Raise your hand if you knew that after the March tragedy, the stock market would reach record highs by the end of the year. Off. Put it down. No one believes you.

Even for austerity, “buy when there is blood on the streets” for the crowd, when the epidemic broke out and the world was heading towards economic disaster, it felt awful at the time throwing more money into the game.

Still, Ben Carlson, portfolio manager at Retholz Wealth Management LLC, said in a blog post on Sunday that “investing remains a profitable strategy when things seem futile.”

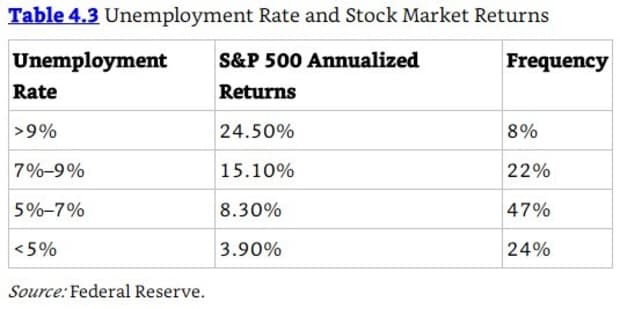

He pointed to this chart as evidence:

In other words, stocks rise when unemployment is high and profits are relatively low when it is low. At least that’s what history has told us.

“It’s competitive that investing gives the best returns when the economy is in disarray,” Carlson wrote. “But getting upset when investing is usually a good sign.”

He conceded that during the initial market downturn, he felt the stock could potentially drop another 60% from there. In the four-week period that began in late February, the stock experienced a bearish market of 30% or more than the all-time high in history. However, only five months later and the stocks were again leading to pressure in the unsupported territory.

“Just think how many bright people have decided to play it safely and wait for the low l height after the stocks rise.” “Guess what? By the time the dust settled it was too late. A lot of people have been proven wrong in the stock market this year. ”

Of course, even in times of rising unemployment, mounting coronaviruses, and political unrest, it was easy to catch the wrong footing, but nevertheless, the Federal Reserve’s action, in retrospect, was where the focus should be.

“The government has thrown away trillions of dollars in this matter. They literally gave people money, ”said Carlos. “It is clear that it will now provide a floor under Trillion and Fed’s implicit support markets. But at the time these programs were being launched a few people were predicting a fall back to the all-time high. “

The best way to navigate madness? The buy-and-hold approach is hard to beat, he suggested, although it wouldn’t be easy to stick to it by a 30% peak-to-truck rough drop in a month. Then again, the shares have recovered 60% since then to earn a net 15%.

“Holding is difficult, but it can be even more difficult to go one step further and buy when the stock is declining and everyone is preparing to exit,” Carlsen wrote. “Buy and hold only works if you buy and hold when the market never seems to fill up again.”

Speaking of the main index, the Dow Jones Industrial Average DJIA,

Last week ended with a decline of 0.6%, while the S&P 500 SPX,

1%, and the Nasdaq Composite Comp,

Lost 0.7%. Small-cap Russell 2000 RUT,

However, it was about 1% higher for the week.

.