(Bloomberg) – Donald Trump’s WeChat ban targets a famous Chinese innovation in the heart of the world’s largest mobile gaming and social media empire, threatening one of the more striking shares of 2020.

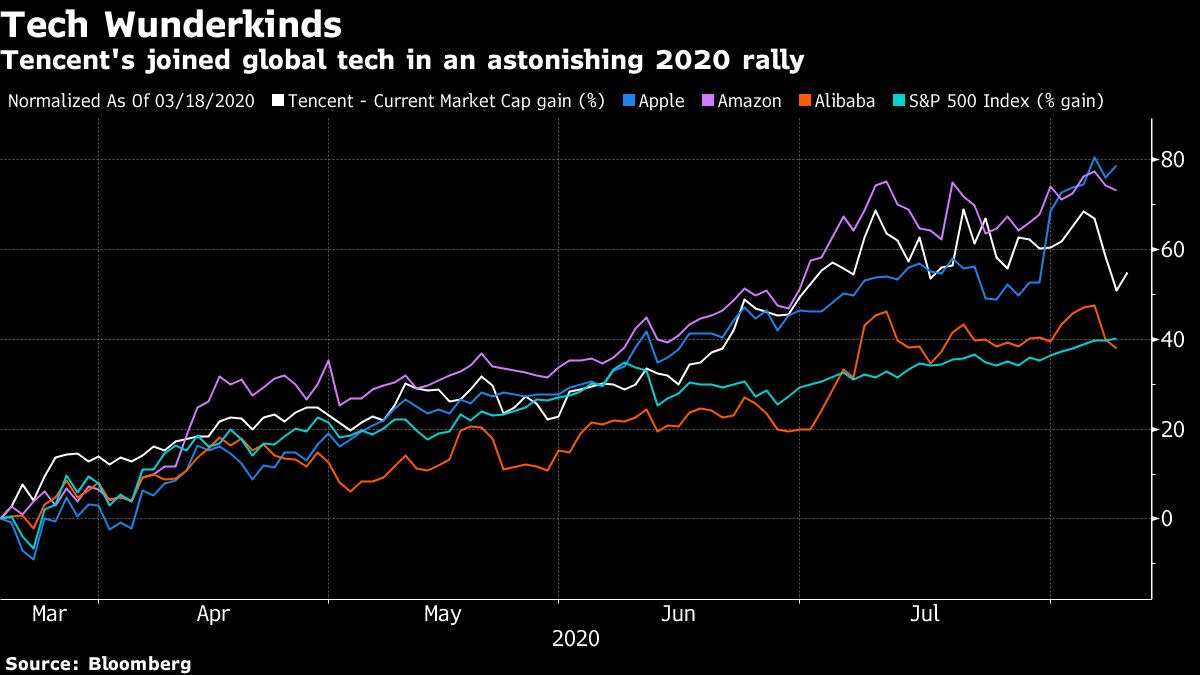

It is difficult to understand the importance of WeChat for Tencent Holdings Ltd. to overwrite. It is the means by which Tencent introduces a billion people to games and other online content, and trillions of dollars increase in annual payments to Apple Inc. markets. to Walmart Inc. WeChat’s reach underscores Tencent’s $ 280 billion gain in market value since a March 18 trough Covid-19 – equivalent to one Samsung Electronics Co. and the fifth largest dollar gain on the planet in that period.

Trump once stopped this rally cold. The U.S. president signed an executive order last week to ban U.S. entities from using WeChat – along with TikTok, the viral video platform of ByteDance Ltd. – to trade in 45 days. Confidence and uncertainty reigned as investors wrestled with the vague edict. Tencent raised $ 2 billion over two days before jumping back in part.

Drivers earning on Wednesday will try to reassure the market that it can resist a White House campaign launched by Huawei Technologies Co. and has already polluted dozens of Chinese immigrants. A U.S. official explained the sanction covers only the app and not its owner. But the heinous language of Trump’s order – which hampers “transactions” with the Chinese company – leaves the door open for the administration to expand it far beyond WeChat, locally called Weixin.

“It really is a gut punch for those companies when you look at their global expansion plans,” Wedbush analyst Daniel Ives told Bloomberg Television. Tencent’s stock stood largely unchanged ahead of this afternoon’s results.

Why Tencent and WeChat are such a big deal in China: QuickTake

The WeChat operator is doing well in the short term: analysts see an average increase of 27% in revenue in June-quarter and a spike of 13% in net income. But investors appear divided over the plight of China’s second-largest corporation. Options on the company – contracts that allow the holder to buy or sell a share at a predetermined price – suggest that traders support a 5.7% swing in Tencent shares after signing revenue, or roughly four times the normal band.

The three most popular options as of Wednesday included a Bullish contract that projected a roughly 16% rise to HK $ 600 at the end of September and a bearish one that suggested a 20% plunge, Bloomberg data shows. But the put-to-call ratio, as the number of traded put options, divided by the number of buy contracts, is close to its lowest since May, suggesting more optimistic than still bearish investors.

The extended wave reflects the central role that WeChat plays in Tencent’s empire, and the increased fallout now that it’s in Trump’s crusades. Launched in 2011 as a WhatsApp clone, the service has become deeply ingrained in Chinese life, indispensable for the hordes who use it to chat, shop, watch videos, play games, flirt, order food and take taxis. It pioneered the all-in-one or super-app concept by incorporating lite apps as mini-programs – a model emulated by Alibaba Group Holding Ltd. and Facebook Inc. Its success stemmed in part from the fact that China bans global services such as WhatsApp, Twitter and Instagram, allowing WeChat and a host of other Chinese equivalents to thrive in an alternative internet empire.

Nowadays, if the Chinese company is a mashup of Facebook, Netflix, WhatsApp and Spotify, then WeChat is the smartphone and payment backbone that binds them all together.

“The impact on the valuation would be more severe if the implementation included banning all transactions of Chinese companies of US companies with Tencent in its entirety, because this also includes Weixin, advertising on mainland China by US subsidiary companies, it international cloud company, the international gaming company, and so forth, ”Morningstar analyst Chelsey Tam wrote this week.

At the very least, Trump’s order will likely remove WeChat from Apple and Google’s mobile stores, which in turn means updating updates or even eliminating a service that is essential for communication on the factory floor, in households and in the boardroom. . And as U.S. consumer giants like Starbucks Corp. and Walmart are prevented from doing business with WeChat in China, Tencent may also take a hit for advertising and e-commerce sales.

But the ban has broader consequences. Even if the executive order does not address WeChat China, Tencent could interfere in other ways. Take Tencent’s $ 15 billion cloud services and fintech division, a major driver of growth in recent years. If US companies are unable to sell servers to support WeChat, that effectively means they will not be able to sell to Tencent itself unless the messaging service can be completely ring-fenced. Secretary of State Michael Pompeo has already urged U.S. companies to cut ties with Chinese cloud providers, including Tencent and Alibaba, as part of a “clean internet” campaign.

Read more: Trump ban on Top Messaging App risks Snarling Global Business

Then there’s Tencent’s cash cow. Gamers around the world were one of the fastest and loudest opponents of the action, going online to campaign to save titles like PUBG Mobile and Call of Duty Mobile. Tencent has invested about $ 22 billion in Activision Blizzard Inc.’s US gaming assets and companies. to Fortnite maker Epic Games Inc. and the developers of League of Legends Riot Games Inc.

What Bloomberg Intelligence says

The transfer of US-China tensions in the software field, highlighted by President Donald Trump’s executive orders against Tencent and ByteDance, could increase the risks for global video game makers if business operations are forced to decipher. Tencent has at least $ 22 billion in gaming investment in the US that, if banned expands, could lead to forced investment similar to ByteDance’s TikTok, while Activision Blizzard risks generating 10-20% of Blizzard revenue in China through its partnership with NetEase.

– Vey-Sern Ling and Matthew Kanterman, analysts

Click here for the survey.

Tencent has in recent years been looking for ways to extend its dominance of China’s social media and gaming scenes internationally, with mixed success. The smaller global expo is now on the verge of launching ByteDance, whose TikTok is the first truly successful Chinese-made internet service.

Now it is turning inwards faster than before. On Monday, Tencent struck a deal on game-streaming platforms DouYu International Holdings Ltd. and Huya Inc. to merge into a $ 10 billion local leader. Last month it offered to buy out and take over private domestic search engine Sogou Inc.

But Beijing’s own movements could complicate matters. China has threatened to retaliate against what it sees as growing US aggression, but any attempt to undermine US operations in China could harm Tencent and potentially complicate matters for non-US players.

“Uncertainties still exist for Tencent and other Chinese Internet companies with companies in the US, and Chinese pure gaming will be considered safer by investors,” Bernstein analysts including David Dai wrote in a report.

(Updates to the fifth paragraph of Tencent’s shares)

Please visit us at bloomberg.com for more articles like this

Subscribe now to stay ahead with the most trusted business news source.

© 2020 Bloomberg LP