[ad_1]

Turkey, monetary policy buyback auctions with traditional methods in the simplification process were recorded in the completion of the final redemption.

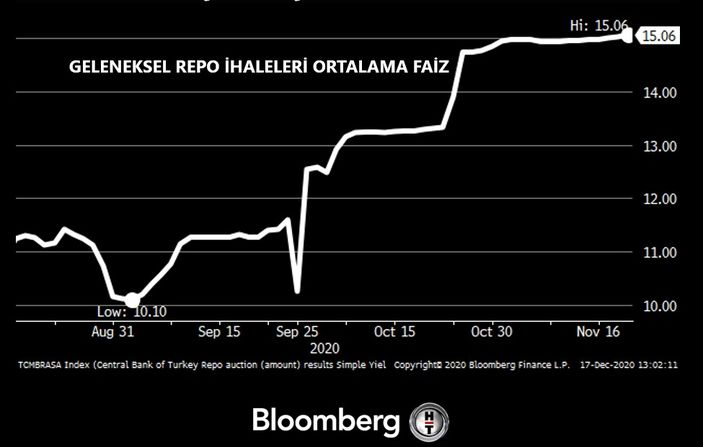

On December 17, the last redemption of the repo auctions of the traditional method, which have been used in monetary policy for a period, was carried out. On December 17, TL was not awarded to the system through repo auctions of the traditional method. Thus, the traditional method of repo auctions, which had been used for a period in monetary policy, has ended.

The Central Bank of the Republic of Turkey (CBRT) as part of the adjustment process had begun on August 13 in the repo auctions to traditional methods. Following the change of chairman at the CBRT in November, the first Monetary Policy Committee decided to simplify.

With the decision taken at the MPC meeting in November, it was pointed out that the financing provided by the repo auctions of the traditional method and the late liquidity window lines maturing in one month will begin to be carried out with the repo amount auctions. to one week, the main monetary policy tool of the Central Bank, as of November 20, 2020.

While the CBRT determined liquidity in the traditional repo auction method, the interest rate was set according to the demands of market players. The highest interest rate in the traditional method repo auctions, which began on August 13, was 15.06 percent on November 19.

Strong emphasis on simplification in the text of the 2021 Monetary and Exchange Policy

In the text of the “Monetary and exchange policy of 2021”, presented this week by the president of the CBRT, Naci Ağbal, there were also messages about simplification. In the text, “The CBRT’s main policy tool is the one-week repo auction rate. The interest rate corridor used to limit the intraday volatility of overnight interest rates and the Late Liquidity Window, which it functions as the ultimate lender of the CBRT, it will not be used as a monetary policy tool apart from its functions. ” expressions were used.

[ad_2]