, are promoting cross-country ball fights. snow, snowshoeing and “pure altitude” Massage.

For now, most operators are clinging to hopes of a great 2021-22 season and have opened reservations early.

“We already have several thousand reserved for next season when we normally only have several hundred,” Logan said, although many reservations have been moved forward from this season.

Xavier Schouller, Managing Director of Peak Retreats, another ski tour operator, noted that clients were using this year’s unspent vacation budget and changing: “We’ve seen a lot more demand for luxury accommodations than we normally would. “.

He added that he was not “totally disappointed” that the resorts had been forced to close: “Better have the second part [of the season] than to take a little bite and lose the rest. “