[ad_1]

With the cumulative effects of the depreciation of the Turkish lira in November, consumer inflation rose 2.3 percent monthly and 14.03 percent annually, well above expectations, led by food and transportation.

Inflation rose to August 2019 levels, with annual inflation above 14 percent in November.

The exchange rate dropped with Elvan’s announcement.

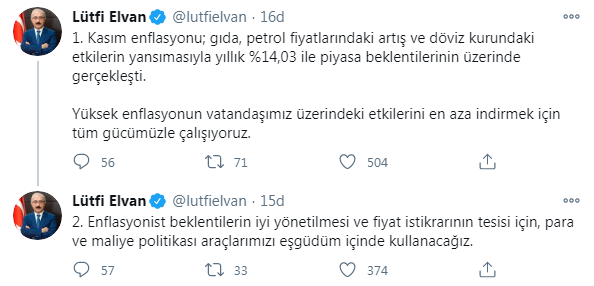

Treasury and Finance Minister Lütfi Elvan, for his part, made a statement on Twitter after the inflation data announced above expectations. Expressing that the increase in the prices of food, oil and the reflection of the effects on the exchange rate, was carried out above market expectations with an annual rate of 14.03 percent.

“We are working with all our might to minimize the effects of high inflation on our citizens. We will use our fiscal and monetary policy tools in coordination to manage inflation expectations well and establish price stability. “

USD / TL rose from 7.8560 to 7.9195 after inflation data beat expectations. After Elvan’s statement that “for price stability, monetary and fiscal policy will be used in coordination,” it fell below pre-data levels. The pair fell to the lowest levels of the day at 7.80. After the TL inflation data, the worst daily performance against the dollar among emerging currencies became the best performance.

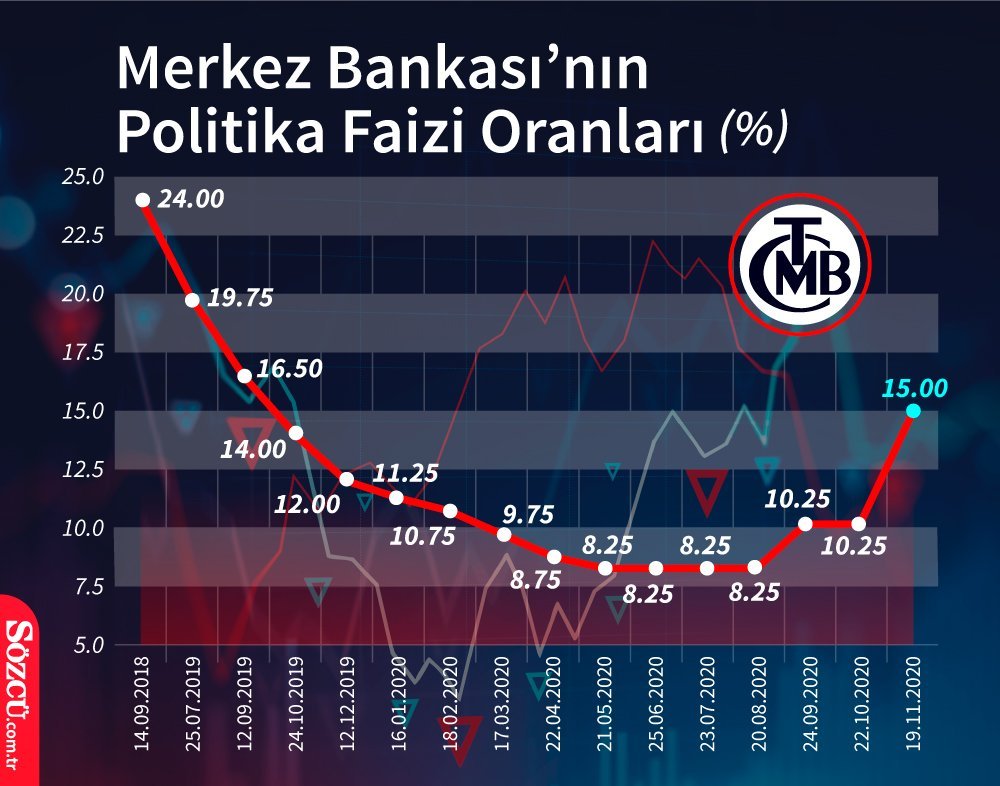

After the data, the Central Bank’s expectations of an interest rate increase this month have strengthened.

“WE HAVE A PROBLEM, SEND THE MESSAGE”

Timothy Ash of BlueBay Investment said: “While there were many rumors that inflation data was being manipulated in the market and that the series was manipulated by pressure on retailers not to raise prices, the management team previous economic rejected the problem. It appears the new recruits are sending the message that ‘yes, we have a problem and we will use all the tools we have to fight inflation.’

INTEREST RATE INCREASE THE SINGLE COUNTRY TURKEY

According to data compiled by TD Securities, almost all developing countries except Turkey in 2020 went for sale at official interest rates. Turkey was the only one to make an increase. Inflation in many countries among developing countries, on the other hand, consists of a target and estimates in Turkey was the only country that degrades in this regard.

THE DATA CREATED A NEW EXPECTATION OF INCREASED INTEREST

Enver Erken of Tera Yatırım said: “We believe that an interest rate hike in the MPC on December 24 will be necessary to strengthen the real interest position, help the Turkish lira stabilize and control deterioration in inflation. “If the real interest rate remains above 2 percent according to current inflation, this rate increase can be around 150 basis points,” he said.

In the minutes of the Monetary Policy Committee meeting, the CBRT stated that the November data indicated an increase in inflation due to the volatility of the exchange rate, but this increase would be temporary with the stable stance of monetary policy.

THE MEETING IS DECEMBER 24

Bankers interpreted this announcement as that the CBRT might not give a policy response due to its “temporary” view on rising inflation in November. However, after the realization of inflation far exceeded expectations in November, expectations began to evolve towards an increase in interest rates with greater clarity. The next decision of the CBRT MPC is on December 24.

Jason Tuvey, Senior Economist for Emerging Economies at Capital Economics, said: “Headline inflation rose to 14 percent in November, well above expectations, and as the Turkish lira rose strongly last month and the economy appears to experience a further decline, this will lead to further rate hikes on the CBT. ” “The pressure to do it increases.”

[ad_2]