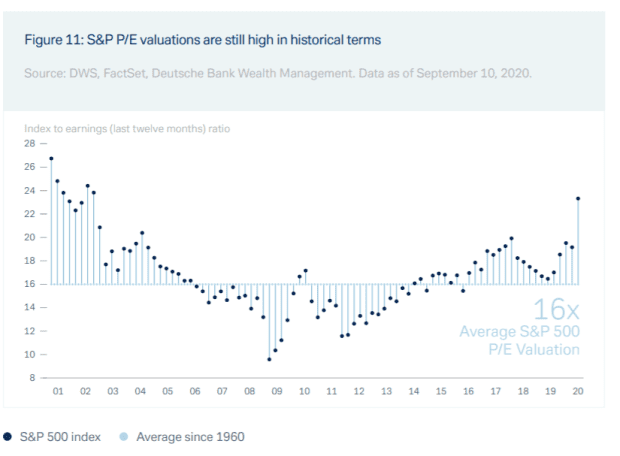

There is no alternative, or TIAA, has been a solid investment strategy for those who are riding the stock-market wave. But Dutsch Bank’s international private bank’s chief investment office fee has its limitations, as the team has set a 12-month price target for the S&P 500 SPX.

3,300 by the end of September 2021. The S&P 500 closed at 3,443.12 on Tuesday.

Fischer Tuan Hyunhe, Deutsche Bank’s chief investment officer for Europe and Asia Pacific, an international private bank, said that if the current Vice-Runner-up Vice President B Biden wins the election, the bank will earn S&P 500 of ડ 170 per share in 2022. Suppose a price-to-earnings ratio of 19 gives a target of 3230. However, Biden is proposing corporate taxes, due to the weak economy, Deutsche Bank will not be able to meet their expectations until 2022.

If President Donald Trump wins, Deutsche Bank will assume earnings of 180 180 per share in 2022 due to the small tax burden. “It will still continue with its tax reform, which has largely benefited tech companies, as their tax burden is now at historically low levels,” Hyun said.

Hunih said the TINA trade is definitely not over, as interest rates on government bonds are too low, and central banks have vowed not to raise interest rates any time soon. Initially, consumers switched to investment-grade bonds, and now Dash Bank is advising them to go higher in higher yields and emerging markets if they have a risk appetite. He said it was clear that in the long run higher equity allocation would be the right asset allocation, and that is why TIAA would play an important role.

Hunih said the bank is still recommending an increase in value stocks. The revenue of the tech sector G sector which is to come in the next two weeks will show further evidence that those companies have benefited from the coronavirus epidemic, benefiting from trends towards e-commerce, digital entertainment and working from home. Deutsche Bank is still wary of value stocks – automobile manufacturers have suffered both from the economic blow of the epidemic as well as the transition to electric vehicles, and banks have been struggling with low interest rates for a long time.

Its customers, who focus on saving rather than building wealth, are looking for ways to diversify due to the interest-rate environment. “Now our clients have a strong belief that rates will stay low for a long time and so they really have to do something, but it’s not like they’re turning 50% of traditional government bonds directly into corporate credit, higher yields and emerging markets.” Or equity, ”he said. Dutsh Bank Wealth Management had સંપ 206 billion in assets under management at the end of June.

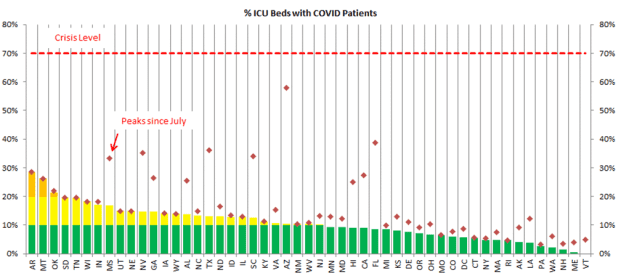

Markets are unprepared for two risks, he said. “So far [the rise in coronavirus cases] Not really leading to another lockdown, then I think the markets will be OK. But if we see a similar scenario like March or April, it is not yet clear in price, as banks like ours will need to adjust our GDP forecast, not only for this year, but also for 2021. “

He said the second risk is the election result which is not clear in one direction or the other. It will take time to count the votes by mail, and in the meantime, Trump will be able to declare himself the winner, which could lead to instability.

Humming

The focus has shifted back to Washington DC after leaders on Capitol Hill extended their monetary stimulus talks by a day. The Associated Press reports that Senate Majority Leader Mitch McConnell warned the White House not to split Republicans with a 2 2 trillion relief deal with House Speaker Nancy Pelosi ahead of the Nov. 3 election.

In other major political negotiations hanging in the market, the EU’s chief negotiator, Michel Barnier, said a trade deal with the UK was within reach.

Netflix NFLX,

Premarket fell 1% as it registered 2.3 million net new subscribers in its third quarter, topping 10 million in two consecutive quarters amid orders for COVID-1 related epidemics. His earnings came in better than expected.

Social Media App Snap SNAP,

After a surprisingly higher-than-expected profit in the third quarter, the boom is due. Other social-media stocks, including Facebook FB,

Pinterest pin,

And Twitter TWTR,

Also advanced in the premarket trade. Ericsson ERIC rallied in Stockholm after reports of a strong demand for 5G devices by telecom equipment makers.

Eastward Federal Reserve’s badge book at 2 p.m.

Electric vehicle maker Tesla TSLA,

Reports results after the market closes. Tesla has already reported third-quarter deliveries, so the focus will be on profitability and its fourth-quarter outlook.

Markets

After gaining 113 points for Dow Industrial DJIA,

On Tuesday, the U.S. Stock Futures ES00,

NQ00,

Lower edge.

USD LR DXY,

Yield on 10-year Treasury TMUBMUSD10Y, while was lower

Went up to 0.81%.

Chart

The bad news is that the percentage of intensive care unit beds with civil-19 patients in the U.S. is rising in the middle of the U.S. The good news is that, according to an analysis by Evercore ISI, that percentage is still not close to emergency-level capacity.

Reads randomly

The world’s first central bank launched a digital currency – the Bahamas sand dollar.

Medieval monastery, under a parking garage.

Scientists believe they have found a missing tectonic plate.

Need to know the initial start and update to the initial bell, but sign up here to deliver it once to your email book. The emailed version will be sent out at about 7:30 p.m.

.