[ad_1]

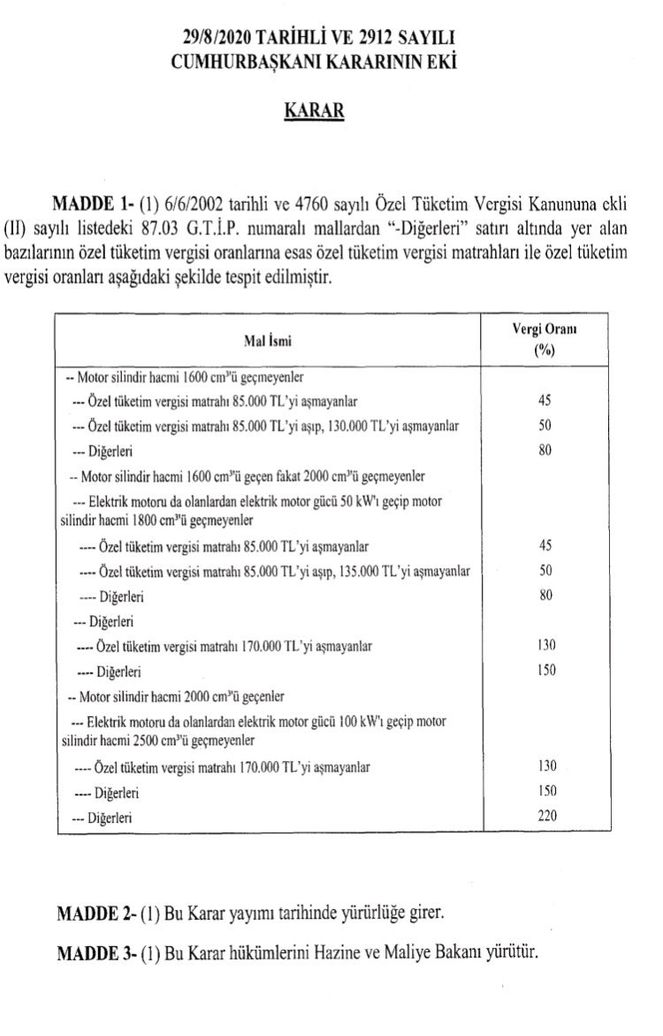

Although the tax base for cheaper cars was increased, there was a small discount from SCT, while large increases were made in the Special Consumption Tax for medium and high segment cars. Today, with the amendment made by the Presidential Decree, the SCT rate remained the same for vehicles with up to 1600 engines, but the tax rate increased by increasing the tax rate. It increased to 85 thousand. Thus, the rate of cheap cars, which should have risen to 50 percent due to the increase in the naked price due to the increase in the exchange rate, remained again at 45 percent. In vehicles with a tax base between 70 and 120 thousand TL and a tax rate of 50 percent, the tax bases were changed to 85-135 thousand TL.

THERE IS A TAX INCREASE BELOW 1,600 CC

However, on these small motor vehicles, the tax has been increased from 60 percent to 80 percent for those whose SCT base exceeds 130 thousand (1 TL 120 so far). Therefore, even if the engine size is small, the rate has increased by 20 percent for a midsize vehicle. The SCT increase was much more painful for cars with an engine volume of more than 1,600cc. The proportion increased from 100 percent to 130 percent in cars with 1.6-2000 engine capacity. The tax increased from 110 percent to 150 percent for those whose SCT base exceeds 170 thousand lire in this engine volume. For vehicles with more than 2 thousand engines, the tax base rate was increased from 100 percent to 130 percent for those whose tax base does not exceed 170 thousand lire, and from 110 percent to 150 percent for those that exceed the 170 thousand lire. In this segment, a 220 percent tax will be applied to luxury cars that have so far been taxed at 160 percent.