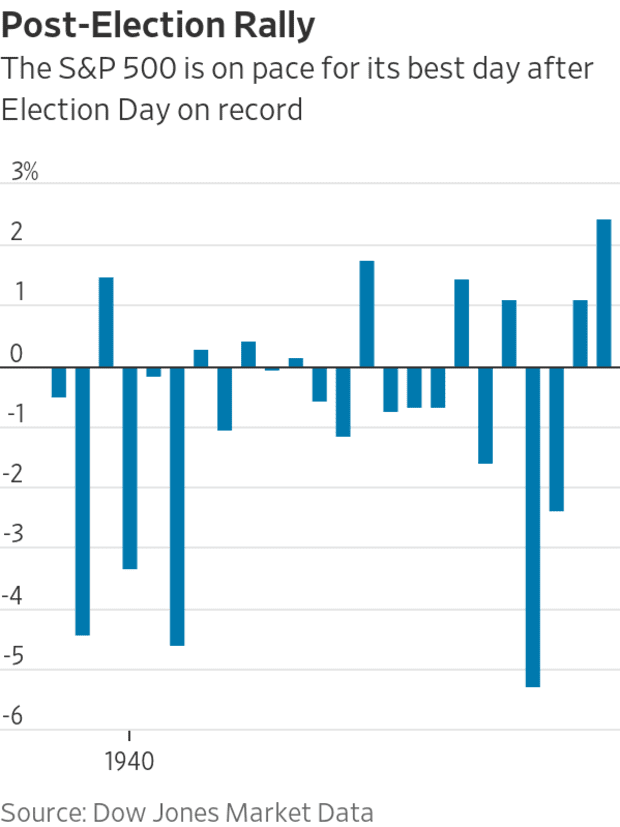

U.S. The presidential election has been a draw, but it has not stopped the stock market from targeting the best day since the election more than 100 years later.

Dow Jones Industrial Average DJIA,

Its intraday high near midsection on Wednesday was close to 505 or above 6.6%, representing the fastest daily gain for the 144-year-old benchmark after a 33.3333% return after 10,000 presidential victories. Democratic rival William Jennings Brian by Republican President William M. Kinley.

Read: Trump, Biden Race Goes Overtime as Battlefield States Stay in Balance: Live Blog

The 2020 election between President Donald Trump and former Vice President Joe Biden is very close to being called even a day after election day. There appear to be many avenues for each candidate to win.

If Biden were to win Nevada, Michigan and Wisconsin, while Trump took another outstanding race, which would get the Democratic Challenger to at least 270 voters. Biden could also reach 270, if he wins over Maine’s second congressional district, Nevada, North Carolina and Wisconsin, as Trump seems to claim other states haven’t been called yet.

See: Here we know about eight states whose electorate has not been invited to vote

Tight races control the huge margin of victory that was indicated by the poll data that leads to the Oval Office fee race. The vote drew attention to the White House’s Democratic sweep and the so-called blue wave not only in the House but also in the Senate majority.

Although that result has not been achieved, Wall Street is betting that Biden will win and retain a majority control of the Republican Senate. That scenario is seen as positive for equity markets in the long run as it would limit Biden’s ability to raise corporate taxes, impose Republicans’ 2017 tax, and impose stricter rules on industries, including technology.

Meanwhile, the S&P 500 Index SPX,

According to Dow Jones market data, the stock rose 2.6% and was looking to rise to its strongest post-election day on record.

Dow Jones market data

Nasdaq Composite Index COMP,

An increase of 2.2%, which would be the best return on the index the day after the presidential election record. To be sure, the Nasdaq Composite was first released in 1971 and the S&P 500 in 1957, both significantly smaller than the Dow.

The market’s reaction to what happens in an undecided election is still a conundrum for many market participants. However, many traders are arguing that the stock market is a forecasting mechanism that rarely trades on the day’s news.

.