[ad_1]

With the SCT regulation approved by President Recep Tayyip Erdoğan and published in the Official Gazette, question marks remain in the minds of citizens. Which vehicles are included in the SCT increase, which vehicles have a discount without being affected by the SCT regulation Is being investigated. Request New car price list of the SCT 2020 regulation …

DISCOUNTED VEHICLE LIST FOR THE SCT 2020 OFFER!

An unexpected event occurred in the auto industry on August 30. With the Presidential Decree, a discussion has begun on which vehicles the SCT regulations will enter into force in the Official Gazette. The regulation was based on the ranges of volume of engine cylinders and the bases of the Special Consumption Tax (SCT) for passenger cars determined by the Ministry of Finance and Finance, and the prices of new vehicles were determined. While the new SCT regulation increased the price of many vehicles, it showed that the SCT of some models remained constant. With the SCT regulation, vehicles that do not change the SCT rate are Discounted vehicles after SCT regulation interpreted as. List of vehicles not affected by SCT regulations For the curious, the cars that do not have SCT increase and their details are in our news …

WHAT BRANDS HAVE A DISCOUNT AFTER THE SCT REGULATION?

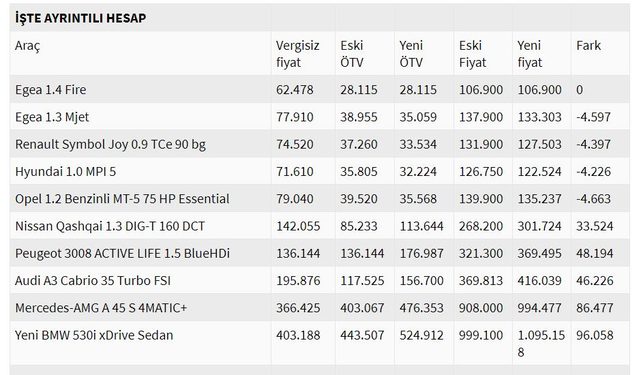

After the decision to raise the SCT made on August 30, the prices of some models of Fiat Egea, Renault Symbol, Opel and Hyundai are falling. What brand of cars will drop in price after the SCT regulation? it was being explored. The prices of the brands Fiat Egea, Renault Symbol, Opel and Hyundai will fall between 4,500 lire and 5,500 lire. With the SCT’s decision covering more than 1600 cc motor vehicles, the SCT decreased from 50 to 45 percent for vehicles with a sales price of more than 125 thousand. According to the news from Rahim Ak de Habertük, the prices of some models of the brands Fiat Egea, Renault Symbol, Opel and Hyundai, which are between 125 thousand and 150 thousand lire, will be reduced. In particular, the prices of small engine models of vehicles with a high SCT base such as BMW and Mercedes will increase. For example, the tax-driven rise of 46,000 lira will be reflected in the prices of the Audi A3 Convertible. On the other hand, the ratio increased from 100 to 130 percent in cars with an engine volume of 1.6 to 2,000 cc. The tax increased from 110 percent to 150 percent for those whose SCT base exceeds 170 thousand lire in this engine volume. In these vehicles there will be price increases from 30 thousand lire to 100 thousand lire.

FISCAL REGISTRATION IN LUXURY CARS WITH SCT REGULATION!

Following the SCT regulations, the price of vehicles with a SCT taxable base of 70 thousand lire and a volume of less than 1,600 cc increased to 85 thousand lire. For this reason, the rate of cheap vehicles, which should have risen to 50 percent since the prices of naked vehicles, which were affected by the increase in exchange rates, remained again at 45 percent. For vehicles with a tax base of between 70 and 120 thousand lire and a tax rate of 50 percent, the tax base has been changed to 85-135 thousand TL. For small motor vehicles, the tax base has been increased from 60 percent to 80 percent for those whose SCT base exceeds 130 thousand (120 a TL so far). Therefore, even if the engine size is small, the rate has increased by 20 percent for a midsize vehicle. The SCT increase was much more painful for cars with an engine volume of more than 1,600cc. The proportion increased from 100 percent to 130 percent in cars with 1.6-2000 engine capacity. The tax increased from 110 percent to 150 percent for those whose SCT base exceeds 170 thousand lire in this engine volume. For vehicles with more than 2 thousand engines, the tax base rate was increased from 100 percent to 130 percent for those whose tax base does not exceed 170 thousand lire, and from 110 percent to 150 percent for those that exceed the 170 thousand lire. In this segment, a 220 percent tax will be applied to luxury cars that have so far been taxed at 160 percent.