[ad_1]

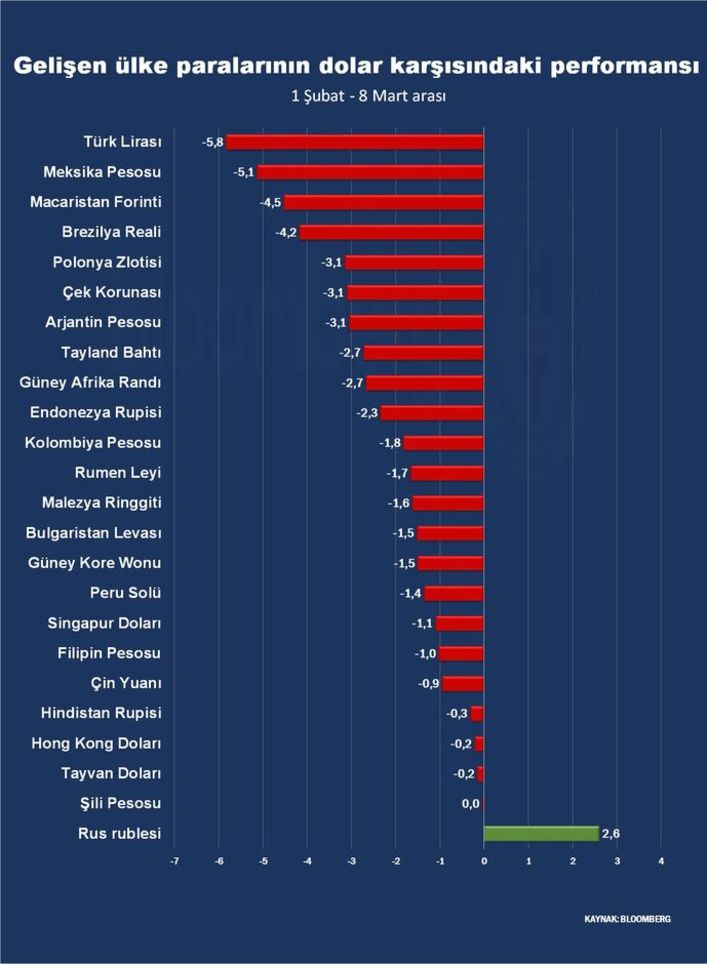

entered the new week on a rapid rise with decreased risk appetite.

The exchange rate tested more than 7.70 on the first trading day of the new week, an increase of 2 percent. Thus, for the first time since December 21, it registered more than 7.70 in the dollar / TL exchange rate.

Although the exchange rate was above 9.15, the daily increase was more than 2 percent on the basket side.

On the global markets side, S&P 500 futures were seen to go from high to low and, at the same time, the dollar gained value. The daily rise of the Bloomberg dollar index reached 0.5 percent. Interest on US 10-year bonds remained at 1.60 percent.

With the effect of the rise in US bond yields last week, the exchange rate surpassed 7.58, the highest level since December 2020.

Analysts at Societe Generale in Turkey report assessing the impact on emerging market bond yields; South Africa, along with Hungary, Chile and Colombia, was among the most vulnerable countries in this context.

Summit 2021 in risk premium

Turkey’s risk premium of 341 basis points of the process, while the two-year benchmark interest rate of the 16.01 percent level. This level reached in the risk premium was recorded as the highest level in 2021.

New price stability message from Ağbal

Kurt’s developments in global markets should increase while Ağbal, president of the Central Bank of the Republic of Turkey, Naci bank reiterated its emphasis on price stability in the blog post. Stating that firm steps will continue to be taken to achieve price stability, Ağbal explained that the proposed strategy is not temporary. Emphasizing that price stability is a prerequisite, Ağbal claimed that permanent price stability will bring the Turkish lira to the value it deserves.

Although there was a relaxation in the exchange rate after Ağbal’s article, the rise in bond yields caused the exchange rate to rise again.

Tendency to dollarization in individuals

Figures released by the CBRT last week showed that there was no decline in individuals’ foreign currency deposits based on currency deposit data adjusted for the peg effect.

Foreign currency deposit data for the week of February 26 indicated that the decline in foreign currency deposits by individuals had not started.

According to data from the CBRT, as of this week, the total foreign currency deposits of national residents decreased by 2,100 million dollars and reached 232,700 million. Almost all of the decrease in headline data was seen to have come from legal entities.

Consequently, as of the week of February 26, foreign currency deposits from individuals decreased by $ 4 million, while foreign currency deposits from legal entities decreased by $ 2,050 million.

Looking at the parity-adjusted data released by the CBRT on the foreign currency deposit data from the previous week, it was observed that foreign currency deposits from real people increased.

According to these data, as of the week of February 26, foreign currency deposits of real people increased by 81 million dollars. When foreign currency deposits of legal entities are analyzed without the parity effect, it was observed that the decrease was $ 2,160 million.

[ad_2]