[ad_1]

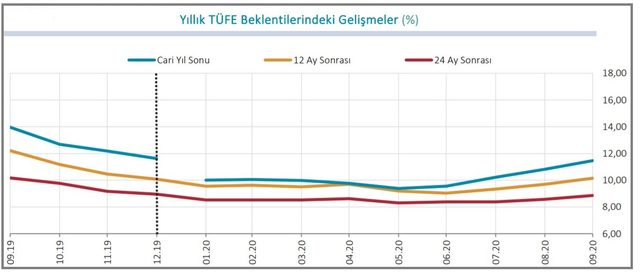

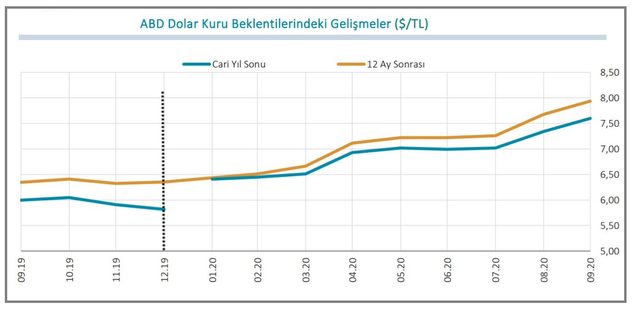

According to the results of the Central Bank’s expectations survey in September, there was an increase in the expectation of year-end inflation and the dollar / TL exchange rate. According to the data, the inflation expectation at the end of the year, which was 10.82 percent in the previous survey period, increased to 11.46 percent; The expectation of the dollar / TL exchange rate among banks at the end of the year increased from 7.3428 to 7.5990.

In the Expectations Survey of September 2020, which was answered by 59 participants consisting of representatives and professionals from the real sector and the financial sector, the expectation of the CPI 12 months ahead was 9.70 percent in the period of the previous survey, while it was 10.15 percent in this survey period. The expectation of the CPI 24 months in advance was made at 8.58 percent and 8.86 percent, respectively, during the same survey periods.

The survey revealed the following results:

“In the survey period of September 2020, when evaluating the probability estimates of the participants for the next 12 months, the average probability of the CPI is between 9.00 and 9.99 percent with 29.93 percent probability, 10.00 – 10.99 percent with a probability of 25.46 percent, between 11.00 and 11.99 percent, with a probability of 20.18 percent.

According to the evaluation made on the basis of point estimates in the same period of the survey, 34.69 percent of the expectations of the participants were in the range of 9.00 – 9.99 percent, 22.45 percent percent of their expectations in the range of 10.00 – 10.99 percent, 22 percent, It is observed that the expectations of 45 of them are in the range of 11.00 – 11.99 percent.

In the survey period of September 2020, when evaluating the probability estimates of the participants for the next 24 months, the CPI is in the range of 8.00 to 8.99 percent with a probability of 33.15 percent, and in the range of 9.00 to 9.99 percent with a probability of 26.97 percent. With a probability of 15.42 percent, it is projected to increase between 10.00 and 10.99 percent.

According to the evaluation made on the basis of point estimates in the same period of the survey, when CPI inflation expectations are evaluated after 24 months, 45.45 percent of the expectations of the participants are in the range of 8.00 – 8.99 percent and 18.18 percent of expectations are 9.00 – 9 percent. It is observed that the expectations of 18.18 percent are between 10.00 and 10.99 percent in the range of 99.

EXPECTATIONS OF INTEREST

The current interest rate expectation at a month-end day in the BIST Repo and Reverse-Repo market, which was 9.79 percent in the previous survey period, was performed as 11.00 percent in this survey period. CBRT’s current month-end expectation of weighted average financing cost was 9.43 percent in the previous survey period and 10.58 percent in this survey period. The CBRT one-week buyback auction interest rate expectation for the current month was 8.43 percent and 8.62 percent, respectively, during the same survey periods.

While the 12-month secondary market compound interest rate expectation after the remaining five years or nearly five years to maturity was 12.18 percent in the previous survey period, it increased to 12.42 percent. in this survey period. On the other hand, the expectation of the compound interest rate of the secondary market after 12 months of GDBI, whose maturity is ten years or close to ten years, was realized at 12.72 percent and 12.71 percent, respectively, during the same survey periods.

EXCHANGE RATE EXPECTATIONS

The current expectation of the year-end exchange rate (USD / TL) was 7.34 TL in the previous survey period, while it was 7.60 TL in this survey period. The exchange rate expectation after 12 months was TL 7.68 in the previous survey period, and it was TL 7.94 in this survey period.

GDP GROWTH EXPECTATIONS …

While the GDP growth expectation for 2020 was -1.6 percent in the previous survey period, it was at -1.5 percent in this survey period. The GDP growth expectation for 2021 was 4.3 percent in the previous survey period and was realized at 4.2 percent in this survey period. “