[ad_1]

By Kevin Peachey

Personal Finance Correspondent

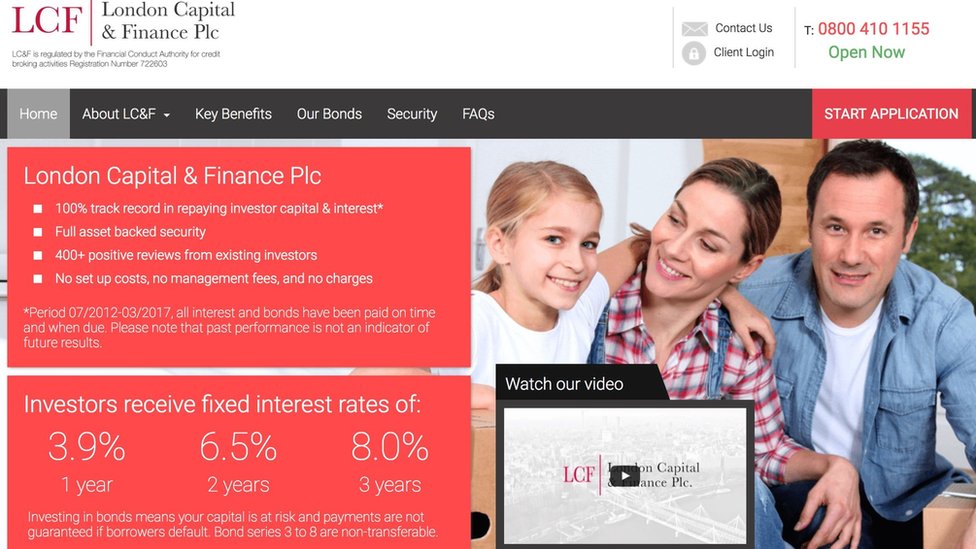

image copyrightLCF promotional material

The city regulator was unable to “effectively supervise and regulate” London Capital and Finance (LCF), which collapsed at a loss for investors.

Bank of England Governor Andrew Bailey, who ran the Financial Conduct Authority (FCA), apologized to those who lost their life savings.

Some 11,625 people invested a total of £ 237 million with LCF before it collapsed in administration in January 2019.

Many lost their entire investment, but can now receive one-time compensation.

-

Thousands face ruin as £ 236 million firmly folded

“The scheme will assess whether there is a justification for more one-time compensation payments in certain circumstances for some LCF bondholders,” said Treasury Secretary John Glen.

Former Court of Appeals Judge Dame Elizabeth Gloster, who wrote the review, said the FCA’s failure to properly regulate was due to “significant gaps and weaknesses” in its practices and policies at a time when it was led by Bailey. , who was CEO. at the FCA before becoming Governor of the Bank of England.

The report said the FCA’s “flawed approach” allowed LCF to appear respectable, even when it came to its unregulated products.

“The responsibility for failure regarding the FCA’s focus on its perimeter rests with the executive committee and with Mr. Bailey,” the report says.

In a statement, Bailey said: “As CEO [chief executive] of the FCA between 2016 and 2020, I apologize to the LC&F bondholders.

“When I was asked to lead the FCA in July 2016, it was clear that a substantial reform program was essential for the oversight of many of its 60,000 companies. We took immediate steps to change the focus.

“The necessary changes in culture, mindset and systems were a major work program across the organization, which took some time to implement. I regret that those changes did not come in time for LC&F bondholders.”

What happened in this case?

Many people who contributed money to LCF were first-time investors, including inheritance recipients, small business owners, or recent retirees.

They believed they were putting their money in secure, FCA-approved fixed rate ISAs. In fact, LCF was approved, but the products, which were high-risk mini-bonds, were not.

LCF offered yields of around 8% on three-year mini-bonds.

The FCA ordered LCF to withdraw its marketing and, after further investigation, froze LCF’s assets, leading to the company’s collapse in management.

A report by the administrators said there were a series of “highly suspicious transactions” involving a “small group of connected people” that led to large sums of money from investors ending up in their “personal possession or control.”

Many investors face the possibility of losing most, if not all, of their money. In some cases, it was many tens of thousands of pounds.

Several independent financial advisers said they warned the FCA, some as far back as 2015, about what they considered “misleading, inaccurate and unclear” advertisements, which are often promoted on social media.

‘This was my son’s money’

Among those who lost the money invested in LCF was Amanda Cunningham, who had invested decades of savings in the plan for her son’s future.

“He [her son] suffers from autism, I don’t even know if he’ll be able to keep a job. That money was there to give him the life he should have, “he told Radio 4’s Money Box.

“I can’t afford to stay with him forever and if something happens to me, that money was there for his future.”

He said he hoped the review would change the accusation that investors were to blame for losing their money. She has only received a fraction in compensation.

“That [the FCA] it should have protected us, “he said.” The whole system is faulty and bad. “

What is this review about?

Dame Elizabeth Gloster, Judge, was appointed by the FCA, under the direction of the government, to conduct an independent review of the events and circumstances surrounding the failure of the LCF.

Specifically, it considered whether the FCA “performed its functions with respect to LCF in a manner that allowed it to effectively fulfill its statutory responsibilities.”

Their report has revealed a number of flaws, with the FCA missing several opportunities to further investigate the LCF. The call managers did not forward the fraud allegations and the FCA did not pay enough attention to the unregulated aspects of the business.

Andrea Hall, speaking on behalf of a campaign group of hundreds of LCF bondholders, said the report revealed “serious regulatory flaws” by the FCA.

“The FCA returned this to our faces. I am delighted that all the hard work to prove it has paid off and has been recognized,” she said. “This review is better than we could have imagined.”

Sorry

Charles Randell, who chairs the FCA, said: “We accept all the recommendations that have been made to the FCA and deeply regret the mistakes we have made.

“The collapse of LCF has had a devastating effect on many investors and we will do our best to conclude our investigations as soon as possible and support the recovery of more funds for investors.”

Bonuses for executive committee members in 2019-20 that had now been deferred would not be paid, the FCA said.

Separate investigations by the FCA and the Serious Fraud Office (SFO) into LCF continue. The OFS has made five arrests.

The compensation is also being discussed by other bodies, but more details of the new Treasury compensation scheme will be released next year.

Earlier this month, the FCA permanently banned the mass marketing of speculative mini-bonds for retail investors.

Related topics

-

Personal finance

- Personal investment

- Money