[ad_1]

Brexit has failed to have much of an impact on financial services employment in London, a Financial Times investigation showed, and international banks kept most of their staff since the vote to leave the EU and big managers of Assets contracted in the UK capital.

Initial warnings that tens of thousands of jobs would leave the city as a result of the 2016 Brexit vote have been slashed. An FT survey of 24 large international banks and asset managers found that the majority had increased their workforce in London over the past five years.

Twelve foreign-based banks, which employed about 71,000 people in London five years ago, now have a reduced staff of about 65,000. But most of the decline was due to group-wide restructurings at Credit Suisse, Deutsche Bank and Nomura.

Nine of the world’s largest asset managers have increased UK hiring since the vote, and their combined total workforce increased 35 percent to more than 10,000 employees during the period.

“There was some change, but the magnitude has been relatively moderate,” said Frédéric Oudéa, CEO of Société Générale. He said his bank had moved 300 people from London to Paris.

French rival BNP Paribas has increased its staff in the UK. Japan’s MUFG has added 400 net jobs in London. Goldman Sachs has increased by nearly 900 employees in London since late 2015, including as it added 500 jobs in the EU, by hiring for its core businesses and new areas, including consumer banking and cash management.

JPMorgan has kept its London workforce at around 11,000, while the total number of staff in the UK has risen between 2,000 and 18,000 as the bank hired elsewhere, including technology and operations centers in Glasgow and Edinburgh.

In most cases, the numbers are very different from the original estimates of companies, including Deutsche Bank and JPMorgan, whose executives at one point said that up to 4,000 of their staff could leave London, and several other banks that suggested that the figures would be about 1,000.

“We were totally sticking our finger in the air,” said a former top executive at one of the major banks. “Everybody said 1,000. They thought that if they said hundreds, no one would believe them. ”

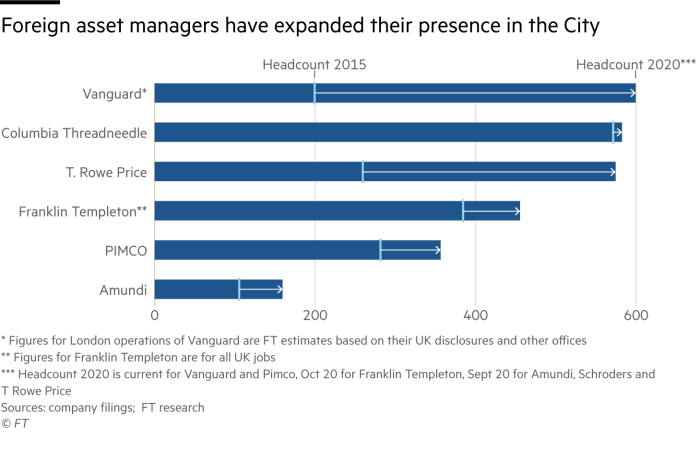

Vanguard, the world’s second-largest asset manager, and T Rowe Price, another US-based asset manager, more than doubled their London workforce over the period to 600 and 575 respectively.

Invesco, which is based in Henley outside London, added around 295 employees to bring its total UK headcount to 1,201, while Pimco, the world’s largest bond fund manager, and Columbia Threadneedle also they increased their staff in London.

The investment industry hiring wave is in stark contrast to predictions from 2017, when UK fund managers said they expected 16 per cent of UK-based asset management jobs to be able to move to other financial centers by the end of 2020. Only one respondent in a survey of 300 managers and investors by MJ Hudson, a London-based consultancy, said they expected the workforce in the UK investment industry to increase by 2020.

BlackRock, the world’s largest asset manager, declined to provide figures, as did Fidelity International and Capital Group.

The fund sector hiring wave, which has also been replicated in the EU, coincided with the rapid growth of the investment industry globally and increased regulatory requirements in the UK.

While asset managers have created EU funds to be able to sell to European investors after Brexit, the retail investment rules allow them to keep most of their office investment functions in the UK.

Deutsche Bank London office. The German lender has undergone group-wide restructuring © Jason Alden / Bloomberg

Senior industry figures say the ultimate cost to the city could be much higher depending on the final outcome of the Brexit negotiations and the potential for the EU to develop as a financial center.

“The big question, of course, is how is the capital markets union evolving? Is Europe really coming together and building it?” asked Richard Gnodde, a principal at London-based Goldman Sachs International, referring to long-term efforts to develop deeper capital markets rather than relying on bank loans as a mainstay of the company’s financing.

“If it were to move even halfway between where we are now and where the US is in terms of penetration of the capital markets for finance and investment banks, when I look at our workforce in the US and our workforce here. , I would be adding thousands and thousands of people. “

However, he added that some of those jobs serving the EU would be done outside the region in low-cost countries.

In the EU, the fragmentation of business between Paris, Frankfurt, Dublin, Amsterdam, Luxembourg and other hubs makes it more difficult for anyone to rival the services and skills pool in London, but finance chiefs generally believe the EU will attract more jobs in the long run.

“The mistake a lot of people made in London was to think of labor movements like Dunkirk in reverse, where French fishermen would pick up British bankers and bring them back to France,” said Nicolas Mackel, Luxembourg’s chief executive officer for Finance, an association private to develop Luxembourg’s financial services center. “This has not happened. Why? Because these things take time. ”