[ad_1]

The Chancellor’s wife, Rishi Sunak, is a shareholder in a restaurant business that channeled investments through a mailbox company in the tax haven of Mauritius, in a structure that could allow its backers to avoid taxes in India.

The company, International Market Management (IMM), hopes to build a chain of dozens of restaurants across India, through franchise agreements with celebrity chef Jamie Oliver and American fast food brand Wendy’s.

The involvement of Sunak’s wife, Akshata Murty, stemmed from an investigation by The Guardian into a number of financial assets held by Sunak and his close family, many of which have not been declared in the official register of ministerial interests. .

Murty invested in IMM, which was created in 2014, along with some of the better-known names in UK hedge fund circles. Before entering parliament, Sunak worked in hedge funds, eventually co-founding the US branch of the Cayman Islands, registered Thélème Partners.

IMM is chaired by David Stewart, who was previously CEO of the fund headed by Crispin Odey, one of the main sponsors of a no-deal Brexit.

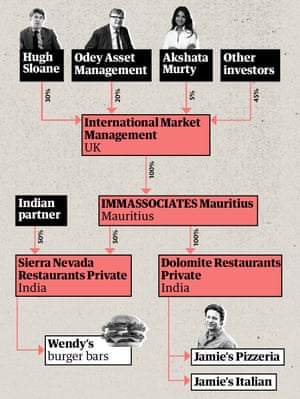

Stewart raised financing for the company from a group of wealthy friends and acquaintances, with Odey Asset Management taking 20% of the shares and Hugh Sloane, a founder of the Sloane Robinson fund, taking a 30% stake. Murty, the daughter of one of India’s best-known businessmen, spent £ 500,000 on a 5% stake, according to documents seen by The Guardian.

Each of the investors owns shares in IMM, which is a UK registered company. Instead of investing directly in the two Indian subsidiaries that operate the restaurants, IMM channeled the money raised from its shareholders through an intermediary company in Mauritius.

How Investors Routed Funds Through Mauritius

After reviewing the structure of the IMM, experts from the Tax Service of India and the Independent Commission for International Corporate Tax Reform, a campaign group, concluded that the agreement could reduce taxes payable on profits in India.

If the business is sold, there will be no capital gains tax in India. If IMM had invested directly, it would have had to pay the Indian government 20% of any capital gains, at current rates. The setup also reduces the amount of tax payable on dividends in India, from 10% to 5%.

It appears that IMM administrators were aware of the tax advantages when they established their intermediary company, IMMASSOCIATES Mauritius, according to documents seen by The Guardian. A completed form for the offshore services company that acted on their behalf asked: “Will the company try to take advantage of Mauritius’ network of double taxation agreements?” IMM administrators checked the “yes” box and the “India” box.

IMM CEO Jasper Reid, who runs the company from New Delhi, said: “This is a standard approach for companies investing in India and it is nothing out of the ordinary.” Murty and Odey Asset Management declined to comment. Sloane did not respond to a request for comment.

“If minimizing Indian tax revenue is ‘standard’ for British investors, that is not a justification, it is a condemnation,” said Alex Cobham, executive director of the campaign group Tax Justice Network. “India needs its tax revenue for schools and hospitals. We must hope that the Chancellor himself is committed to the progressive imposition of top income and wealth, or the UK will only see the deepening of the stark individual, racial, gender and regional inequalities that the pandemic has exposed. “

IMM’s tax structure is legal, but controversial. The use of Mauritius as a conduit for capital to India has become notorious. A collection of islands in the Indian Ocean, with a population of 1.3 million, the small state is one of the largest sources of foreign investment in India.

By establishing mailbox companies in Mauritius, essentially shell companies with no staff and no business activity, investors can funnel money from Indian companies to tax haven. Investments made through Mauritius are estimated to have cost India between $ 10 billion and $ 15 billion over the past 20 years in taxes on lost capital gains, taxes on dividends and taxes on interest payments. and royalties.

The system has been used by foreign investors, but also by Indian nationals, who basically send their funds in a round trip. There is no suggestion that Murty has reversed his investment.

Do you have information on this story? Send an email to [email protected], or (using a non-work phone) use Signal or WhatsApp to send a message to +44 7584 640566.

Murty’s family fortune comes from India, where his father co-founded the IT company Infosys. He now resides in the UK.

“Mauritius’s path to invest in India has been a concern of the Indian government and civil society for decades,” said Neeti Biyani of the non-profit Center for Budget and Government Accountability. “This trend has caused developing countries like India to lose crucial revenues, which could have been used to realize human rights, fund public services and finance development.”

The loss of tax revenue from offshore arrangements is said to have hampered India’s ability to meet its obligations on children’s rights. In an effort to close the loophole, the Indian government renegotiated its tax treaty with Mauricio last year. However, because IMM invested before 2017, it should still benefit from the terms of the previous treaty, experts said.

Any tax advantage is theoretical at the moment, as the latest company filings in India show that IMM restaurants have yet to turn a profit. Investors would also be liable for personal taxes on earned income. In the UK, these could be as high as 38% for higher income dividend earners.

However, the owners are optimistic. According to the latest accounts, the subsidiary that operates Wendy’s hamburgers is “poised for rapid expansion” and plans to grow to 50 locations in the next five years.