Experts sound the alarm again that the dollar could lose its role as a reserved currency of the world. This is a common and historically indecisive concern – but things may actually be different this time around.

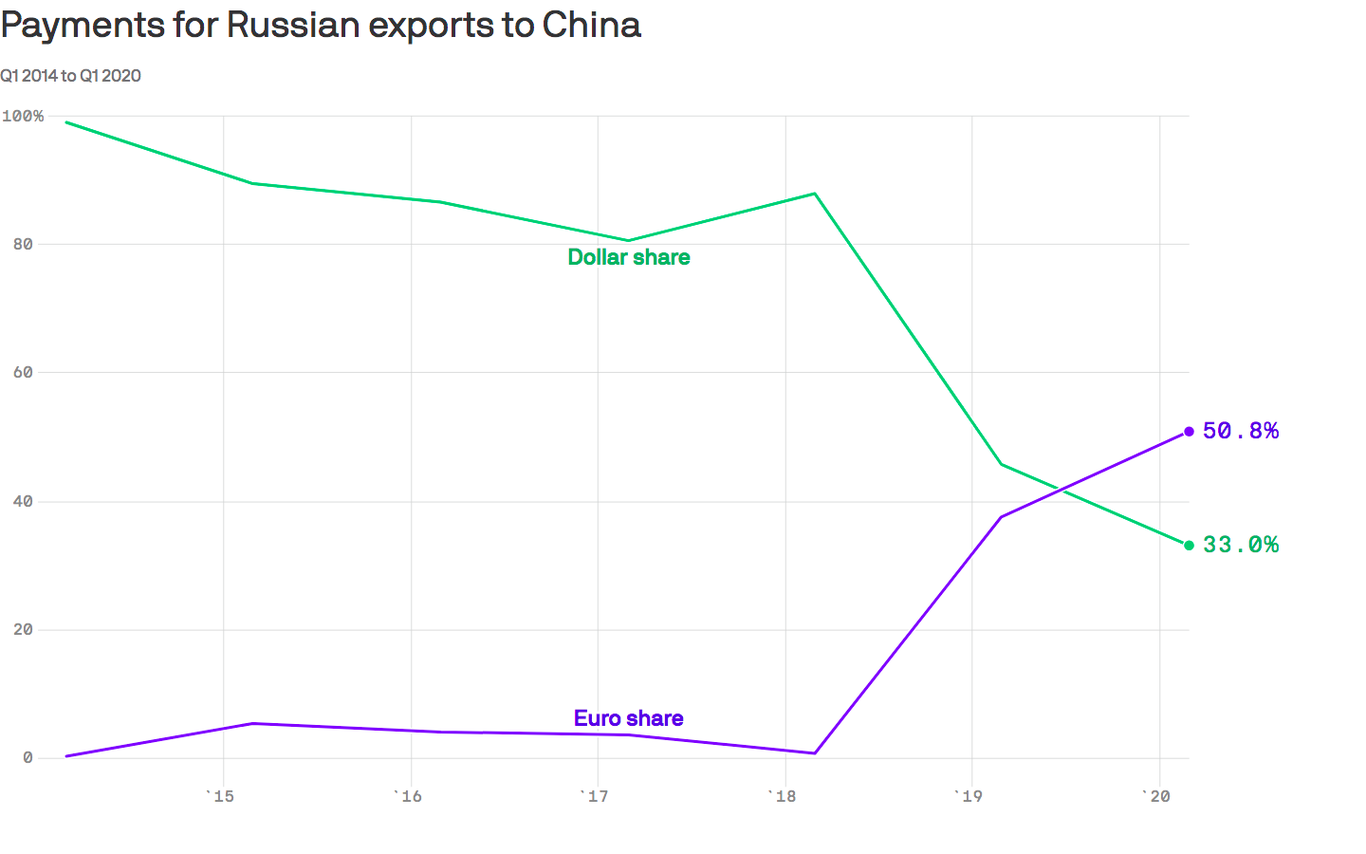

What’s happening: New data from the Bank of Russia show that the country now receives more euros than dollars for its exports to China, with the share of goods purchased in euros increasing by 0.3% at the beginning of 2014 (and just 1.3 % in the second quarter of 2018) to almost 51% at the end of Q1 this year.

- The share of euros that Russia receives for exports to the European Union increased to 43% from 38% at the end of last year, the data show.

Why it matters: The euro is the strongest competitor of the dollar, accounting for one to one percent of global currency reserves – 20% of central bank holdings versus about 60% for the dollar, according to the IMF.

Flashback: As I wrote last week, more speculators are betting that the euro will rise and that the dollar will fall then at any moment in history, according to CFTC data.

Between the lines: A growing chorus of investors, including billionaire hedge fund manager Ray Dalio, has publicly raised concerns in recent months that the U.S. response to the coronavirus pandemic – vibrations in the Fed’s balance sheet expansion and vibrations in government spending , while still having the worst outbreak in the world – further underscores the supremacy of the dollar.

- Goldman Sachs currency strategists have pointed to the growing value of gold as evidence that the US could “ban” its currency and “raise real concerns about the longing of the US dollar as a reserve currency.”

- Instead of dollars, many central banks have increased purchases of gold, especially those in China, Russia, India and Turkey in recent years, with 2018 and 2019 the first and second highest years for record annual purchases.

The big picture: There has been a long-term concerted effort by Russia and China to move the world away from the dollar – this is now in line with the coronavirus pandemic, the unification of the eurozone, and a moment of weakness for the United States of America.

.