(Bloomberg) – Fourteen years ago, China’s Season Holding Group overturned the nickel market by cheaply extracting the metal used to make steel stainless steel. They seem to be doing it once again, focusing on the battery.

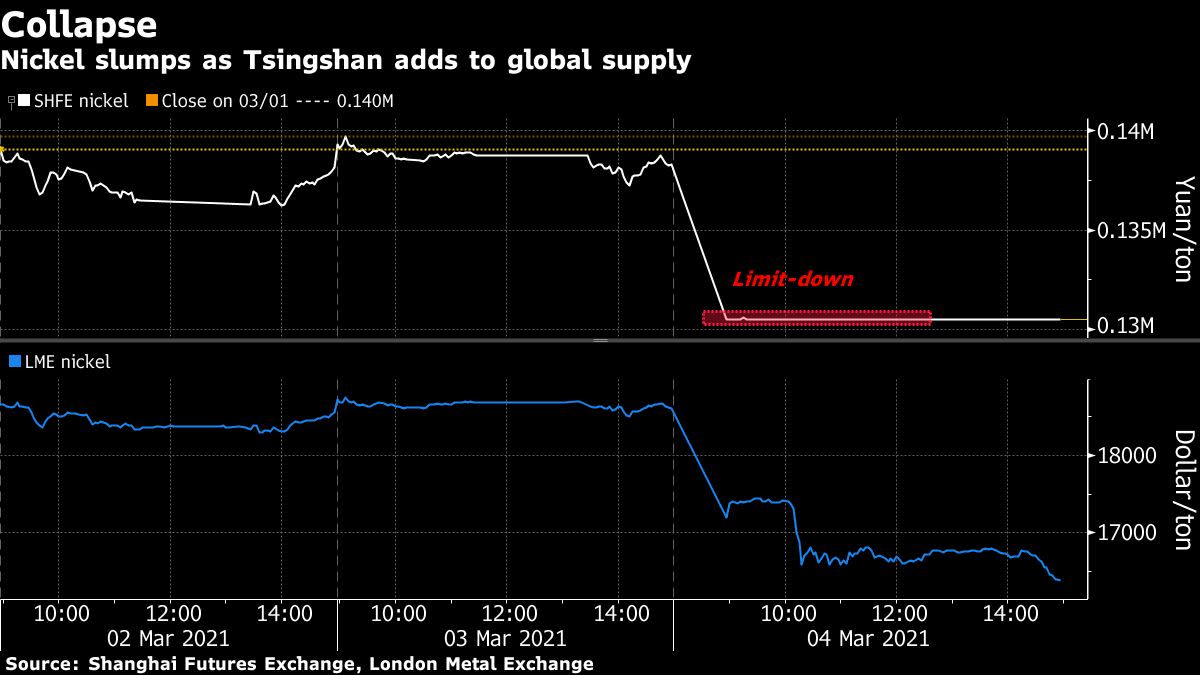

The company’s new way of making nickel for barriers is breaking down one of the biggest hurdles to meet growing demand, lowering key pillars that support the market. The prospect of surplus supply saw the metal cap see its biggest two-day loss in a decade, and even when Friday’s prices are at higher levels, it is close to a three-month low.

Singson’s move dates back to the early 2000s, when fuel goods in China saw the price of metals used in everything from kitchen utensils to aircraft rise in 2007.

The rally, and the supply chain largely controlled by the West, inspired Sean to find a cheaper alternative. It has come up with a way to use nickel pig iron from large deposits in Indonesia, getting rid of low-grade substitutes that helped send prices below 10,000 10,000 after just two years.

Read more about how Singh made his mark in the Max market

Now the world’s top stainless-steel maker and major nickel maker is rebounding in the market. The group said it would start supplying nickel mats to battery-material manufacturers and plans to expand nickel investments in Indonesia, amid rising prices for battery demand and a bullish outlook amid global energy change.

“2007 and 2021 are the two goals for the nickel industry,” said Venu Yao, a senior commodity moditus strategist at ING Bank.

Nickel rose 1.8% to, 16,425 a tonne on the London Metal Exchange at 6.07pm after falling 14% in the past two days. Its worst day ended with the most active deal in Shanghai since trading began in 2015. Most other LME metals hit higher levels on Friday.

The purpose of the sings

Synzon plans to process nickel pig iron – until now only used for stainless steel – in an intermediate product called matte, which can be further refined into battery nickel. It could open a major supply route from Indonesia’s low-grade Latte or Mines to electric vehicles, and Elon Musk said Tesla Inc. The biggest concern for batteries is the possibility of a structural deficit of the material.

Currently, exchange-traded nickel is only for so-called Class 1 nickel, which must have a purity of at least 99.8%. According to ING, this type of nickel accounts for less than 25% of the total finished nickel supply.

“If we can use the new methods developed by Sinzang to produce matte and convert it to sulfate, we could see a conversion in the price of Class 1 and Class 2,” ING’s Yao said in a note on Thursday.

According to Mastile analyst Celia Wang, the process is likely to come as a shock to the company.

It may also take time to significantly increase matte production. Sydney-listed Nickel Mines Ltd, which considers Singh’s group company as a significant shareholder, said on Friday that its projects at Morowali Industrial Industrial Park in Indonesia have not yet made the minor changes needed to make MAT and they will continue to sell NPIs in Singhni. Stainless operation.

Nickel prices were trading at a six-year high last month, on the assumption that E.V. The growing demand for is accelerating the shortage. Musk said in February that nickel was Tesla’s top concern for scaling for lithium-ion cell production and had instead replaced the use of iron for some EV batteries.

Nickel is important for the world’s clean-energy transition. It packs more packaging into batteries and allows manufacturers to reduce the use of cobalt, which is more expensive and has a supply chain that is considered less transparent. Kasturi’s earlier comments drew attention to the possibility of a shortage. He called for more production with miners last year, promising a “huge contract” for supply that is produced efficiently and “environmentally sensitive”, amid concerns that the deficit will begin in early 2023.

For more articles like this, please meet us at Bloomberg.com

Subscribe to stay ahead with the most trusted business news source.

21 2021 Bloomberg L.P.