[ad_1]

President Shihab Kavcioglu of the Central Bank of the Republic of Turkey, in April, will be the first interest rate decision under the presidency or will take place in the months after the Monetary Policy Committee (MPC) meeting on “the Just prejudice interest rates to download, “he said towards the finding.

Responding to Bloomberg’s questions in writing, Kavcıoğlu assessed that “I do not find a biased approach that immediately cuts interest rates in April or the following months.”

“We will continue to make our decisions in the new period as well, with an understanding of institutional monetary policy to ensure the permanence of the fall in inflation,” said Kavcıoğlu, “We will also observe the effects of the policy measures adopted so far. In this framework “.

“The Central Bank is firmly committed to the inflation target of 5%”

Speaking for the first time after taking office, Kavcıoğlu stated that the Central Bank is firmly committed to the 5 percent inflation target.

Just before Kavcıoğlu’s appointment as chair of the CBRT, the Monetary Policy Committee headed by Naci Ağbal raised the monetary policy rate above expectations, and expectations of a sudden change in monetary policy arose with the dismissal of Ağbal. While this situation led to strong selling in the Turkish lira, concerns were raised that investors would revert to unorthodox policies.

Related news

“CBRT will continue to use monetary policy tools independently”

President Recep Tayyip Erdogan often expresses that he sees high interest rates as the reason for high inflation, unlike many central bankers around the world. Erdogan laid off three CBRT heads in just two years.

When asked about how to convince the markets that the CBRT is instrument independent after these layoffs, Kavcıoğlu said: “The law has given the Central Bank instrument independence to use the tools at its disposal to reduce inflation permanently. Changing world conditions at our Central Bank under and it will continue to use monetary policy tools independently in light of the national macroeconomic evolution, especially the inflation outlook ”.

“We will also consider the real returns of similar countries in monetary policy.”

Until Ağbal began the aggressive tightening cycle in November when he took office, investors criticized CBRT for acting quickly to stop the tightening and for being too slow to take action against risks.

Kavcıoğlu stated that it did not seem right for him to comment on previous decisions, both ethically and in principle.

Kavcıoğlu said: “We strictly adhere to the medium-term inflation target of 5 percent set by the government and I am aware of how important this is for sustainable growth. When determining the stance of monetary policy, we will take into account global capital flows, real returns from similar countries and the portfolio preferences of residents along with actual and expected inflation. “

“Exchange rates will be formed according to the balance between supply and demand under free market conditions”

Answering the question about the use of reserves to support the Turkish lira, Kavcıoğlu made the assessment that in the next period, the Central Bank will adhere to the floating exchange rate regime as indicated in the text of the Monetary and Exchange Policy , and the exchange rates will be formed according to the balance of supply and demand under free market conditions.

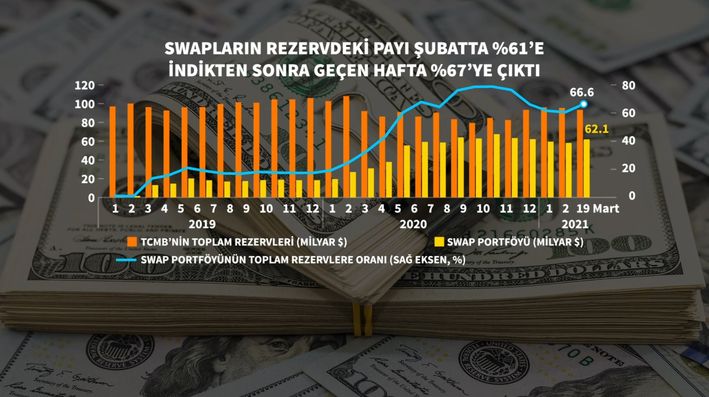

Last year, Turkish banks used more than $ 100 billion of their foreign exchange reserves to back the lira, according to a report by Goldman Sachs Group Inc. opposition, and the ruling party stated that the reserves were used to finance the current account deficit.

Turkey’s total gross reserves, including gold, fell 20 percent last year, Central Bank president Ağbal, until just before his appointment it fell to $ 85.2 billion, a decrease of more than 50 percent. in net reserves it fell to $ 19.6 billion.

“The tools to strengthen reserves will be put into use through prior communication”

The CBRT governor said: “The Central Bank will be able to activate the tools to strengthen its reserves in advance and as needed when the right conditions are met.”

When asked if the CBRT will continue to apply a single policy interest rate, Kavcıoğlu said: “We will maintain the operational framework of monetary policy, the one-week buyback rate will remain our main policy tool in terms of monetary policy. We see that the simplified operational monetary policy framework strengthens the transmission mechanism and allows the communication of decisions and practices in a simpler and clearer way ”.

Full text of the interview

The monetary policy of the Central Bank is shaped by a common understanding of the Monetary Policy Committee, which is chaired by me and has 7 members. The Law grants independence of instruments to the Central Bank in the use of its tools to permanently reduce inflation. Our Central Bank will continue to use monetary policy tools independently under changing global conditions and in light of domestic macroeconomic developments, especially the inflation outlook.

Interest rate decision from the last MPC meeting

Changing conditions around the world are pushing central banks to make tough decisions. The Monetary Policy Committee also makes a decision evaluating the specific data set for those conditions in each period. In principle, it does not seem appropriate to comment on previous decisions ethically. At the April meeting, as at all other meetings, we will make our decisions as a Board of Directors evaluating the evolution of inflation and all available data.

Is an interest rate cut in April among the options?

I do not find a biased approach that the interest rate will be lowered immediately with respect to the MPC decision in April or the following months. As a result, monetary policy decisions are made by the Monetary Policy Committee, taking into account the information and existing data set on macroeconomic developments. We are firmly committed to the government’s 5 percent medium-term inflation target, and I realize how important this is for sustainable growth. When determining the stance of monetary policy, we will also take into account actual and expected inflation, global capital flows, real returns from similar countries, and the portfolio preferences of residents. In the new period, we will continue to make our decisions with an institutional monetary policy approach to ensure the permanence of the fall in inflation. In this context, we will also look at the effects of the policy measures taken so far.

Bookings

Each period needs to be evaluated on its own terms and conditions. Turkey was forced to grapple with the challenges posed by the pandemic and after the process in the geopolitical developments experienced in recent years. In the next period, the Central Bank will adhere to the floating exchange rate regime as established in the text of the Monetary and Exchange Rate Policy, and the exchange rates will be formed in accordance with the balance of supply and demand in free market conditions.

We maintain our objective of strengthening foreign exchange reserves in terms of monetary policy efficiency and financial stability. In addition, the Central Bank may activate the tools to strengthen its reserves by communicating in advance and as required when the appropriate conditions are met.

Monetary policy framework

We will preserve the operational framework of monetary policy, the one-week repo rate will continue to be our main policy tool in terms of monetary policy. We see that the simplified operational monetary policy framework strengthens the transmission mechanism and allows for simpler and clearer communication of decisions and practices.

Fight against inflation

We see that in addition to conjunctural conditions, structural factors are also effective in inflation. This situation can systematize price changes that are outside the central bank’s sphere of influence. Therefore, policy implementations around the solution of factors such as the high and volatile evolution of the prices of unprocessed foods, the rigidity of the prices of services and the pass-through of the exchange rate, which cause rigidities that make it difficult to fight monetary policy with inflation.

I believe that the objective of solving the structural problems contemplated in the fight against inflation in the Economic Reform Package announced by our government is of vital importance in the fight against inflation. At this point, the coordination of monetary policy and other economic policies is of great importance.

[ad_2]