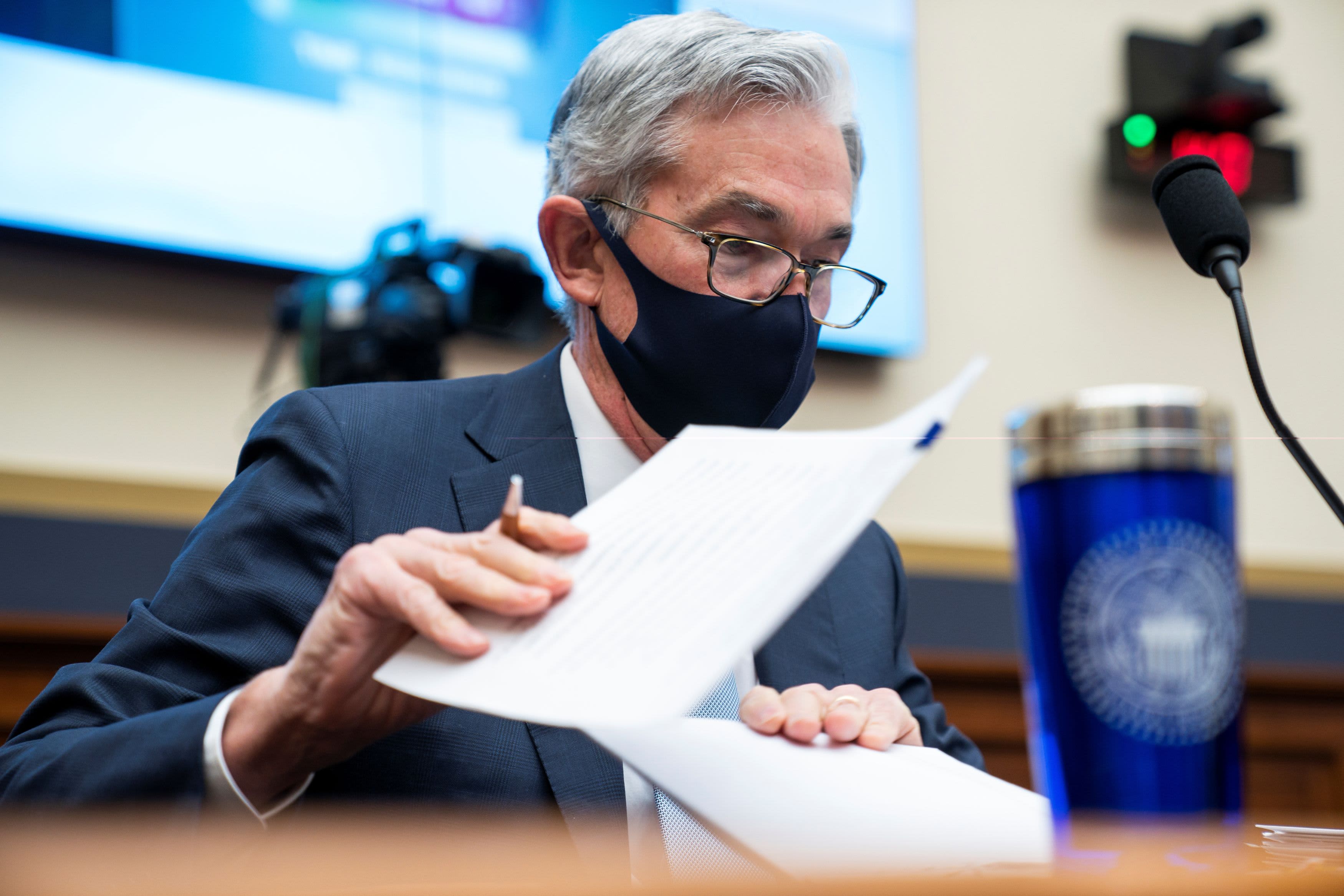

Federal Reserve Chair Jerome Powell prepares for a House Financial Services Committee hearing on “Treasury Department Oversight and the Federal Reserve’s Epidemic” on December 2, 2020 at the Riburn House Office Fee Building in Washington DC.

Jim Low Scalzo | Reuters

The Federal Reserve has taken a step that will cement the risk of climate change in the financial system for its approval.

In a statement released on Tuesday, the central bank said it had formally joined a global peer group addressing the impact of climate change on finance. The Central Bank and Supervisors of F Network, named after him, was created in 2017 to green the financial system and now has 83 members worldwide. U.S. Already had been an informal participant for over a year.

Federal Reserve Board Chairman Jerome H. “As we develop our understanding of how to best assess the impact of climate change on the financial system, we look forward to continuing our discussions with our 6 partners around the world and moving forward in depth,” Powell said. One line.

More from Impact Investment:

Here’s why the 401 (k) plan is behind the green investment options

The Biden administration, the game changer’s investment could be affected

How to seize climate change investment opportunities

The issue of climate change in the Fed has become a more obvious topic in light trends such as average average temperatures and environmental reversals such as constantly rising sea levels and more frequent severe weather events.

For example, in its most recent Fiscal Stability Report, the Fed explored climate change for the first time, saying that, in part, “Federal Reserve Supervisors expect banks to have a system that properly identifies, measures, controls and monitors all of them. , Which is likely to extend to climate risks for many banks. “

The translation is that if those risks are not taken into account, hazards like hurricanes, floods, droughts or wildfires can suddenly change the value of the property, which will shock the system.

At this time, it is uncertain how the Fed’s participation in the global network will affect policy and regulation. When Democrats applied for membership, about 50 Republican congressional lawmakers sent a letter to the Fed last week urging it to slow down and avoid proposals requiring banks to consider weather reversals in stress tests elsewhere. (These tests are usually a way for regulators to assess the bank’s financial vulnerability in what-if situation they operate.)

The letter also expressed concern that the introduction of climate-change aspects in these measures could have a chilling effect on banks’ readiness to lend to industries such as coal, oil and gas.

However, the move was applauded by the non-profit Ceres Accelerator for Sustainable Capital Markets.

“This news … is a clear indication that the agency is acknowledging its role in addressing the systemic risk of climate change,” Steven Rothstein, the group’s managing director, said in a statement.

.